Section 7. MOS Memory Market Trends - Smithsonian: The Chip ...

Section 7. MOS Memory Market Trends - Smithsonian: The Chip ...

Section 7. MOS Memory Market Trends - Smithsonian: The Chip ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7 <strong>MOS</strong> MEMORY MARKET TRENDS<br />

OVERVIEW<br />

<strong>The</strong> <strong>MOS</strong> memory market consists of DRAM, SRAM, ROM, EPROM, EEPROM, and flash memory<br />

products. Following the overview, each segment of the <strong>MOS</strong> memory market will be discussed<br />

in greater detail.<br />

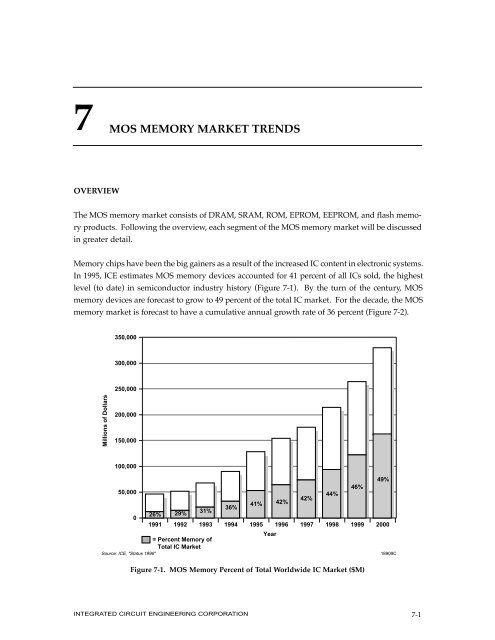

<strong>Memory</strong> chips have been the big gainers as a result of the increased IC content in electronic systems.<br />

In 1995, ICE estimates <strong>MOS</strong> memory devices accounted for 41 percent of all ICs sold, the highest<br />

level (to date) in semiconductor industry history (Figure 7-1). By the turn of the century, <strong>MOS</strong><br />

memory devices are forecast to grow to 49 percent of the total IC market. For the decade, the <strong>MOS</strong><br />

memory market is forecast to have a cumulative annual growth rate of 36 percent (Figure 7-2).<br />

Millions of Dollars<br />

350,000<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

26%<br />

1991<br />

29%<br />

1992<br />

31%<br />

1993<br />

= Percent <strong>Memory</strong> of<br />

Total IC <strong>Market</strong><br />

Source: ICE, "Status 1996"<br />

36%<br />

1994<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-1<br />

41%<br />

1995<br />

Year<br />

42%<br />

1996<br />

42%<br />

1997<br />

44%<br />

1998<br />

46%<br />

1999<br />

Figure 7-1. <strong>MOS</strong> <strong>Memory</strong> Percent of Total Worldwide IC <strong>Market</strong> ($M)<br />

49%<br />

2000<br />

18909C

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Figure 7-3 shows ICE’s forecast of the specific <strong>MOS</strong> memory market segments through the year<br />

2000. Following three straight years (1993-1995) of better than 40 percent growth, the <strong>MOS</strong> memory<br />

market is forecast to catch its breath in 1996 and 199<strong>7.</strong> It is anticipated that the slower growth<br />

rate will be the result of additional capacity (especially for DRAMs) that is forecast to come on line<br />

in the late-1996/early-1997 time period. Additional capacity will help fill demand for DRAMs<br />

and other memory products, thus reducing average selling prices and causing the market to grow<br />

more slowly than the during the first half of the decade.<br />

7-2<br />

Millions of Dollars<br />

180,000<br />

160,000<br />

140,000<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

1991<br />

Source: ICE, "Status 1996"<br />

1992<br />

WW IC ($M)<br />

WW <strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> ($M)<br />

WW <strong>Memory</strong> Percent Change<br />

Percent <strong>Memory</strong> of Total IC<br />

DRAM ($M)<br />

SRAM ($M)<br />

EPROM ($M)<br />

Flash ($M)<br />

ROM ($M)<br />

EEPROM ($M)<br />

Other <strong>Memory</strong><br />

Source: ICE, "Status 1996"<br />

1993<br />

1994<br />

1995<br />

Year<br />

CAGR = 36%<br />

1996<br />

1997<br />

1998<br />

Figure 7-2. 1991-2000 <strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> CAGR<br />

90,305<br />

32,455<br />

55%<br />

36%<br />

23,420<br />

3,755<br />

1,390<br />

865<br />

1,890<br />

720<br />

415<br />

128,493<br />

53,225<br />

64%<br />

41%<br />

40,700<br />

6,000<br />

1,365<br />

1,800<br />

2,010<br />

885<br />

465<br />

154,434<br />

64,415<br />

21%<br />

42%<br />

50,075<br />

7,200<br />

1,240<br />

2,300<br />

2,050<br />

1,020<br />

530<br />

175,853<br />

73,745<br />

14%<br />

42%<br />

57,715<br />

8,435<br />

1,120<br />

2,830<br />

1,980<br />

1,090<br />

575<br />

214,382<br />

93,950<br />

27%<br />

44%<br />

75,265<br />

10,280<br />

1,035<br />

3,535<br />

1,960<br />

1,235<br />

640<br />

1999<br />

1994 1995 1996 1997 1998 1999<br />

Figure 7-3. <strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> Forecast<br />

2000<br />

18903B<br />

264,291<br />

122,325<br />

30%<br />

46%<br />

100,595<br />

12,235<br />

935<br />

4,500<br />

1,925<br />

1,420<br />

715<br />

2000<br />

331,866<br />

162,875<br />

33%<br />

49%<br />

136,780<br />

15,050<br />

845<br />

5,800<br />

1,875<br />

1,700<br />

825<br />

18914D<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Any “cooling off” period, ICE believes, will be short lived. With lower ASPs, consumers will<br />

begin to upgrade their computer systems with affordable memory. Those who long waited for<br />

lower prices before upgrading will likely jump at the chance to buy more memory, creating inflated<br />

demand and a return to a supply shortage.<br />

DRAMs make up the majority of <strong>MOS</strong> memory sales and are forecast to be the dominant memory<br />

product through the year 2000 (Figure 7-4). ICE forecasts that in the year 2000, 84 percent of<br />

the <strong>MOS</strong> memory market will be attributed to DRAM sales, up from 77 percent in 1995. Strong<br />

software, PC, and electronic equipment sales will provide the impetus necessary to take DRAM<br />

sales to a new level.<br />

DRAM<br />

SRAM<br />

ROM<br />

EPROM<br />

EEPROM<br />

FLASH<br />

OTHER<br />

TOTAL:<br />

DRAM<br />

SRAM<br />

ROM<br />

EPROM<br />

EEPROM<br />

FLASH<br />

OTHER<br />

TOTAL:<br />

1997<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

72%<br />

12%<br />

6%<br />

4%<br />

2%<br />

3%<br />

1%<br />

$32.5B<br />

78%<br />

11%<br />

3%<br />

2%<br />

1%<br />

4%<br />

1%<br />

$73.7B<br />

Source: ICE, "Status 1996"<br />

DRAM<br />

SRAM<br />

ROM<br />

EPROM<br />

EEPROM<br />

FLASH<br />

OTHER<br />

TOTAL:<br />

DRAM<br />

SRAM<br />

ROM<br />

EPROM<br />

EEPROM<br />

FLASH<br />

OTHER<br />

TOTAL:<br />

1998<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

80%<br />

11%<br />

2%<br />

1%<br />

1%<br />

4%<br />

1%<br />

$94.0B<br />

1995<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

77%<br />

11%<br />

4%<br />

2%<br />

2%<br />

3%<br />

1%<br />

1994 1996<br />

$53.2B<br />

DRAM<br />

SRAM<br />

ROM<br />

EPROM<br />

EEPROM<br />

FLASH<br />

OTHER<br />

TOTAL:<br />

DRAM<br />

SRAM<br />

ROM<br />

EPROM<br />

EEPROM<br />

FLASH<br />

OTHER<br />

TOTAL:<br />

<strong>MOS</strong> memory consumption was again headed by the North American region (Figure 7-5). ICE<br />

estimates that North America consumed 36 percent of all <strong>MOS</strong> memory products in 1995, down<br />

slightly from 1994.<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-3<br />

