AP Econ Module 41 Capital Flows Balance Payments - Sunny Hills ...

AP Econ Module 41 Capital Flows Balance Payments - Sunny Hills ...

AP Econ Module 41 Capital Flows Balance Payments - Sunny Hills ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A country's balance 0l paymenls on lhe<br />

currenl accounl,0r lhe curlent account,<br />

is its balance 0f payments 0n goods and<br />

services plus net intemational transfer<br />

payments and factor lncome.<br />

A counlry's balance ol payments on<br />

goods and seruices is the ditterence<br />

between its exports and its impons during a<br />

given period.<br />

The merchandise trade balance, or<br />

trade balance, is the difference between a<br />

country's exports and imp0rts 0f goods,<br />

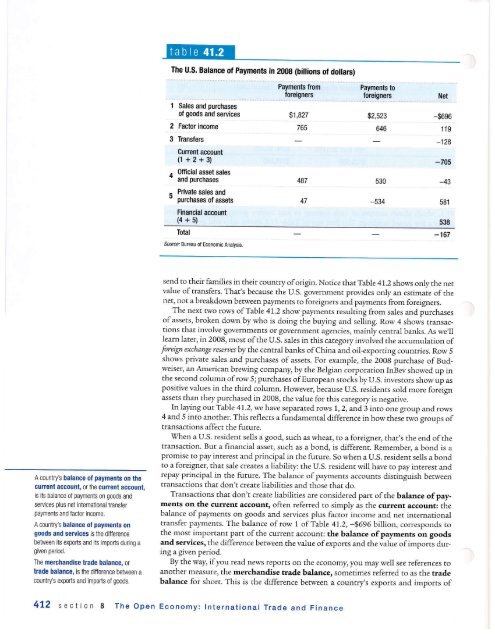

The U.S. <strong>Balance</strong> of <strong>Payments</strong> in 2mB (billions of dollars)<br />

2<br />

3<br />

Sales and purchases<br />

ot goods and services<br />

Factor income<br />

Transf€rs<br />

Cunent account<br />

(1 +2+3)<br />

olficial asset sales<br />

and purchases<br />

Private sales and<br />

purchasss of assets<br />

Financial account<br />

(4+5)<br />

Total<br />

Source, Bureau of Eoonomic Analysis.<br />

<strong>Payments</strong> from<br />

loreigners<br />

$1,827<br />

765<br />

487<br />

47<br />

<strong>Payments</strong> to<br />

loreigners Net<br />

$2,523<br />

b4b<br />

-534<br />

-$696<br />

119<br />

-128<br />

-705<br />

_43<br />

581<br />

538<br />

-167<br />

send to their families in their country oforigin. Notice that Table <strong>41</strong>.2 shows only the net<br />

value of ffansfers. ThaCs because the U.S. government provides only an estimate ofthe<br />

neg not a breakdown between payments to foreigners and pal,rnents from foreigners.<br />

The next two rows ofTable <strong>41</strong>.2 show payments resulting fiom sales and purchases<br />

ofassets, broken down by who is doing the buying and selling. Row 4 shows rransactions<br />

that involve governments or government agencies, mainly central banks. As we,ll<br />

leam later, in 2008, most ofthe U.S. sales in this caregory involved the accumulation of<br />

foreign exchange ruenu by the central banks ofChina and oil-expocing counries. Row 5<br />

shows private sales and purchases of assets. For example, the 2008 purchase of Budweiser,<br />

an American brewing company, by rhe Belgian corporation InBev showed up in<br />

the second column ofrow 5; purchases ofEuropean stocks by U.S. invesrors show up as<br />

positive values in the third column. However, because U.S. residents sold more foreign<br />

assets than they purchased in 2008, rhe value for this category is negarive.<br />

In laying out Table <strong>41</strong>,2, wehave separared rows 1, 2, and 3 into one group and rows<br />

4 and 5 into another. This reflects a fundamenral difference in how these two groups of<br />

transactions affect the future.<br />

Vtren a U.S. residenr sells a good, such as wheat, to a foreigner, thaCs the end ofthe<br />

transaction. But a financial assetr such as a bon4 is different. Remember, a bond is a<br />

promise to pay interesr and principal in the future. So when a U.S. resident sells a bond<br />

to a foreigner, that sale creates a liability: the U.S. resident will have to pay interest and<br />

repay principal in the future. The balance of payments accounts distinguish berween<br />

transactions that don't create liabilities and those that do.<br />

Transactions that don't create liabilities are considered part ofthe balance ofpayments<br />

on the cutrerlt account, often referred to simply as the cufrerlt accoune the<br />

balance of payments on goods and services plus factor income and net international<br />

transfer payments. The balance of row 1 ofTable <strong>41</strong>.2, -9696 billion, coresponds to<br />

the most important part ofthe currenr account: the balance ofpapnents on goods<br />

and services, the difference between the value ofexports and che value ofimporrs during<br />

a given period.<br />

By the way, ifyou read news reports on rhe economy, you may well see references to<br />

another measureJ the merchandise tmde balance, sometimes referred to as the trade<br />

balance for short. This is rhe difference between a councy's exports and imports of<br />

<strong>41</strong>2 section 8 The Open <strong>Econ</strong>omy: lnternational Trade and Finance