1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

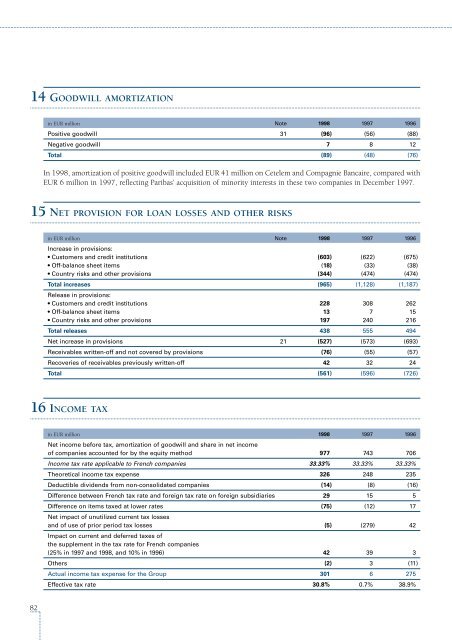

14 GOODWILL AMORTIZATION<br />

82<br />

in EUR million Note <strong>1998</strong> 1997 1996<br />

Positive goodwill 31 (96) (56) (88)<br />

Negative goodwill 7 8 12<br />

Total (89) (48) (76)<br />

In <strong>1998</strong>, amortization of positive goodwill included EUR 41 million on Cetelem and Compagnie Bancaire, compared with<br />

EUR 6 million in 1997, reflecting <strong>Paribas</strong>’ acquisition of minority interests in these two companies in December 1997.<br />

15 NET PROVISION FOR LOAN LOSSES AND OTHER RISKS<br />

in EUR million Note <strong>1998</strong> 1997 1996<br />

Increase in provisions:<br />

• Customers and credit institutions (603) (622) (675)<br />

• Off-balance sheet items (18) (33) (38)<br />

• Country risks and other provisions (344) (474) (474)<br />

Total increases<br />

Release in provisions:<br />

(965) (1,128) (1,187)<br />

• Customers and credit institutions 228 308 262<br />

• Off-balance sheet items 13 7 15<br />

• Country risks and other provisions 197 240 216<br />

Total releases 438 555 494<br />

Net increase in provisions 21 (527) (573) (693)<br />

Receivables written-off and not covered by provisions (76) (55) (57)<br />

Recoveries of receivables previously written-off 42 32 24<br />

Total (561) (596) (726)<br />

16 INCOME TAX<br />

in EUR million <strong>1998</strong> 1997 1996<br />

Net income before tax, amortization of goodwill and share in net income<br />

of companies accounted for by the equity method 977 743 706<br />

Income tax rate applicable to French companies 33.33% 33.33% 33.33%<br />

Theoretical income tax expense 326 248 235<br />

Deductible dividends from non-consolidated companies (14) (8) (16)<br />

Difference between French tax rate and foreign tax rate on foreign subsidiaries 29 15 5<br />

Difference on items taxed at lower rates<br />

Net impact of unutilized current tax losses<br />

(75) (12) 17<br />

and of use of prior period tax losses<br />

Impact on current and deferred taxes of<br />

the supplement in the tax rate for French companies<br />

(5) (279) 42<br />

(25% in 1997 and <strong>1998</strong>, and 10% in 1996) 42 39 3<br />

Others (2) 3 (11)<br />

Actual income tax expense for the Group 301 6 275<br />

Effective tax rate 30.8% 0.7% 38.9%