1999<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

82%<br />

10%<br />

1%<br />

1%<br />

1%<br />

4%<br />

1%<br />

$122.3B<br />

Figure 7-4. <strong>MOS</strong> <strong>Memory</strong> Product <strong>Market</strong>share<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

78%<br />

11%<br />

3%<br />

2%<br />

2%<br />

3%<br />

1%<br />

$64.4B<br />

DRAM<br />

SRAM<br />

ROM<br />

EPROM<br />

EEPROM<br />

FLASH<br />

OTHER<br />

TOTAL:<br />

2000<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

–<br />

84%<br />

9%<br />

1%<br />

1%<br />

1%<br />

4%<br />

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Figure 7-6 leaves no doubt that the Japanese companies are responsible for the greatest amount of<br />

<strong>MOS</strong> memory production. However, the figure also points out how quickly regional production<br />

can increase or decrease from one year to the next. Between 1993 and 1995, for instance, ICE estimates<br />

that Japan’s share of <strong>MOS</strong> memory production decreased 10 percentage points, while the<br />

ROW region increased 10 points. Apparently, no marketshare lead is safe in the IC industry, even<br />

in a market that seemed solidly in the grasp of the Japanese.<br />

<strong>MOS</strong> memory production by region for each memory segment is shown in Figure 7-<strong>7.</strong> Japanese<br />

firms supplied the largest amount of DRAMs, SRAMs, and ROMs—the largest memory market<br />

segments. ROW companies gained additional marketshare in several segments during 1995.<br />

Surprisingly, North American companies actually gained marketshare in the DRAM segment<br />

while making their presence known in the EPROM, EEPROM, and rising flash memory markets.<br />

SGS-Thomson, the world’s leading EPROM manufacturer was the source of Europe’s strong<br />

showing in the EPROM market and also a significant contributor to the EEPROM market.<br />

Listed in Figure 7-8 are sales estimates for the top five worldwide <strong>MOS</strong> memory suppliers in 1995.<br />

Together the five firms accounted for half of <strong>MOS</strong> memory sales during the year. ICE shows that<br />

Samsung continued as the leading supplier of <strong>MOS</strong> memory devices in 1995. Fueled by strong<br />

7-4<br />

ROW<br />

19%<br />

Europe<br />

18%<br />

Source: ICE, "Status 1996"<br />

North American<br />

Companies<br />

20%<br />

ROW<br />

Companies<br />

23%<br />

Source: ICE, "Status 1996"<br />

1994<br />

$32.5B<br />

Japan<br />

26%<br />

North America<br />

37%<br />

ROW<br />

22%<br />

Europe<br />

18% North America<br />

36%<br />

1995 (EST)<br />

$53.2B<br />

Japan<br />

24%<br />

Figure 7-5. <strong>MOS</strong> <strong>Memory</strong> Consumption by Region<br />

European<br />

Companies<br />

4%<br />

1994<br />

$32.5B<br />

Japanes<br />

Companies<br />

53%<br />

North American<br />

Companies<br />

21%<br />

European<br />

Companies<br />

4%<br />

Figure 7-6. <strong>MOS</strong> <strong>Memory</strong> Production<br />

1995 (EST)<br />

$53.2B<br />

ROW<br />

Companies<br />

29%<br />

18912E<br />

Japanese<br />

Companies<br />

46%<br />

20173A<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

DRAM demand, its <strong>MOS</strong> memory sales increased well beyond its 1994 level. <strong>The</strong> strong DRAM<br />

market allowed another Korean supplier,LG Semicon, to join the top-five list. NEC, Hitachi, and<br />

Toshiba were lumped together at the number two, three, and four positions.<br />

Percentage<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

15%<br />

49%<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

3%<br />

DRAM<br />

$40,700M<br />

Source: ICE, "Status 1996"<br />

33%<br />

30%<br />

<br />

<br />

Rank<br />

1<br />

2<br />

3<br />

4<br />

5<br />

Other<br />

Total<br />

47%<br />

20%<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

3%<br />

SRAM<br />

$6,000M<br />

<br />

<br />

75%<br />

2% 1%<br />

ROM<br />

$2,010M<br />

North American<br />

Companies<br />

European<br />

Companies<br />

22%<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-5<br />

53%<br />

9%<br />

29%<br />

EPROM<br />

$1,365M<br />

9%<br />

<br />

<br />

<br />

<br />

66%<br />

7%<br />

26%<br />

EEPROM<br />

$885M<br />

Japanese<br />

Companies<br />

ROW<br />

Companies<br />

Figure 7-<strong>7.</strong> 1995 <strong>MOS</strong> <strong>Memory</strong> Production by Segment ($M)<br />

Company<br />

Samsung<br />

NEC<br />

Toshiba<br />

Hitachi<br />

Mitsubishi<br />

—<br />

—<br />

Source: ICE, "Status 1996"<br />

1994<br />

Sales<br />

($M)<br />

4,060<br />

3,440<br />

3,400<br />

3,150<br />

1,830<br />

16,575<br />

32,455<br />

<strong>Market</strong>share<br />

(%)<br />

12<br />

11<br />

10<br />

10<br />

6<br />

51<br />

100<br />

Company<br />

Samsung<br />

NEC<br />

Hitachi<br />

Toshiba<br />

LG Semicon<br />

1995 (EST)<br />

Sales<br />

($M)<br />

7,545<br />

5,630<br />

5,560<br />

4,535<br />

3,165<br />

26,790<br />

53,225<br />

Figure 7-8. Total <strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> Leaders<br />

—<br />

—<br />

1%<br />

<br />

<br />

14<br />

11<br />

10<br />

9<br />

6<br />

50<br />

100<br />

85%<br />

<strong>Market</strong>share<br />

(%)<br />

14495N<br />

8%<br />

5%<br />

Flash<br />

$1,800M<br />

2%<br />

<br />

<br />

14516N

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

ROMs<br />

ROMs represent the least expensive type of semiconductor memory. <strong>The</strong>y are used primarily for<br />

storing data for electronic equipment such as fonts for laser printers, dictionary data in word<br />

processors, and sound-source data in electronic musical instruments. ROMs are also used extensively<br />

in video game software. A six-year quarterly history of the ROM market, including dollar<br />

volume, units, and ASP, is displayed in Figure 7-9. <strong>The</strong> surge in the ROM market beginning in<br />

1993 closely coincided with a jump in PC sales and other consumer-oriented electronic systems.<br />

ICE believes the ROM market will show only one more year of growth before it starts to dwindle<br />

in size through the remainder of the decade (Figure 7-10). <strong>The</strong> main reason for the decline is that<br />

the biggest market for mask ROMs—video games—is moving toward CD-ROM-based machines.<br />

<strong>The</strong> result is a mask ROM market that will likely begin a sales downturn in 199<strong>7.</strong><br />

Despite the fact that high-performance game applications for ROMs may be dwindling, demand<br />

for the high-density versions has increased. Sharp added 3V versions to its high-density line, and<br />

in 2H95, began volume production of its 64M ROM device.<br />

Sharp also introduced a novel memory device that combines ROM and RAM on one chip. A customer<br />

can choose on a page-by-page basis whether the page should be RAM or ROM, solving<br />

memory mapping headaches for small, handheld systems.<br />

7-6<br />

Billings in Millions<br />

650<br />

600<br />

550<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

219<br />

$2.85<br />

77<br />

Source: ICE, "Status 1996"<br />

Dollar Volume<br />

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q<br />

(EST)<br />

1990 1991 1992<br />

ASP<br />

Year<br />

Figure 7-9. 1990-1995 ROM <strong>Market</strong><br />

Unit Volume<br />

1993 1994 1995<br />

$5.06<br />

607<br />

120<br />

5.20<br />

5.00<br />

4.80<br />

4.60<br />

4.40<br />

4.20<br />

4.00<br />

3.80<br />

3.60<br />

3.40<br />

3.20<br />

3.00<br />

2.80<br />

2.60<br />

2.40<br />

17854G<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION<br />

ASP ($)

Millions of Dollars<br />

2,100<br />

2,000<br />

1,900<br />

1,800<br />

1,700<br />

1,600<br />

1,500<br />

1,400<br />

1,300<br />

1,200<br />

1,100<br />

1,000<br />

Percent<br />

Change<br />

1991<br />

Source: ICE, "Status 1996"<br />

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

1992 1993 1994 1995<br />

Year<br />

1996 1997 1998 1999 2000<br />

16% 33% 16% 6% 2% –3% –1% –2% –3%<br />

Figure 7-10. ROM <strong>Market</strong> to Fizzle<br />

Another interesting ROM development targeting the multimedia market is the Record-On-Silicon<br />

