On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

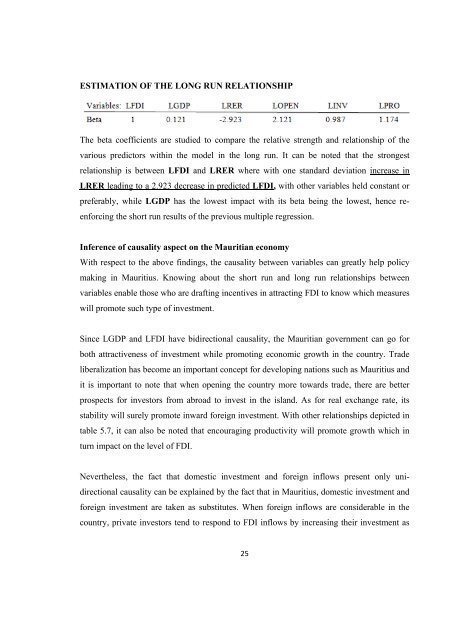

ESTIMATION OF THE LONG RUN RELATIONSHIP<br />

The beta coefficients are studied to compare <strong>the</strong> relative strength and relationship <strong>of</strong> <strong>the</strong><br />

various predictors within <strong>the</strong> model in <strong>the</strong> long run. It can be noted that <strong>the</strong> strongest<br />

relationship is between LFDI and LRER where with one standard deviation increase in<br />

LRER leading to a 2.923 decrease in predicted LFDI, with o<strong>the</strong>r variables held constant or<br />

preferably, while LGDP has <strong>the</strong> lowest impact with its beta being <strong>the</strong> lowest, hence reenforcing<br />

<strong>the</strong> short run results <strong>of</strong> <strong>the</strong> previous multiple regression.<br />

Inference <strong>of</strong> causality aspect on <strong>the</strong> Mauritian economy<br />

With respect to <strong>the</strong> above findings, <strong>the</strong> causality between variables can greatly help policy<br />

making in Mauritius. Knowing about <strong>the</strong> short run and long run relationships between<br />

variables enable those who are drafting incentives in attracting FDI to know which measures<br />

will promote such type <strong>of</strong> investment.<br />

Since LGDP and LFDI have bidirectional causality, <strong>the</strong> Mauritian government can go for<br />

both attractiveness <strong>of</strong> investment while promoting economic growth in <strong>the</strong> country. Trade<br />

liberalization has become an important concept for developing nations such as Mauritius and<br />

it is important to note that when opening <strong>the</strong> country more towards trade, <strong>the</strong>re are better<br />

prospects for investors from abroad to invest in <strong>the</strong> island. As for real exchange rate, its<br />

stability will surely promote inward foreign investment. With o<strong>the</strong>r relationships depicted in<br />

table 5.7, it can also be noted that encouraging productivity will promote growth which in<br />

turn impact on <strong>the</strong> level <strong>of</strong> FDI.<br />

Never<strong>the</strong>less, <strong>the</strong> fact that domestic investment and foreign inflows present only unidirectional<br />

causality can be explained by <strong>the</strong> fact that in Mauritius, domestic investment and<br />

foreign investment are taken as substitutes. When foreign inflows are considerable in <strong>the</strong><br />

country, private investors tend to respond to FDI inflows by increasing <strong>the</strong>ir investment as<br />

25