On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

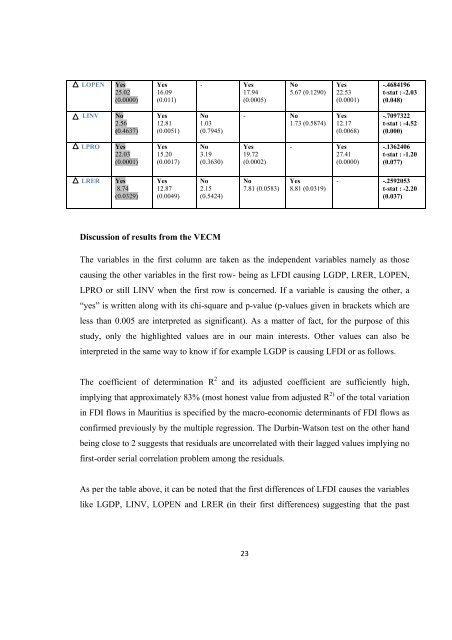

LOPEN Yes<br />

25.02<br />

(0.0000)<br />

LINV<br />

No<br />

2.56<br />

(0.4637)<br />

LPRO Yes<br />

22.03<br />

(0.0001)<br />

LRER Yes<br />

8.74<br />

(0.0329)<br />

Yes<br />

16.09<br />

(0.011)<br />

Yes<br />

12.81<br />

(0.0051)<br />

Yes<br />

15.20<br />

(0.0017)<br />

Yes<br />

12.87<br />

(0.0049)<br />

- Yes<br />

17.94<br />

(0.0005)<br />

No<br />

1.03<br />

(0.7945)<br />

No<br />

3.19<br />

(0.3630)<br />

No<br />

2.15<br />

(0.5424)<br />

Discussion <strong>of</strong> results from <strong>the</strong> VECM<br />

23<br />

No<br />

5.67 (0.1290)<br />

- No<br />

1.73 (0.5874)<br />

Yes<br />

19.72<br />

(0.0002)<br />

No<br />

7.81 (0.0583)<br />

Yes<br />

22.53<br />

(0.0001)<br />

Yes<br />

12.17<br />

(0.0068)<br />

- Yes<br />

27.41<br />

(0.0000)<br />

Yes<br />

8.81 (0.0319)<br />

-.4684196<br />

t-stat : -2.03<br />

(0.048)<br />

-.7097322<br />

t-stat : -4.52<br />

(0.000)<br />

-.1362406<br />

t-stat : -1.20<br />

(0.077)<br />

- -.2592053<br />

t-stat : -2.20<br />

(0.037)<br />

The variables in <strong>the</strong> first column are taken as <strong>the</strong> independent variables namely as those<br />

causing <strong>the</strong> o<strong>the</strong>r variables in <strong>the</strong> first row- being as LFDI causing LGDP, LRER, LOPEN,<br />

LPRO or still LINV when <strong>the</strong> first row is concerned. If a variable is causing <strong>the</strong> o<strong>the</strong>r, a<br />

“yes” is written along with its chi-square and p-value (p-values given in brackets which are<br />

less than 0.005 are interpreted as significant). As a matter <strong>of</strong> fact, for <strong>the</strong> purpose <strong>of</strong> this<br />

study, only <strong>the</strong> highlighted values are in our main interests. O<strong>the</strong>r values can also be<br />

interpreted in <strong>the</strong> same way to know if for example LGDP is causing LFDI or as follows.<br />

The coefficient <strong>of</strong> determination R 2 and its adjusted coefficient are sufficiently high,<br />

implying that approximately 83% (most honest value from adjusted R 2) <strong>of</strong> <strong>the</strong> total variation<br />

in FDI flows in Mauritius is specified by <strong>the</strong> macro-economic determinants <strong>of</strong> FDI flows as<br />

confirmed previously by <strong>the</strong> multiple regression. The Durbin-Watson test on <strong>the</strong> o<strong>the</strong>r hand<br />

being close to 2 suggests that residuals are uncorrelated with <strong>the</strong>ir lagged values implying no<br />

first-order serial correlation problem among <strong>the</strong> residuals.<br />

As per <strong>the</strong> table above, it can be noted that <strong>the</strong> first differences <strong>of</strong> LFDI causes <strong>the</strong> variables<br />

like LGDP, LINV, LOPEN and LRER (in <strong>the</strong>ir first differences) suggesting that <strong>the</strong> past