On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

On the Determinants of Foreign Capital Flows - DAAD partnership ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

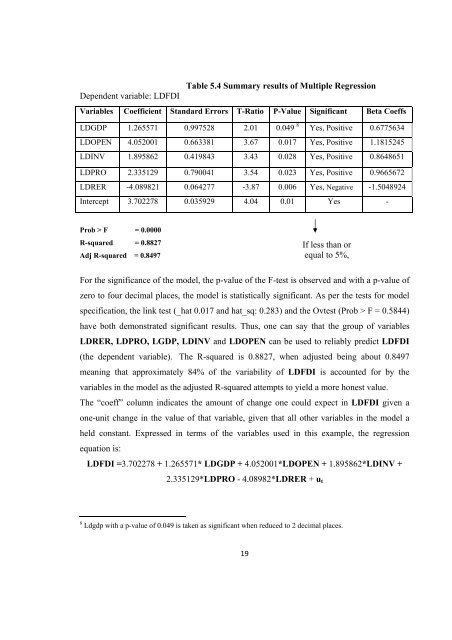

Dependent variable: LDFDI<br />

Table 5.4 Summary results <strong>of</strong> Multiple Regression<br />

Variables Coefficient Standard Errors T-Ratio P-Value Significant Beta Coeffs<br />

LDGDP 1.265571 0.997528 2.01 0.049 8 Yes, Positive 0.6775634<br />

LDOPEN 4.052001 0.663381 3.67 0.017 Yes, Positive 1.1815245<br />

LDINV 1.895862 0.419843 3.43 0.028 Yes, Positive 0.8648651<br />

LDPRO 2.335129 0.790041 3.54 0.023 Yes, Positive 0.9665672<br />

LDRER -4.089821 0.064277 -3.87 0.006 Yes, Negative -1.5048924<br />

Intercept 3.702278 0.035929 4.04 0.01 Yes -<br />

Prob > F = 0.0000<br />

R-squared = 0.8827<br />

Adj R-squared = 0.8497<br />

For <strong>the</strong> significance <strong>of</strong> <strong>the</strong> model, <strong>the</strong> p-value <strong>of</strong> <strong>the</strong> F-test is observed and with a p-value <strong>of</strong><br />

zero to four decimal places, <strong>the</strong> model is statistically significant. As per <strong>the</strong> tests for model<br />

specification, <strong>the</strong> link test (_hat 0.017 and hat_sq: 0.283) and <strong>the</strong> Ovtest (Prob > F = 0.5844)<br />

have both demonstrated significant results. Thus, one can say that <strong>the</strong> group <strong>of</strong> variables<br />

LDRER, LDPRO, LGDP, LDINV and LDOPEN can be used to reliably predict LDFDI<br />

(<strong>the</strong> dependent variable). The R-squared is 0.8827, when adjusted being about 0.8497<br />

meaning that approximately 84% <strong>of</strong> <strong>the</strong> variability <strong>of</strong> LDFDI is accounted for by <strong>the</strong><br />

variables in <strong>the</strong> model as <strong>the</strong> adjusted R-squared attempts to yield a more honest value.<br />

The “coeff” column indicates <strong>the</strong> amount <strong>of</strong> change one could expect in LDFDI given a<br />

one-unit change in <strong>the</strong> value <strong>of</strong> that variable, given that all o<strong>the</strong>r variables in <strong>the</strong> model a<br />

held constant. Expressed in terms <strong>of</strong> <strong>the</strong> variables used in this example, <strong>the</strong> regression<br />

equation is:<br />

LDFDI =3.702278 + 1.265571* LDGDP + 4.052001*LDOPEN + 1.895862*LDINV +<br />

2.335129*LDPRO - 4.08982*LDRER + ut<br />

8 Ldgdp with a p-value <strong>of</strong> 0.049 is taken as significant when reduced to 2 decimal places.<br />

19<br />

If less than or<br />

equal to 5%,