Assessing Competitiveness In Moldova's Economy - Economic Growth

Assessing Competitiveness In Moldova's Economy - Economic Growth

Assessing Competitiveness In Moldova's Economy - Economic Growth

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Development Alternatives, <strong>In</strong>c. / BIZPRO Moldova Moldova <strong>Competitiveness</strong> Assessment<br />

<strong>In</strong> 2003, Moldova’s exporters increased exports overall by more than a third over the previous<br />

year. <strong>In</strong> the West, recent trends have been favorable to Moldova’s economy, primarily in terms of<br />

outsourcing opportunities in manufacturing; exports to the EU grew by more than 47 percent<br />

over 2002. Exports to the EU tend to leave the initiative with the buyer, who typically (though no<br />

longer always) provides design specifications, furnishes all of the materials, handles compliance<br />

with norms and standards, and markets the finished goods to the end consumer. As buyers in the<br />

EU have gained experience with Moldova, and as the EU’s eastern neighbors are now members,<br />

Moldova is becoming more a more attractive place for outsourcing business. Of course, these<br />

arrangements mean that only a portion of the total value added is generated in Moldova. Yet when<br />

viewed in a strategic context, rather than as a stopgap measure, these arrangements offer a<br />

(relatively) low-risk opportunity for learning how to operate and succeed in<br />

competitive markets. At least some of Moldova’s exporters understand that opportunity and are<br />

viewing current arrangements strategically.<br />

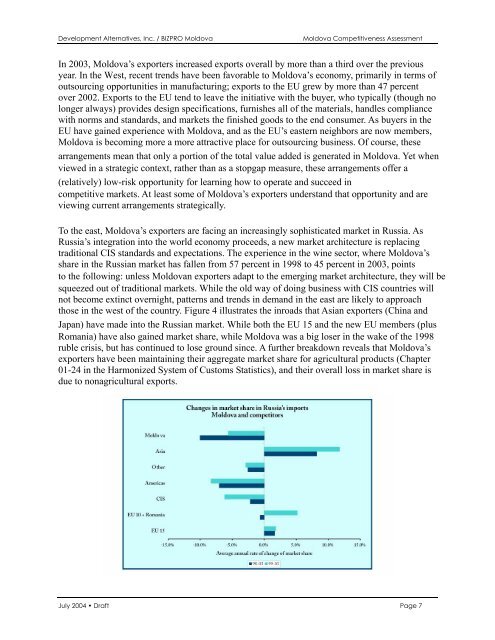

To the east, Moldova’s exporters are facing an increasingly sophisticated market in Russia. As<br />

Russia’s integration into the world economy proceeds, a new market architecture is replacing<br />

traditional CIS standards and expectations. The experience in the wine sector, where Moldova’s<br />

share in the Russian market has fallen from 57 percent in 1998 to 45 percent in 2003, points<br />

to the following: unless Moldovan exporters adapt to the emerging market architecture, they will be<br />

squeezed out of traditional markets. While the old way of doing business with CIS countries will<br />

not become extinct overnight, patterns and trends in demand in the east are likely to approach<br />

those in the west of the country. Figure 4 illustrates the inroads that Asian exporters (China and<br />

Japan) have made into the Russian market. While both the EU 15 and the new EU members (plus<br />

Romania) have also gained market share, while Moldova was a big loser in the wake of the 1998<br />

ruble crisis, but has continued to lose ground since. A further breakdown reveals that Moldova’s<br />

exporters have been maintaining their aggregate market share for agricultural products (Chapter<br />

01-24 in the Harmonized System of Customs Statistics), and their overall loss in market share is<br />

due to nonagricultural exports.<br />

Figure 4: Shifts in the penetration of Russia’s import markets<br />

July 2004 • Draft Page 7