(ROS) device from Siemens. With a 50-percent reduction in die area compared with conventional<br />

ROM, the company claims the ROS could halve the cost of conventional ROM and push into<br />

markets for non-semiconductor storage, such as compact disks and photographic film. Few<br />

details of the technology are available now, but a 64M version of the device will be introduced in<br />

199<strong>7.</strong><br />

In the ROM market, Japanese IC makers continued to hold a dominant position (Figure 7-11).<br />

Sharp and NEC held the largest shares of the ROM market in 1995. However, not all Japanese IC<br />

vendors are staying in the ROM business. Fujitsu announced its intentions to withdraw from the<br />

mask ROM business. It plans to cancel development efforts for 32M and other next-generation<br />

units, and, in 1996, will stop producing and shipping its current line of 16M and smaller products.<br />

<strong>The</strong> ROM market by geographic region is shown in Figure 7-12. <strong>The</strong> ROW region, where numerous<br />

ROM-intensive electronic games are manufactured, greatly increased its share of the ROM<br />

market in 1995.<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-7<br />

20348A

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

<strong>Market</strong> demand for ROMs is slowly migrating toward higher densities (Figure 7-13). Most ROM<br />

manufacturers elected to keep their ROM production at the 4M level. However, UMC in Taiwan,<br />

Sharp in Japan, and Samsung in Korea intend to develop mask ROMs beyond the 32M<br />

density.<br />

EPROMs<br />

EPROMs (electrically programmable read only memory) have long been the cornerstone of the<br />

non-volatile memory market. Created in the 1970’s with Intel’s invention of the UV-erasable<br />

PROM, these devices have since been produced in an assortment of part types with varying<br />

speeds and densities. <strong>The</strong>y are used in numerous applications and have been a favorite for their<br />

versatility. However, EPROMs’ stronghold has been tested in recent years with the emergence of<br />

other non-volatile memory products, specifically flash memory.<br />

7-8<br />

Rank<br />

1<br />

2<br />

3<br />

4<br />

5<br />

Other<br />

Total<br />

Company<br />

Sharp<br />

NEC<br />

Samsung<br />

Toshiba<br />

Hitachi<br />

—<br />

—<br />

Source: ICE, "Status 1996"<br />

Europe<br />

2%<br />

Source: ICE, "Status 1996"<br />

Japan<br />

74%<br />

1994<br />

$1,890M<br />

North<br />

America<br />

13%<br />

1994 1995 (EST)<br />

Sales<br />

($M)<br />

470<br />

380<br />

292<br />

240<br />

230<br />

278<br />

1,890<br />

<strong>Market</strong>share<br />

(%)<br />

25<br />

20<br />

15<br />

13<br />

12<br />

15<br />

100<br />

Company<br />

Sharp<br />

NEC<br />

Toshiba<br />

Hitachi<br />

Samsung<br />

—<br />

—<br />

Figure 7-11. ROM <strong>Market</strong> Leaders<br />

ROW<br />

11%<br />

Europe<br />

3%<br />

Figure 7-12. ROM <strong>Market</strong> by Region<br />

Sales<br />

($M)<br />

500<br />

400<br />

255<br />

245<br />

230<br />

380<br />

2,010<br />

Japan<br />

59%<br />

1995 (EST)<br />

$2,010M<br />

<strong>Market</strong>share<br />

(%)<br />

ROW<br />

21%<br />

14496N<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION<br />

25<br />

20<br />

13<br />

12<br />

11<br />

19<br />

100<br />

North<br />

America<br />

17%<br />

16790J

40<br />

30<br />

20<br />

10<br />

0<br />

24%<br />

Source: ICE, "Status 1996"<br />

31%<br />

18%<br />

27%<br />

≤2M 4M 8M >8M<br />

≤2M 4M 8M >8M<br />

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

<strong>The</strong> recent history of the EPROM market, including unit shipments and ASPs, is shown in Figure<br />

7-14. Dollar volume remained reasonably steady until 1994 when the impact of flash memory was<br />

felt. However, high initial prices and lack of supply in the flash market allowed the EPROM market<br />

to rebound late in 1994 and into 1995.<br />

Billings in Millions<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

1Q<br />

378<br />

<strong>Market</strong>share Percent<br />

$3.35<br />

2Q<br />

Source: ICE, "Status 1996"<br />

3Q<br />

4Q<br />

1994<br />

$1,890M<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-9<br />

22%<br />

31%<br />

19%<br />

1995 (EST)<br />

$2,010M<br />

Figure 7-13. ROM Unit Shipments by Density<br />

1Q<br />

2Q<br />

3Q<br />

1991 1992<br />

Dollar Volume<br />

ASP<br />

4Q<br />

1Q<br />

2Q<br />

3Q<br />

4Q<br />

1Q<br />

2Q<br />

3Q<br />

28%<br />

4Q<br />

18915D<br />

Unit Volume<br />

113 110<br />

1Q<br />

2Q<br />

1993<br />

Year<br />

1994 1995<br />

Figure 7-14. 1991-1995 EPROM <strong>Market</strong><br />

314<br />

$2.85<br />

3Q 4Q<br />

(EST)<br />

4.00<br />

3.80<br />

3.60<br />

3.40<br />

3.20<br />

3.00<br />

2.80<br />

2.60<br />

2.40<br />

2.20<br />

2.00<br />

ASP ($)<br />

17853G

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

ICE believes that the EPROM sales peaked in 1994 and have now started to track a slow market<br />

decline through the end of the decade (Figure 7-15). <strong>The</strong> decline comes as many long-time<br />

EPROM suppliers, evaluating their capacity allocations, have chosen to produce devices with<br />

higher profit margins.<br />

<strong>The</strong> year 1999 should be the first (since its initial market days) that the EPROM market fails to<br />

reach the $1 billion level. Still, even though it is forecast to decline, a roughly one-billion dollar<br />

market is quite sizable. As will be mentioned later, while numerous competitors have lessened<br />

their commitments to the EPROM market, others have increased production to milk all they can<br />

from the roughly $1 billion business.<br />

<strong>The</strong> density domain of EPROMs remained at the lower level (256K and 512K, Figure 7-16). <strong>The</strong><br />

choice between EPROM and flash memory comes into play at higher densities ( 1M). In some<br />

cases, lower cost, lower voltage, and faster speed of some EPROM products may offer an advantage<br />

over competing devices. However, the trade-off of lower price is sometimes met with less<br />

flexibility (Figure 7-17).<br />

<strong>The</strong> leading EPROM suppliers for 1995 are shown in Figure 7-18. This list has changed several<br />

times during the past five years and will probably change more by the year 2000.<br />

7-10<br />

Millions of Dollars<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Percent Change<br />

From Previous<br />

Year<br />

Source: ICE, "Status 1996"<br />

$1,390 $1,365<br />

1994<br />

3%<br />

1995<br />

–2%<br />

$1,240<br />

1996<br />

–9%<br />

$1,120<br />

1997<br />

–10%<br />

Figure 7-15. EPROM <strong>Market</strong> Decline<br />

$1,035<br />

1998<br />

–8%<br />

$935<br />

1999<br />

–10%<br />

$845<br />

2000<br />

–10%<br />

19518B<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Typical Storage Use<br />

