On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

factor is being reduced with high domestic inflows, thus foreign investors are apt to invest in<br />

such a country.<br />

Never<strong>the</strong>less, it is impossible to pronounce which one <strong>of</strong> <strong>the</strong>se variables causes FDI since<br />

relationship between factors does not mean causality <strong>of</strong> one variable on ano<strong>the</strong>r. To be more<br />

effective in policy making, it is hence imperative to look at <strong>the</strong> causality aspect <strong>of</strong> each <strong>of</strong><br />

<strong>the</strong>se determinants on FDI made possible through <strong>the</strong> cointegration and VAR/VECM model.<br />

The latter are also very useful on addressing <strong>the</strong> issues <strong>of</strong> dynamics and endogeneity in FDI<br />

modeling.<br />

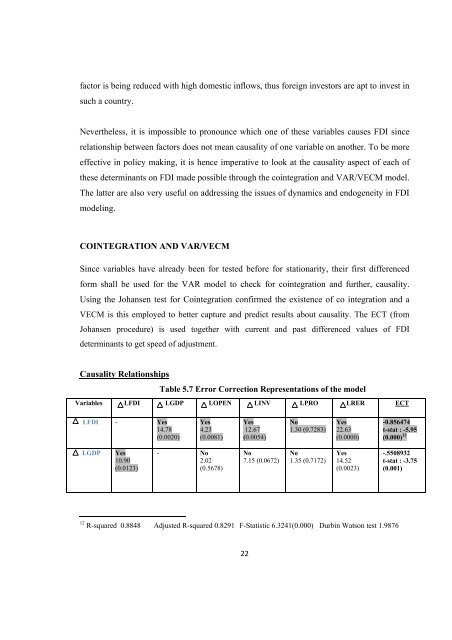

COINTEGRATION AND VAR/VECM<br />

Since variables have already been for tested before for stationarity, <strong>the</strong>ir first differenced<br />

form shall be used for <strong>the</strong> VAR model to check for cointegration and fur<strong>the</strong>r, causality.<br />

Using <strong>the</strong> Johansen test for Cointegration confirmed <strong>the</strong> existence <strong>of</strong> co integration and a<br />

VECM is this employed to better capture and predict results about causality. The ECT (from<br />

Johansen procedure) is used toge<strong>the</strong>r with current and past differenced values <strong>of</strong> FDI<br />

determinants to get speed <strong>of</strong> adjustment.<br />

Causality Relationships<br />

Table 5.7 Error Correction Representations <strong>of</strong> <strong>the</strong> model<br />

Variables LFDI LGDP LOPEN LINV LPRO LRER ECT<br />

LFDI - Yes<br />

14.78<br />

(0.0020)<br />

LGDP Yes<br />

10.90<br />

(0.0123)<br />

Yes<br />

4.23<br />

(0.0081)<br />

- No<br />

2.02<br />

(0.5678)<br />

Yes<br />

12.67<br />

(0.0054)<br />

No<br />

7.15 (0.0672)<br />

22<br />

No<br />

1.30 (0.7283)<br />

No<br />

1.35 (0.7172)<br />

Yes<br />

22.63<br />

(0.0000)<br />

Yes<br />

14.52<br />

(0.0023)<br />

-0.856474<br />

t-stat : -5.95<br />

(0.000) 12<br />

-.5508932<br />

t-stat : -3.75<br />

(0.001)<br />

12 R-squared 0.8848 Adjusted R-squared 0.8291 F-Statistic 6.3241(0.000) Durbin Watson test 1.9876