You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIRECTORS’ REPORT<br />

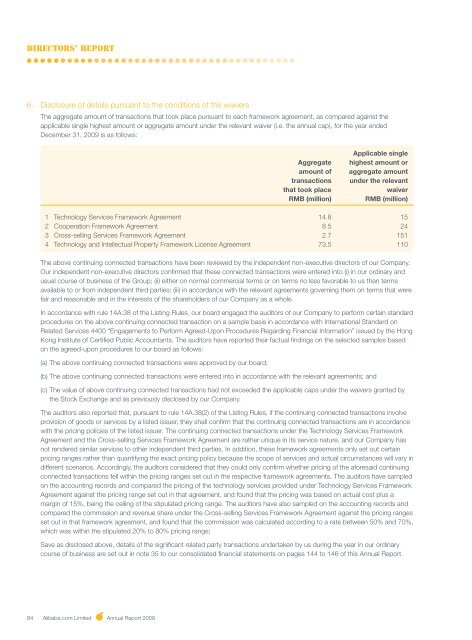

6. Disclosure of details pursuant to the conditions of the waivers<br />

The aggregate amount of transactions that took place pursuant to each framework agreement, as compared against the<br />

applicable single highest amount or aggregate amount under the relevant waiver (i.e. the annual cap), for the year ended<br />

December 31, <strong>2009</strong> is as follows:<br />

84 <strong>Alibaba</strong>.com Limited <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong><br />

Applicable single<br />

Aggregate highest amount or<br />

amount of aggregate amount<br />

transactions under the relevant<br />

that took place waiver<br />

RMB (million) RMB (million)<br />

1 Technology Services Framework Agreement 14.8 15<br />

2 Cooperation Framework Agreement 8.5 24<br />

3 Cross-selling Services Framework Agreement 2.7 151<br />

4 Technology and Intellectual Property Framework License Agreement 73.5 110<br />

The above continuing connected transactions have been reviewed by the independent non-executive directors of our Company.<br />

Our independent non-executive directors confirmed that these connected transactions were entered into (i) in our ordinary and<br />

usual course of business of the Group; (ii) either on normal commercial terms or on terms no less favorable to us than terms<br />

available to or from independent third parties; (iii) in accordance with the relevant agreements governing them on terms that were<br />

fair and reasonable and in the interests of the shareholders of our Company as a whole.<br />

In accordance with rule 14A.38 of the Listing Rules, our board engaged the auditors of our Company to perform certain standard<br />

procedures on the above continuing connected transaction on a sample basis in accordance with International Standard on<br />

Related Services 4400 “Engagements to Perform Agreed-Upon Procedures Regarding Financial Information” issued by the Hong<br />

Kong Institute of Certified Public Accountants. The auditors have reported their factual findings on the selected samples based<br />

on the agreed-upon procedures to our board as follows:<br />

(a) The above continuing connected transactions were approved by our board;<br />

(b) The above continuing connected transactions were entered into in accordance with the relevant agreements; and<br />

(c) The value of above continuing connected transactions had not exceeded the applicable caps under the waivers granted by<br />

the Stock Exchange and as previously disclosed by our Company.<br />

The auditors also reported that, pursuant to rule 14A.38(2) of the Listing Rules, if the continuing connected transactions involve<br />

provision of goods or services by a listed issuer, they shall confirm that the continuing connected transactions are in accordance<br />

with the pricing policies of the listed issuer. The continuing connected transactions under the Technology Services Framework<br />

Agreement and the Cross-selling Services Framework Agreement are rather unique in its service nature, and our Company has<br />

not rendered similar services to other independent third parties. In addition, these framework agreements only set out certain<br />

pricing ranges rather than quantifying the exact pricing policy because the scope of services and actual circumstances will vary in<br />

different scenarios. Accordingly, the auditors considered that they could only confirm whether pricing of the aforesaid continuing<br />

connected transactions fell within the pricing ranges set out in the respective framework agreements. The auditors have sampled<br />

on the accounting records and compared the pricing of the technology services provided under Technology Services Framework<br />

Agreement against the pricing range set out in that agreement, and found that the pricing was based on actual cost plus a<br />

margin of 15%, being the ceiling of the stipulated pricing range. The auditors have also sampled on the accounting records and<br />

compared the commission and revenue share under the Cross-selling Services Framework Agreement against the pricing ranges<br />

set out in that framework agreement, and found that the commission was calculated according to a rate between 50% and 70%,<br />

which was within the stipulated 20% to 80% pricing range;<br />

Save as disclosed above, details of the significant related party transactions undertaken by us during the year in our ordinary<br />

course of business are set out in note 35 to our consolidated financial statements on pages 144 to 146 of this <strong>Annual</strong> <strong>Report</strong>.