Typical Number<br />

of Writes<br />

Densities Available<br />

Flexibility<br />

Cost Per Bit<br />

≤256K<br />

40%<br />

Source: ICE, "Status 1996"<br />

1995 (EST)<br />

492M<br />

>1M<br />

14%<br />

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-11<br />

512K<br />

28%<br />

1M<br />

18%<br />

19519B<br />

Figure 7-16. EPROM <strong>Market</strong> by Density (Units)<br />

EPROM Flash EEPROM<br />

Fixed programs<br />

Write once<br />

256K to 8M<br />

Least<br />

Least<br />

In-system modifiable<br />

programs<br />

Write up to 100,000<br />

times<br />

256K to 16M<br />

Frequently updated<br />

programs and data<br />

Write up to one million<br />

times<br />

1K to 64K (serial)<br />

64K to 4M (parallel)<br />

Most<br />

Most<br />

Source: Atmel/ICE, "Status 1996" 20411<br />

Rank<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

Other<br />

Total<br />

Figure 7-1<strong>7.</strong> EPROMs Offer Lower Cost But Less Flexibility<br />

Company<br />

SGS-Thomson<br />

AMD<br />

TI<br />

Atmel<br />

National<br />

Cypress<br />

Source: ICE, "Status 1996"<br />

—<br />

—<br />

1994<br />

Sales<br />

($M)<br />

395<br />

215<br />

190<br />

145<br />

160<br />

45<br />

240<br />

1,390<br />

<strong>Market</strong>share<br />

(%)<br />

28<br />

15<br />

14<br />

10<br />

12<br />

3<br />

17<br />

100<br />

Sales<br />

($M)<br />

345<br />

170<br />

135<br />

125<br />

125<br />

105<br />

360<br />

1,365<br />

Figure 7-18. EPROM <strong>Market</strong> Leaders<br />

1995 (EST)<br />

<strong>Market</strong>share<br />

(%)<br />

25<br />

13<br />

10<br />

9<br />

9<br />

8<br />

26<br />

100<br />

14497N

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Since 1993, several “big-name” vendors have dropped out of the EPROM business. In the early<br />

1990’s, Intel was the EPROM leader. Today, it is out of the market. Likewise, Philips<br />

Semiconductor, previously a medium-sized EPROM player, withdrew from the market. And,<br />

Fujitsu, concluding that flash memories will replace EPROMs in many applications, terminated<br />

development of its next-generation 8M EPROM device.<br />

During 1995, several leading EPROM suppliers were caught somewhere between trying to<br />

improve a technology that will likely return small, near-term financial rewards or investing in<br />

flash memory, which represents the future of nonvolatile memory and offers greater profitability.<br />

Texas Instruments, National Semiconductor, and AMD all reduced their EPROM production and<br />

future commitments to the EPROM market.<br />

TI informed customers that it would reduce production of its EPROMs roughly 50 percent beginning<br />

in 2H95 in order to allow more capacity for manufacturing digital signal processors.<br />

National’s total EPROM production was expected to diminish by 60 percent in 1995 as the company<br />

placed more emphasis on application-specific devices. Meanwhile, AMD was forced to closely<br />

evaluate its internal fab production commitments after losing two key EPROM foundry partners.<br />

Not every company distanced themselves from EPROMs, however. SGS-Thomson retained its<br />

leadership position in the EPROM business by emphasizing high-speed devices and filling out<br />

other niche organizations in its EPROM line-up. For instance, ST ramped production of its 8M<br />

(100ns and 120ns versions) and 16M (150ns and 200ns versions) lines in 1995 to meet increased<br />

demand for cost-effective alternatives to high-density ROM and flash memory devices.<br />

Smaller EPROM producers such as Cypress Semiconductor and Integrated Silicon Solutions Inc.<br />

have provided mainly niche-oriented high-speed EPROMs but are eager to fill the void left by<br />

larger players. A summary of those suppliers placing greater and less emphasis on the EPROM<br />

market is shown in Figure 7-19.<br />

Through the years, the EPROM market has been much more evenly balanced by region than other<br />

memory segments (Figure 7-20). ICE forecasts that the ROW region will capture more of the<br />

EPROM market in the coming years, while the European and Japanese markets will fluctuate<br />

around the same level as in 1995. Reduced EPROM consumption in North America is due to<br />

quick acceptance and implementation of flash memory in this region.<br />

EEPROMs<br />

EEPROMs (electrically erasable programmable read only memories) offer users excellent capabilities<br />

and performance. <strong>The</strong>y are available in either a serial or parallel version. Parallel EEPROMs<br />

are available in higher densities, are generally faster, offer high endurance and reliability, but also<br />

7-12<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

cost more than their serial counterparts. Until recently, parallel EEPROMs found little interest<br />

beyond the military market. Serial EEPROMs, though generally less dense and slower than parallel<br />

devices, are much cheaper.<br />

Less Emphasis<br />

AMD<br />

• Evaluating in-house<br />

capacity allocation<br />

• Lost two EPROM foundry<br />

suppliers<br />

• More wafer starts at Flash<br />

facility (FASL) in Japan<br />

National<br />

• EPROM production down<br />

60 percent in 1995<br />

• Integrating EPROM and Flash<br />

capabilities with MCU<br />

and MPU technology to create<br />

application-specific products<br />

Texas Instruments<br />

• Reduced EPROM production<br />

50 percent to provide more<br />

capacity for DSPs<br />

Source: ICE, "Status 1996"<br />

North<br />

America<br />

33%<br />

Source: ICE, "Status 1996"<br />

SGS-Thomson<br />

More Emphasis<br />

• Upgrading EPROM<br />

process to 0.6 µm<br />

• Densities to 16M;<br />

many low-voltage versions<br />

Cypress<br />

• Previously a high-speed<br />

EPROM player, now<br />

attacking slow, low-cost<br />

segment left behind by others<br />

Integrated Silicon Solution Inc.<br />

• High-performance EPROMs<br />

for code storage applications<br />

Figure 7-19. EPROM Suppliers – Coming and Going<br />

1994<br />

$1,390M<br />

ROW<br />

15%<br />

Japan<br />

29%<br />

Europe<br />

23%<br />

North<br />

America<br />

29%<br />

Figure 7-20. EPROM <strong>Market</strong> by Region<br />

Japan<br />

29%<br />

1995 (EST)<br />

$1,365M<br />

<strong>The</strong> near-term EEPROM market forecast is shown in Figure 7-21. In 1995 the EEPROM market<br />

grew 23 percent following up on 20 percent growth in 1994. <strong>The</strong> CAGR for EEPROMs is estimated<br />

to be 14 percent for the 1995-2000 time period. Due in part to military use, the North American<br />

market was the largest for EEPROMs in 1995 (Figure 7-22).<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-13<br />

ROW<br />

20%<br />

20412<br />

Europe<br />

22%<br />

16791J

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

ICE estimates that in 1995, the serial EEPROM market accounted for 90 percent of the $885 million<br />

EEPROM market (Figure 7-23). <strong>The</strong> largest serial EEPROM density shipping in volume was<br />

the 64K density device. Companies such as Atmel, Xicor, and SGS-Thomson supplied the large<br />

majority of these devices.<br />

<strong>The</strong> largest parallel EEPROMs built in volume during 1995 were 1M devices. <strong>The</strong>y were used<br />

extensively, although not exclusively, in military applications. Parallel EEPROMs are of particular<br />

interest in the military because they offer more flexibility than other kinds of solid-state memory.<br />

Specifically, parallel EEPROMs can be erased bit by bit, whereas other types of memory such<br />

as flash can only be erased in larger block segments at one time.<br />

7-14<br />

Millions of Dollars<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Percent<br />

Change<br />

720<br />

1994<br />

Source: ICE, "Status 1996"<br />

885<br />

1995<br />

1,020<br />

1996<br />

North<br />

America<br />

51%<br />

1995 (EST)<br />

$885M<br />

Source: ICE, "Status 1996"<br />

Japan<br />

12%<br />

1,090<br />

1997<br />

Year<br />

1,235<br />

1998<br />

ROW<br />

13%<br />

Europe<br />

24%<br />

1,420<br />

1999<br />

16792G<br />

1,700<br />

2000<br />

20% 23% 15% 7% 13% 15% 20%<br />

Figure 7-21. EEPROM <strong>Market</strong> Forecast ($M)<br />

Figure 7-22. 1995 EEPROM <strong>Market</strong><br />

20347A<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Serial EEPROM<br />

90%<br />

1995 (EST)<br />

$885M<br />

Source: ICE, "Status 1996"<br />

Figure 7-23. 1995 EEPROM <strong>Market</strong><br />

Parallel EEPROM<br />

10%<br />

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Parallel EEPROMs can be found in defense applications such as flight controllers, vehicle control<br />

systems, field communications equipment, secure radios, command and control systems, radar,<br />

and guidance subsystems. <strong>The</strong> lightness, ruggedness, and fast performance of parallel EEPROMs<br />

make them well suited for harsh environments. Figure 7-24 gives a sampling of parallel EEPROM<br />

