On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In addition, Dunning’s underlying <strong>the</strong>ory <strong>of</strong> FDI does suggest that pull factors lie as <strong>the</strong><br />

foreground to injecting investment in an economy in terms <strong>of</strong> <strong>the</strong> OLI paradigm. Thus, fiscal<br />

incentives may be thought as secondary - as confirmed by Morisset (2003.) The work <strong>of</strong><br />

Krever (2005) reiterates <strong>the</strong> latter fact by admitting that tax ranks low in <strong>the</strong> long list <strong>of</strong><br />

factors considered by investors since <strong>the</strong>y will go for a two stage process whereby <strong>the</strong>y will<br />

first start by “screening countries based on fundamental determinants” and only those<br />

economies which satisfy <strong>the</strong> first stage requirements will go through <strong>the</strong> later one <strong>of</strong> being<br />

“evaluated in terms <strong>of</strong> tax rates, grants or o<strong>the</strong>r incentives as considered.”<br />

Attracting FDI is very demanding, especially in this globalized era. Policy-makers have<br />

<strong>the</strong>refore become increasingly interested in understanding <strong>the</strong> motivating factors underlying<br />

FDI. The driving force is “improving investment incentives for foreign investors” (Zitta &<br />

Powers, 2003). Although a number <strong>of</strong> investigations have been conducted in this area<br />

(Blomström & Kokko, 1998), not enough is known about <strong>the</strong> specific motivations that<br />

influence particular investment flows.<br />

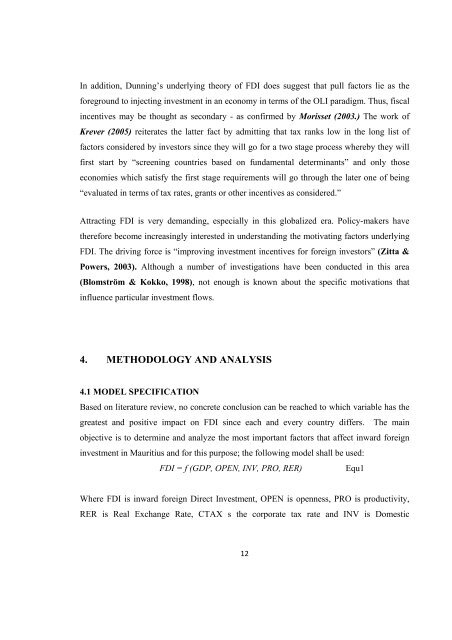

4. METHODOLOGY AND ANALYSIS<br />

4.1 MODEL SPECIFICATION<br />

Based on literature review, no concrete conclusion can be reached to which variable has <strong>the</strong><br />

greatest and positive impact on FDI since each and every country differs. The main<br />

objective is to determine and analyze <strong>the</strong> most important factors that affect inward foreign<br />

investment in Mauritius and for this purpose; <strong>the</strong> following model shall be used:<br />

FDI = f (GDP, OPEN, INV, PRO, RER) Equ1<br />

Where FDI is inward foreign Direct Investment, OPEN is openness, PRO is productivity,<br />

RER is Real Exchange Rate, CTAX s <strong>the</strong> corporate tax rate and INV is Domestic<br />

12