You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

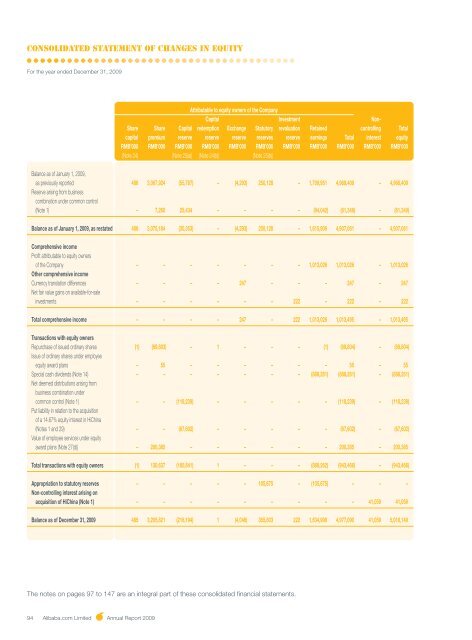

Consolidated Statement of Changes in Equity<br />

For the year ended December 31, <strong>2009</strong><br />

94 <strong>Alibaba</strong>.com Limited <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong><br />

Attributable to equity owners of the Company<br />

Capital Investment Non-<br />

Share Share Capital redemption Exchange Statutory revaluation Retained controlling Total<br />

capital premium reserve reserve reserve reserves reserve earnings Total interest equity<br />

RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000<br />

(Note 24) (Note 25(a)) (Note 24(b)) (Note 25(b))<br />

Balance as of January 1, <strong>2009</strong>,<br />

as previously reported 486 3,067,924 (55,787) – (4,293) 250,128 – 1,709,951 4,968,409 – 4,968,409<br />

Reserve arising from business<br />

combination under common control<br />

(Note 1) – 7,260 25,434 – – – – (94,042) (61,348) – (61,348)<br />

Balance as of January 1, <strong>2009</strong>, as restated 486 3,075,184 (30,353) – (4,293) 250,128 – 1,615,909 4,907,061 – 4,907,061<br />

Comprehensive income<br />

Profit attributable to equity owners<br />

of the Company – – – – – – – 1,013,026 1,013,026 – 1,013,026<br />

Other comprehensive income<br />

Currency translation differences – – – – 247 – – – 247 – 247<br />

Net fair value gains on available-for-sale<br />

investments – – – – – – 222 – 222 – 222<br />

Total comprehensive income – – – – 247 – 222 1,013,026 1,013,495 – 1,013,495<br />

Transactions with equity owners<br />

Repurchase of issued ordinary shares (1) (69,803) – 1 – – – (1) (69,804) – (69,804)<br />

Issue of ordinary shares under employee<br />

equity award plans – 55 – – – – – – 55 – 55<br />

Special cash dividends (Note 14) – – – – – – – (888,261) (888,261) – (888,261)<br />

Net deemed distributions arising from<br />

business combination under<br />

common control (Note 1) – – (118,239) – – – – – (118,239) – (118,239)<br />

Put liability in relation to the acquisition<br />

of a 14.67% equity interest in HiChina<br />

(Notes 1 and 29) – – (67,602) – – – – – (67,602) – (67,602)<br />

Value of employee services under equity<br />

award plans (Note 27(d)) – 200,385 – – – – – – 200,385 – 200,385<br />

Total transactions with equity owners (1) 130,637 (185,841) 1 – – – (888,262) (943,466) – (943,466)<br />

Appropriation to statutory reserves – – – – – 105,675 – (105,675) – – –<br />

Non-controlling interest arising on<br />

acquisition of HiChina (Note 1) – – – – – – – – – 41,059 41,059<br />

Balance as of December 31, <strong>2009</strong> 485 3,205,821 (216,194) 1 (4,046) 355,803 222 1,634,998 4,977,090 41,059 5,018,149<br />

The notes on pages 97 to 147 are an integral part of these consolidated financial statements.