suppliers and some of the devices they offer.<br />

Aeroflex Circuit Technology<br />

ARX-E1MX32<br />

(MCM)<br />

Atmel Corp.<br />

AT28C040<br />

AT28C010<br />

Electronic Designs Inc.<br />

EDI5C32128C<br />

EDI5M32128C<br />

EDI5C3232C<br />

EDI5M3232C<br />

Sac-Tec Labs<br />

TBD<br />

ST512x32x<br />

Space Electronics<br />

28CO10RP<br />

79C010RP<br />

28C256ERP<br />

White Microelectronics<br />

WF2048K32<br />

WE128K32<br />

WF1024K32<br />

Xlcor Inc.<br />

X28HC256<br />

X28VC256<br />

X28C010<br />

X28C512<br />

Source: ICE, "Status 1996"<br />

Density<br />

(Bits)<br />

32M<br />

4M<br />

1M<br />

4M<br />

4M<br />

1M<br />

1M<br />

144/<br />

288M<br />

16/<br />

32M<br />

1M<br />

1M<br />

256K<br />

64M<br />

4M<br />

32M<br />

256K<br />

256K<br />

1M<br />

512<br />

Organization<br />

1M x 32<br />

512K x 8<br />

128K x 8<br />

128K x 32<br />

128K x 32<br />

32K x 32<br />

32K x 32<br />

Multiple I/O<br />

512K x 32<br />

1,024K x 32<br />

128K x 8 bit<br />

MCM 32K x 8 bit<br />

32K x 8 bit<br />

2,048K x 32<br />

128K x 32<br />

1,024K x 32<br />

32K x 8<br />

32K x 8<br />

128K x 8<br />

64K x 8<br />

Endurance<br />

(Erase/Write Cycles)<br />

10,000 to 100,000<br />

100,000<br />

100,000<br />

10,000<br />

10,000<br />

10,000<br />

10,000<br />

100,000<br />

100,000<br />

10,000<br />

10,000<br />

10,000<br />

1,000,000<br />

N/A<br />

100,000<br />

100,000<br />

100,000<br />

100,000<br />

100,000<br />

Voltage<br />

(V)<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-15<br />

5<br />

5<br />

5<br />

5<br />

5<br />

5<br />

5<br />

5, 12<br />

5, 12<br />

2<br />

2<br />

2<br />

3.3/5<br />

5<br />

5/12<br />

5<br />

5<br />

5<br />

5<br />

Packaging<br />

2.1" x 2.9" x .275"<br />

32 flatpack, 44 LCC,<br />

32 DIP<br />

32 LCC<br />

68-pin ceramic JLCC<br />

68-pin ceramic PGA<br />

68-pin ceramic JLCC<br />

68-pin ceramic PGA<br />

Hybrid module<br />

SMD module<br />

Hybrid module<br />

SMD module<br />

32-pin flatpack<br />

36-pin flatpack<br />

28-pin flatpack<br />

PGA/HIP & CQFP<br />

PGA/HIP & CQFP<br />

PGA/HIP & CQFP<br />

DIP, LCC<br />

DIP, LCC<br />

DIP, LCC<br />

DIP, LCC<br />

20413<br />

Figure 7-24. Sampling of Parallel EEPROM Suppliers & Devices<br />

Military<br />

Qualifications/Spec<br />

Mil-Std-883<br />

5962-94551<br />

5962-38267<br />

—<br />

—<br />

—<br />

—<br />

Mil-H-38534<br />

compliant<br />

Mil-H-38534<br />

compliant<br />

Class B & S<br />

Class B & S<br />

Class B & S<br />

883/SMD<br />

883/SMD<br />

883/SMD<br />

883<br />

883<br />

883<br />

883<br />

Military<br />

Applications<br />

Airborne<br />

Land-based<br />

avionics<br />

Avionics<br />

Various<br />

Various<br />

Various<br />

Various<br />

Space/Defense<br />

Space/Defense<br />

Military & Space<br />

Military & Space<br />

Military & Space<br />

Solid-state storage<br />

Solid-state storage<br />

Solid-state storage<br />

Flight data recorders,<br />

flight control systems,<br />

communications<br />

20349

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Consumer-oriented applications<br />

represented the largest end-use of<br />

serial EEPROMs in 1995 (Figure 7-<br />

25). Consumer applications span a<br />

wide variety of electronic systems<br />

but essentially involve systems<br />

where “touch” or “push” programmability<br />

exists. Other leading serial<br />

EEPROM applications are shown in<br />

Figure 7-26.<br />

EEPROMs are well suited for low-voltage operation and are being developed along side other<br />

technologies for such applications. In 4Q95, Xicor introduced a prototype million-transistor<br />

device that integrates EEPROM technology with digital signal processing. <strong>The</strong> IC, to be priced<br />

under $50, will be sold to portable communications equipment makers that need in-system programmability<br />

and 1.8-volt operation. Toshiba and Hitachi also improved their EEPROM line-ups<br />

to better meet high-speed, low-voltage, and low power consumption demands.<br />

<strong>The</strong> number of erase/write cycles that a particular EEPROM device offers depends on several factors<br />

such as temperature, voltage, and the number of cycles per day. For EEPROMs, endurance<br />

ratings of 100,000 and one million erase/write cycles are common. In contrast, 100,000 cycles are<br />

7-16<br />

Office 7%<br />

Automotive<br />

8%<br />

Computer-Related<br />

7%<br />

Military/Aerospace<br />

7%<br />

Source: ICE, "Status 1996"<br />

Industrial<br />

15%<br />

1995<br />

Telecom<br />

20%<br />

Consumer<br />

36%<br />

19520B<br />

Figure 7-25. Serial EEPROM Applications (Units)<br />

Consumer<br />

TV<br />

VCR<br />

Radio Tuner<br />

CD/Laser Disk<br />

Feature Phone<br />

Pay Phone<br />

Answer Machine<br />

Pager<br />

Photo Equip.<br />

Handheld Remote<br />

Weight Scale<br />

Camcorder<br />

Exercise Machine<br />

Sonabuoy<br />

Smart Key<br />

Electronic Locks<br />

Smart Cards<br />

Appliances<br />

Karaoke<br />

Video Game<br />

Automotive<br />

Anti-lock Brake Sys.<br />

Air Bag Sensor<br />

Odometer<br />

Trip Computer<br />

Power Steering Ctrl<br />

Cruise Control<br />

Wiper Control<br />

Security System<br />

Shock Sensor<br />

Electronic Key<br />

Keyless Entry<br />

Radio<br />

Cellular Phone<br />

Mobile TV<br />

Industrial<br />

<strong>The</strong>rmostat<br />

Utility Meter<br />

Security<br />

System<br />

Controller<br />

Computer Peripheral<br />

Disk Drive<br />

PC LAN System<br />

PCMCIA Card<br />

Video Graphics Card<br />

Video Monitor<br />

Access Bus Protocol<br />

Laser Printer<br />

Scanner<br />

Bar Code Reader<br />

Communications<br />

Modem<br />

Fax Machine<br />

Copier<br />

Cellular Phone<br />

Mobile Phone<br />

PABX System<br />

Satellite Receiver<br />

POS Terminal<br />

Data Acquisition<br />

PDA<br />

Source: Microchip/ICE, "Status 1996" 20416<br />

Figure 7-26. Typical Serial EEPROM Applications<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

at the high end of performance for flash memory devices. Depending on the design, the number<br />

of erase/write cycles may or may not be important. Figure 7-27 shows applications that change<br />

or update the data in an EEPROM most often during a day. Applications such as a maintenance<br />

log or last number redial are the most taxing on an EEPROM.<br />

Maintenance Log<br />

Last Number Redial<br />

Electronic Lock Access<br />

Power-Down Storage<br />

Digital Potentiometer<br />

Look-Up Table<br />

Tuner Controls<br />

System Configuration<br />

Anti-Lock Braking System<br />

Speed Dial<br />

Airbag<br />

0.01 0.1 1 10 100 1,000<br />

Cycles Per Day<br />

Source: Microchip Technology/ICE, "Status 1996"<br />

19521<br />

Leading EEPROM suppliers are shown in Figure 7-28. Atmel, SGS-Thomson, and Microchip<br />

