1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

1998-Paribas Annual Report - BNP Paribas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

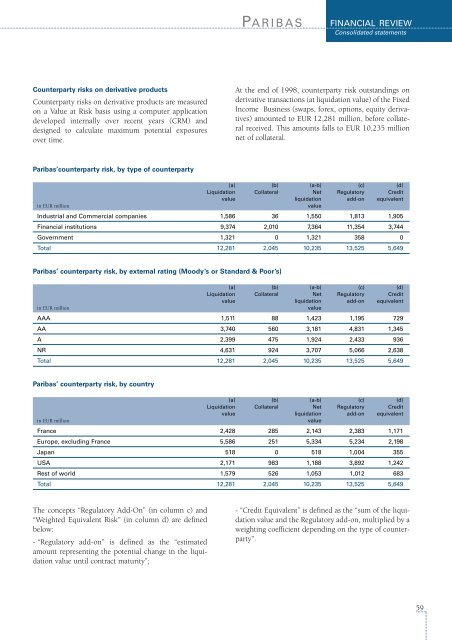

Counterparty risks on derivative products<br />

Counterparty risks on derivative products are measured<br />

on a Value at Risk basis using a computer application<br />

developed internally over recent years (CRM) and<br />

designed to calculate maximum potential exposures<br />

over time.<br />

<strong>Paribas</strong>’counterparty risk, by type of counterparty<br />

PARIBAS<br />

At the end of <strong>1998</strong>, counterparty risk outstandings on<br />

derivative transactions (at liquidation value) of the Fixed<br />

Income Business (swaps, forex, options, equity derivatives)<br />

amounted to EUR 12,281 million, before collateral<br />

received. This amounts falls to EUR 10,235 million<br />

net of collateral.<br />

(a) (b) (a-b) (c) (d)<br />

Liquidation Collateral Net Regulatory Credit<br />

value liquidation add-on equivalent<br />

in EUR million value<br />

Industrial and Commercial companies 1,586 36 1,550 1,813 1,905<br />

Financial institutions 9,374 2,010 7,364 11,354 3,744<br />

Government 1,321 0 1,321 358 0<br />

Total 12,281 2,045 10,235 13,525 5,649<br />

<strong>Paribas</strong>’ counterparty risk, by external rating (Moody’s or Standard & Poor’s)<br />

(a) (b) (a-b) (c) (d)<br />

Liquidation Collateral Net Regulatory Credit<br />

value liquidation add-on equivalent<br />

in EUR million value<br />

AAA 1,511 88 1,423 1,195 729<br />

AA 3,740 560 3,181 4,831 1,345<br />

A 2,399 475 1,924 2,433 936<br />

NR 4,631 924 3,707 5,066 2,638<br />

Total 12,281 2,045 10,235 13,525 5,649<br />

<strong>Paribas</strong>’ counterparty risk, by country<br />

(a) (b) (a-b) (c) (d)<br />

Liquidation Collateral Net Regulatory Credit<br />

value liquidation add-on equivalent<br />

in EUR million value<br />

France 2,428 285 2,143 2,383 1,171<br />

Europe, excluding France 5,586 251 5,334 5,234 2,198<br />

Japan 518 0 518 1,004 355<br />

USA 2,171 983 1,188 3,892 1,242<br />

Rest of world 1,579 526 1,053 1,012 683<br />

Total 12,281 2,045 10,235 13,525 5,649<br />

The concepts “Regulatory Add-On” (in column c) and<br />

“Weighted Equivalent Risk” (in column d) are defined<br />

below:<br />

- “Regulatory add-on” is defined as the “estimated<br />

amount representing the potential change in the liquidation<br />

value until contract maturity”;<br />

FINANCIAL REVIEW<br />

Consolidated statements<br />

- “Credit Equivalent” is defined as the “sum of the liquidation<br />

value and the Regulatory add-on, multiplied by a<br />

weighting coefficient depending on the type of counterparty”.<br />

59