Technology continue to make strides in the market.<br />

Rank<br />

1<br />

2<br />

3<br />

4<br />

5<br />

—<br />

—<br />

Figure 7-2<strong>7.</strong> EEPROM Endurance Requirements<br />

Company<br />

SGS-Thomson<br />

Atmel<br />

Xicor<br />

Microchip<br />

National<br />

Others<br />

—<br />

Source: ICE, "Status 1996"<br />

1994<br />

Sales<br />

($M)<br />

115<br />

140<br />

95<br />

60<br />

45<br />

265<br />

720<br />

<strong>Market</strong>share<br />

(%)<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-17<br />

16<br />

20<br />

13<br />

8<br />

6<br />

37<br />

100<br />

Sales<br />

($M)<br />

170<br />

145<br />

100<br />

85<br />

55<br />

330<br />

885<br />

Figure 7-28. 1995 EEPROM <strong>Market</strong> Leaders<br />

1995 (EST)<br />

<strong>Market</strong>share<br />

(%)<br />

19<br />

17<br />

11<br />

10<br />

6<br />

37<br />

100<br />

14498N

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

FLASH MEMORY<br />

Flash memory is the newcomer on the <strong>MOS</strong> memory block. Despite being commercially available<br />

since around 1990, flash pricing and performance have inched closer to parity with many other<br />

memory devices. Given the option, more and more designers are giving serious consideration to<br />

flash memory products in their systems. Lower pricing, increased performance, and more design<br />

wins in innovative products have stirred a lot of interest in the flash memory market.<br />

Since 1990, flash memory products have revolutionized how designers think about storing control<br />

code in computers, peripherals, communication devices, and a number of other applications.<br />

Several elements, highlighted in Figure 7-29, will help the flash memory market expand further in<br />

1996.<br />

Figure 7-30 demonstrates how flash memory is forecast to be the memory segment with the highest<br />

CAGR through the year 2000. Driving the growth are wide ranging embedded applications,<br />

which account for 80 to 90 percent of all flash sales. Hot markets include PC BIOS, telecommunications<br />

devices such as cellular phones and modems, printers, hard disk drives, and video game<br />

cartridges. Flash devices are serving in new and innovative applications rather than strictly as<br />

EPROM replacement. In fact, 1995 was the first year that the flash memory market was larger<br />

than the EPROM memory market.<br />

A brief market history of flash devices is plotted in Figure 7-31 . <strong>The</strong> forecast growth in the flash<br />

market is plotted in Figure 7-32. By the year 2000, ICE expects the flash market to be $5.8 billion,<br />

more than three times its 1995 size.<br />

Currently, the majority of flash devices shipped are 1M (33 percent) and 4M (24 percent) densities<br />

(Figure 7-33). 16M and 4M devices will ship more than any other size as applications become<br />

more sophisticated toward the end of the decade.<br />

ICE estimates that consumption of flash memory devices was greatest in the North American<br />

region in 1995 (Figure 7-34). Solid business applications—especially in the portable/mobile category—provided<br />

a strong foundation for growth in both the North American and European regions.<br />

7-18<br />

•Ability to rewrite data or code in a system<br />

•ASPs competitive with DRAM at 4M, 16M densities<br />

•High density, low power, rewrite ability, non-volatility<br />

favor growing hand-held/portable/mobile electronics<br />

Source: ICE, "Status 1996"<br />

Figure 7-29. Growth Factors in Flash <strong>Memory</strong> <strong>Market</strong><br />

20073<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Percent<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

–10<br />

Flash<br />

Source: ICE, "Status 1996"<br />

Billings in Millions<br />

600<br />

550<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

$8.57<br />

Dollar Volume<br />

120<br />

14<br />

1Q<br />

2Q<br />

Source: ICE, "Status 1996"<br />

DRAM<br />

SRAM<br />

EEPROM<br />

Figure 7-30. 1992-2000 <strong>Memory</strong> IC CAGRs<br />

3Q<br />

Unit Volume<br />

4Q<br />

1Q<br />

2Q<br />

Year<br />

3Q<br />

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

EPROM<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-19<br />

4Q<br />

1Q<br />

ASP<br />

2Q<br />

1993 1994 1995<br />

Figure 7-31. Flash <strong>Memory</strong> <strong>Market</strong><br />

ROM<br />

3Q<br />

571<br />

$<strong>7.</strong>61<br />

75<br />

4Q<br />

(EST)<br />

9.00<br />

8.80<br />

8.60<br />

8.40<br />

8.20<br />

8.00<br />

<strong>7.</strong>80<br />

<strong>7.</strong>60<br />

<strong>7.</strong>40<br />

<strong>7.</strong>20<br />

<strong>7.</strong>00<br />

6.80<br />

6.60<br />

6.40<br />

ASP ($)<br />

20417<br />

20071A

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

<strong>The</strong> leading flash memory suppliers are displayed in Figure 7-35. Intel and AMD dominate this<br />

market. Both companies are well up the learning curve slope while many other companies are just<br />

beginning to get their flash business off the ground. With its AMD partnership (FASL) in place,<br />

Fujitsu was able to join the small group of manufacturers that generated triple-digit flash revenue<br />

growth in 1995.<br />

7-20<br />

Millions of Dollars<br />

6,000<br />

5,000<br />

4000,<br />

3,000<br />

2000,<br />

1,000<br />

0<br />

Total ($M)<br />

Percent Change<br />

Source: ICE, "Status 1996"<br />

1991<br />

1992<br />

100 270<br />

171%<br />

1993<br />

640<br />

137%<br />

1994<br />

865<br />

35%<br />

1995<br />

1,800<br />

108%<br />

1996<br />

2,300<br />

28%<br />

1997<br />

2,830<br />

23%<br />

1998<br />

3,535<br />

25%<br />

Figure 7-32. Dollar Value of Worldwide Flash <strong>Memory</strong> <strong>Market</strong><br />

4M<br />

24%<br />

2M<br />

13%<br />

≥16M<br />

1%<br />

8M<br />

9%<br />

Source: ICE, "Status 1996"<br />

1995 (EST)<br />

232M<br />

256K<br />

10% 512K<br />

10%<br />

1M<br />

33%<br />

20351A<br />

Figure 7-33. Flash Unit Shipments by Density<br />

1999<br />

4,500<br />

27%<br />

2000<br />

5,800<br />

29%<br />

18692B<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Following behind in flash sales were a handful of other manufacturers from around the world.<br />

<strong>The</strong>se included Atmel, Hitachi, Micron, Mitsubishi, Samsung, SGS-Thomson, and Toshiba. <strong>The</strong>re<br />

are many vendors who want to be a part of the flash memory business, but not all are capable from<br />

a technology standpoint. Neither are many vendors capable from a financial standpoint. That is<br />

why the list of leading vendors is still primarily limited to companies with a strong financial base,<br />

solid R&D skills, and large fab capacity.<br />

At least three significant hurdles face the flash memory market if it is to continue growing at its<br />

fast pace. <strong>The</strong> issues are architecture, voltage supply, and capacity.<br />

Architecture<br />

Others<br />

21%<br />

AMD<br />

25%<br />

Source: ICE, "Status 1996"<br />

ROW<br />

12%<br />

North America<br />

46%<br />

Source: ICE, "Status 1996"<br />

1995 (EST)<br />

$1.8B<br />

Japan<br />

18%<br />

Europe<br />

24%<br />

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

All flash devices are not created equally. <strong>The</strong>re are two prominent architectures that compete in<br />

today’s market: NOR and NAND. Both are based on technology from flash’s predecessors, the<br />

EPROM and EEPROM circuits. NOR and NAND imply different types of memory cell structure.<br />

Each uses floating-gate transistors for storage elements, but differ in the way the memory cells are<br />

linked together.<br />

Also, each is well suited for specific applications—NOR for RAM-like applications requiring fast<br />

access times, and NAND for applications that do not require repetitive random accesses, such as<br />

disk-drive replacements.<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-21<br />

20093A<br />

Figure 7-34. 1995 Flash <strong>Memory</strong> <strong>Market</strong> by Region<br />

1994<br />

$865M<br />

INTEL<br />

54%<br />

Others<br />

20%<br />

AMD<br />

30%<br />

1995 $1.8B<br />

(EST)<br />

Figure 7-35. Leading Flash <strong>Memory</strong> Suppliers<br />

INTEL<br />

50%<br />

20092A

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Beyond NOR and NAND are emerging architectures such as Mitsubishi’s DINOR (divided bitline<br />

NOR) technology and the AND structure that is being promoted by Hitachi. DINOR offers<br />

low power and low voltage in a die size approximately 20 percent smaller than an equivalent<br />

NOR device. While each architecture has its benefits, NOR and NAND were the two front runners<br />

through 1995 and will likely dominate the near-term market.<br />

Figure 7-36 provides a brief comparison of the four available flash architecture styles while Figure<br />

7-37 provides a look at the various flash memory architectures and the vendors who support<br />

them.<br />

7-22<br />

Architecture NOR DINOR NAND AND<br />

Program Method<br />

Erase Method<br />

Possible Power Supply<br />

single 3.3V<br />

single 5V<br />

dual 5V/12V<br />

Die Size (using NOR<br />

as reference)<br />

Suitable Applications<br />

(by density)<br />

1M to 4M<br />

8M to 16M<br />

32M to 256M<br />

Hot carrier injection<br />

Tunnel current<br />

Difficult<br />

Yes<br />

Yes<br />

1<br />

BIOS, EPROM replacement,<br />

communications,<br />

low-density XIP cards<br />

PDA, cellular, networking,<br />

low-density<br />

ATA cards<br />

Not suitable<br />

Tunnel current<br />

Tunnel current<br />

Yes<br />

No<br />

No<br />

0.8<br />

Not suitable<br />

PDA, cellular, networking,<br />

low-density<br />

ATA cards<br />

Not suitable<br />

Tunnel current<br />

Tunnel current<br />

Source: Computer Design/ICE, "Status 1996" 20418<br />

Yes<br />

Yes<br />

Yes<br />

0.9<br />

BIOS, EPROM replacement,<br />

communications,<br />

low-density XIP cards<br />

PDA, cellular, networking,<br />

low-density<br />

ATA cards<br />

High-density ATA cards<br />

(10-100Mbytes)<br />

Figure 7-36. Flash Architectures Stretch to Fit <strong>Memory</strong> Requirements<br />

NOR NAND AND DINOR<br />

Intel<br />

AMD<br />

Fujitsu<br />

TI<br />

Micron<br />

SGS-Thomson<br />

Macronix<br />

UMC<br />

National<br />

Samsung<br />

Toshiba<br />

Hitachi<br />

Mitsubishi<br />

Mitsubishi<br />

Hitachi<br />

Winbond uses its proprietary "split-gate" architecture.<br />

Source: ICE, "Status 1996"<br />

20080A<br />

Figure 7-3<strong>7.</strong> Vendors’ Support of Flash <strong>Memory</strong> Architectures<br />

Tunnel current<br />

Tunnel current<br />

Yes<br />

No<br />

No<br />

0.8<br />

Not suitable<br />

Not suitable<br />

High-density ATA cards<br />

(10-100Mbytes)<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

Voltage<br />

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Another issue being addressed in the flash market is that of single- versus dual-supply voltage,<br />

and the implementation of low-voltage parts. <strong>The</strong> trend is for users to design single-voltage<br />

devices into their systems. That is, the market for 5V program/erase devices is expected to grow<br />

rapidly, overtaking the products incorporating 12V devices in 1996 (Figure 7-38).<br />

Millions of Dollars<br />

4,000<br />

3,500<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

<br />

<br />

<br />

<br />

<br />

<br />

0<br />

<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

500<br />

≤3V-only<br />

3V/5V<br />

5V-only<br />

5V/12V<br />

Source: ICE, "Status 1996"<br />

AMD has emphasized its low-voltage, single-voltage flash products. Most of its devices are manufactured<br />

to write and erase at 5V (low-voltage in the flash market). Until recently, Intel downplayed<br />

the importance of single-voltage flash. However, it now promotes its SmartVoltage flash<br />

technology, which allows flash chips to operate with a 3V or 5V read voltage and 5V or 12V<br />

erase/write voltage. By incorporating its SmartVoltage lineup, it has practically acknowledged<br />

the market for single-power supply flash.<br />

ICE anticipates the 5V flash market maintaining very solid, steady growth through the year 2000.<br />

Growth in the 3V flash market is also expected to surge later in the decade.<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-23<br />

Year<br />

Figure 7-38. Flash <strong>Memory</strong> <strong>Market</strong> by Voltage<br />

20087

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Capacity<br />

Big strides to level the flash memory supply-demand ratio took place in 1995 as several vendors<br />

either brought new flash-dedicated fabs on line or announced their intentions to add more capacity.<br />

Figure 7-39 shows some of the new flash capacity that has come on line or that will soon be<br />

available.<br />

Intel dedicated new fab space to flash memory production. Its Fabs 7 and 9 in New Mexico along<br />

with its announcement to build a new production facility (Fab 18) in Israel should help eliminate<br />

the capacity crunch for flash memory.<br />

7-24<br />

Company Location Process Technology Comments<br />

Intel<br />

Sharp<br />

AMD/Fujitsu<br />

Mitsubishi<br />

Source: ICE, "Status 1996"<br />

Fab 7<br />

New Mexico, USA<br />

150mm wafers<br />

Fab 9<br />

New Mexico, USA<br />

200mm wafers<br />

Fab 18<br />

Kiryat Gat, Israel<br />

200mm wafers<br />

Fab 3<br />

Fukuyama, Japan<br />

200mm wafers<br />

FASL<br />

Aizu-Wakamatsu, Japan<br />

200mm wafers<br />

Saijo Facility<br />

Japan<br />

0.4µm by 1Q96.<br />

Near 100% flash<br />

production.<br />

0.4µm<br />

0.25µm<br />

0.4µm by 1996.<br />

0.5µm<br />

0.5µm<br />

Wafer starts increasing<br />

25% in 1996.<br />

Mostly 5V/12V parts.<br />

Die shrinks to improve<br />

effective capacity/yields.<br />

Production starts 4Q96.<br />

Figure 7-39. New Flash Capacity to Meet Demand<br />

$1 billion investment. First<br />

silicon due 4Q9<strong>7.</strong><br />

Production ramp slated for<br />

1998. When fully operational,<br />

Fab 18 will increase Intel's flash<br />

output 350% over 1995 levels.<br />

Builds Intel devices.<br />

Not yet at capacity.<br />

Running 8M, 16M parts.<br />

Accelerating development of<br />

Intel's SmartVoltage technology.<br />

Opened 4Q94.<br />

Aggressive ramp schedule.<br />

20 million-plus unit shipments<br />

forecast for 1995. Negotiating<br />

to build a second joint-venture<br />

fab in Japan. If approved,<br />

production would begin in late<br />

1997 or early 1998.<br />

Currently processing DRAMs.<br />

Making switch to flash<br />

memories.<br />

20079A<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

AMD ramped production at its joint-venture fab with Fujitsu (FASL) in 1995. Due to continued<br />

demand, the two firms mulled over a second flash-dedicated fab. If approved, the facility would<br />

likely begin production in late 1997 or early 1998.<br />

Meanwhile, the Taiwanese have shown considerable interest in joining the flash party. In the second<br />

half of 1995, at least four companies announced their intentions to become involved with or<br />

expand their involvement in the flash market place (Figure 7-40). Despite the competition, the<br />

Taiwanese companies expect to capitalize on the exploding flash market. Further, the move<br />

demonstrates their resolve to transit into more complex and more profitable product lines.<br />

Company Flash Plans<br />

Formosa Chemical & Fibre<br />

Macronix<br />

UMC<br />

Winbond<br />

Source: ICE, "Status 1996"<br />

Looking for a joint-venture partner to help propel it<br />

into the flash memory business. It desires to<br />

manufacture flash memories (and other related IC<br />

products) in a proposed 200mm sub-micron fab.<br />

Has sold 1M and 4M flash parts for several years.<br />

Designing products around a single-voltage<br />

architecture developed by AMD. Sampled 16M<br />

flash devices co-developed with NKK of Japan.<br />

Designing 1M and 2M flash products around a<br />

single-voltage architecture developed by AMD.<br />

Shipments will begin in mid-1996.<br />

Sampling first members of its flash family based<br />

on its proprietary EEPROM technology. <strong>The</strong> 256K<br />

and 1M 5V-only densities are built around a "splitgate"<br />

architecture, which differs from Intel's and<br />

AMD's cell structure.<br />

Figure 7-40. Taiwan Joining Flash Bandwagon<br />

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

Earlier, it was mentioned that flash memory has been a hit in the portable systems arena.<br />

Specifically, flash memory in the form of flash cards has received much attention as this market<br />

heats up. In 2H95, rival and incompatible memory-card proposals went public to garner a share<br />

of new-generation, low-cost digital consumer devices. Minicard, CompactFlash, and Solid State<br />

Floppy Disk represent three alternatives that aim to replace film, cassette tapes, and full-size PCM-<br />

CIA-type memory cards in digital cameras, audio recorders, and other portable systems. Figure<br />

7-41 provides highlights of each proposition.<br />

It is no wonder flash card technology is taking off. With prices dropping and applications increasing,<br />

consumers stand to benefit from the ease and repetitive use available with digital technology.<br />

Figure 7-42 details cost trends and advantages of flash cards.<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-25<br />

20419

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

With the flurry of activity in the flash memory market, several product announcements and technology<br />

breakthroughs were reported. A sampling of some of the more significant company<br />

alliances and product announcements is listed below.<br />

7-26<br />

Compact-<br />

Flash<br />

Minicard<br />

Solid State<br />

Floppy Disk<br />

Proponent Size (mm)<br />

SanDisk,<br />

others to come<br />

Intel, Philips,<br />

others to come<br />

Toshiba<br />

*Full range not available at launch<br />

36 x 43<br />

x 3.3<br />

35 x 33<br />

x 3.5<br />

45 x 37<br />

x 0.76<br />

<strong>Memory</strong> Type Capacity Connector Type<br />

NOR flash<br />

NOR flash, DRAM,<br />

SRAM, OTP, ROM<br />

NAND flash<br />

2, 4, 12,<br />

15Mbytes<br />

64Kbytes* to<br />

128Mbytes<br />

2Mbytes<br />

50-pin subset<br />

of PCMCIA<br />

40-pad<br />

elastomeric<br />

68-pin PCMCIA<br />

with adapter<br />

Source: EE Times/ICE, "Status 1996" 20420<br />

Figure 7-41. Mini Flash Cards Target Cameras, Audio Recorders, and PDAs<br />

Retail Price ($)<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

1993<br />

1994<br />

What does 5MB get you?<br />

• Images - over 50 digital images<br />

• Voice - More than 1 hour<br />

• Data - 3,500 pages of double-space text<br />

1995<br />

Year<br />

• AMD and Fujitsu started volume production of flash devices at their new jointly owned<br />

facility in Aizu-Wakamatsu, Japan. At the end of 1995, FASL was producing five million<br />

units per month. AMD and Fujitsu also discussed the possibility of building a second flashdedicated<br />

facility in Japan.<br />

1996<br />

1997<br />

1998<br />

Source: SanDisk/ICE, "Status 1996" 20421<br />

Figure 7-42. Retail Price of 5MB Flash Disk Card<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

• Hitachi added its name to the list of vendors offering a 32M flash device. <strong>The</strong> company<br />

developed its version using its proprietary AND architecture on a 0.45µm C<strong>MOS</strong> process.<br />

<strong>The</strong> devices are aimed at solid-state disk applications, but the company also has plans to use<br />

the chips in the flash card business. Samples were available in 4Q95.<br />

• Hyundai Electronics created a new flash memory division in Sunnyvale, California. It<br />

expects to enter the market with 4M and 16M flash products in 1996.<br />

• Intel began offering 4M and 8M boot-block flash devices that are capable of operating at voltages<br />

as low as 2.7 volts. <strong>The</strong> SmartVoltage devices allow flash memories to be read and written<br />

to at multiple voltages, offering a higher degree of flexibility than single-voltage flash,<br />

according to Intel.<br />

• LG Semicon and SanDisk entered into an agreement under which LG Semicon will manufacture<br />

flash memory for use in SanDisk flash data storage products. As part of the agreement,<br />

LG Semicon made an minority investment in SanDisk. <strong>The</strong> agreement also provides<br />

that the two companies will cooperate in further development of flash products.<br />

• Matsushita will supply 32M flash memory chips to SanDisk beginning 1Q96. <strong>The</strong> devices<br />

will be packaged into CompactFlash PC cards with a memory storage capacity of 15MB.<br />

• Micron entered into a licensing agreement with flash market leader Intel. In doing so, it<br />

gained access to the full range of Intel’s flash patents while also signaling that it would align<br />

itself with Intel’s mixed-power supply flash mode.<br />

• Mitsubishi released its 3V-only 16M DINOR flash memory chip, the first in a series of products<br />

that incorporate Mitsubishi’s divided bit-line NOR technology. It was produced using<br />

a half-micron process and volume production is expected in early 1996. Hitachi, working<br />

with Mitsubishi to develop the technology, later introduced its 16M DINOR device.<br />

• National is reselling Toshiba-built 16M flash memories in the merchant market under the<br />

National brand label and is committed to building Toshiba-compatible flash devices.<br />

National also has plans to produce non-standard parts that better target specific applications.<br />

• NEC began marketing flash memory chips in 4Q95. <strong>The</strong> company will initially ship 1M and<br />

4M NOR-type chips that use 12V and 5V to write and read data, respectively. NEC plans to<br />

release an 8M chip in 2Q96. Production will start at 300,000 to 400,000 units per month at<br />

NEC Yamaguchi.<br />

• SanDisk and Intel signed an agreement that allows each to license the other’s patents covering<br />

the design and manufacture of flash memory products, giving both companies unrestricted<br />

rights to use those patents.<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION 7-27

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />

• Samsung sampled its 32M NAND flash memory device. <strong>The</strong> 3V-only (also available in a 5Vonly<br />

version) IC is based on a 0.5µm C<strong>MOS</strong> process. Volume production started in 4Q95.<br />

Samsung expects to introduce a compatible 64M NAND flash memory device in 1996.<br />

• Toshiba developed a 32M flash device. Designed using a 0.425µm C<strong>MOS</strong> process, the<br />

NAND chip operates on a 3V or 5V supply.<br />

• Toshiba and Samsung signed a technical alliance that calls for co-development of NAND<br />

flash devices through (and including) the 64M density. Toshiba is also sharing some of its<br />

flash knowledge with IBM.<br />

• Xicor doubled the size of its flagship flash memory product with the addition of a 128K<br />

device to its SerialFlash family of low-voltage flash memories with serial architecture.<br />

SRAMs<br />

Static RAMs (SRAMs) are memory devices capable of retaining their information at very low<br />

power, without the need for periodic “refresh” as in the case with DRAMs. Although these<br />

devices have lived in the shadow of DRAMs for the longest time, SRAMs took on added importance<br />

and significance in 1995. Why? In a word, Pentium.<br />

Prior to the advent of the Pentium processor, SRAM was considered antiquated technology with<br />

little value. ASPs were such that profit margins were below the interest level of most manufacturers.<br />

<strong>The</strong> present environment, however, shows a 180-degree reversal of that pattern. In many<br />

cases, manufacturers scaled back production of other, less profitable chips to make room for additional<br />

SRAM production. Demand was high, capacity tight, and lead times long for SRAMs<br />

throughout most of 1995.<br />

<strong>The</strong> disparity between Pentium-class MPU clock speeds and DRAM access times became more<br />

apparent during 1995. In many cases, high-performance CPUs remained in idle wait states while<br />

accessing slower DRAM memory. To reduce or eliminate the wait state, designers looked to<br />

SRAM cache memory. Cache memory serves as temporary storage between the CPU and the<br />

main memory and helps CPUs to perform at their optimum level.<br />

As depicted in Figure 7-43, cache memory is becoming a more significant factor in PC systems. With<br />

few exceptions, MPU bus speeds now require a second-level cache built with fast SRAM to tap the<br />

full potential of the microprocessor. <strong>The</strong> result has been SRAM demand that has skyrocketed.<br />

It is estimated that less than one-quarter of 486-based machines—generally those with 50MHz and<br />

slower MPUs—have secondary cache. In contrast, forecasts show that secondary cache will be a<br />

feature on as many as three-fourths of Pentium-based PCs (Figure 7-44). Further, it is estimated<br />

7-28<br />

INTEGRATED CIRCUIT ENGINEERING CORPORATION

<strong>MOS</strong> <strong>Memory</strong> <strong>Market</strong> <strong>Trends</strong><br />