AP Econ Module 41 Capital Flows Balance Payments - Sunny Hills ...

AP Econ Module 41 Capital Flows Balance Payments - Sunny Hills ...

AP Econ Module 41 Capital Flows Balance Payments - Sunny Hills ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

476 section 8<br />

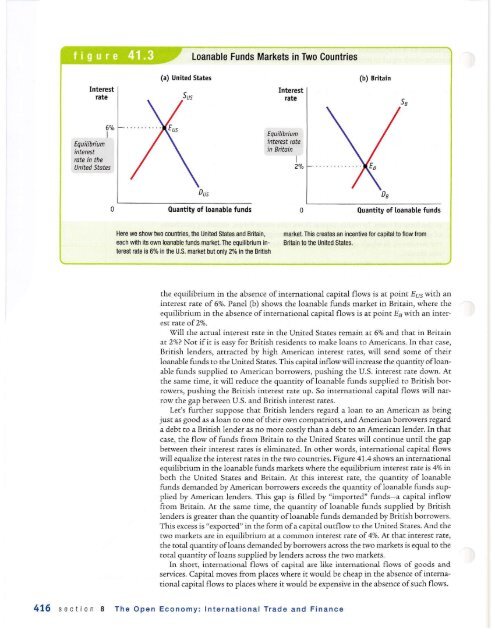

(a) United States<br />

Loanable Funds Markets in Two Countries<br />

Quantity of loanable funds<br />

Here we show two countries, the Unlted Shtes and Britain,<br />

each with its own loanable funds market. The equilibrium in-<br />

tersst rate is 6% in the U.S. market but only 2% in the British<br />

0 ouantity of Loanable f<br />

markel lhis creates an incentive for capihl b flor/v from<br />

Britain to the united States.<br />

(b) Brltaln<br />

ouantity of loanable funds<br />

the equilibrium in the absence of international capital flows is at point Ep.s with an<br />

interest rate of 6%. Panel (b) shows the loanable funds market in Britain, where the<br />

equilibrium in the absence ofinternational capital flows is at point Es with an interest<br />

rate of 2'k.<br />

Vill the actual interest rate in the United States remain at 6% and that in Britain<br />

at 2%? Not if it is easy for British residents to make loans to Americans. In that case,<br />

British lenders, attracted by high American interest rates, will send some of their<br />

loanable funds to the United States. This capital inflow will increase the quandty ofloanable<br />

funds supplied to American borrowers, pushing the U.S. interest rate down. At<br />

the same time, it will reduce the quantity of loanable funds suppJied to British borrowers,<br />

pushing the British interest rate up. So international capital flows will narrow<br />

the gap between U.S. and British interest rates.<br />

Ler's further suppose that British lenders regard a loan to an Americal as being<br />

just as good as a loan to one oftheir own compattiots, and American borrowers regard<br />

a debt to a British lender as no more cosdy tharr a debt to an American lender. In that<br />

case, the flow of funds from Britain to the United Sates will continue until the gap<br />

between their interest rates is eliminated. In other words, international capital flows<br />

will equalize the interest rates in the two countries. Figure <strong>41</strong>.4 shows an international<br />

equilibrium in the loanable funds markets where the equilibrium interest rare is 4% in<br />

both the United States and Brirain. At this interest rate, the quandry of loanable<br />

funds demanded by American borrowers exceeds the quantity of loanable funds supplied<br />

by American lenders. This gap is filled by "imported" funds-a capital inflow<br />

from Britain. At the same time, the quantity of loanable funds supplied by British<br />

lenders is greater than the quantity ofloanable funds demanded by British borrowers.<br />

This excess is "exported" in the form ofa capital outflow to the United States, And the<br />

two markets are in equilibrium at a common interest rate of4%, At thar interest rate,<br />

the total quantity ofloans demaaded by borowers arross the wo markets is equal to the<br />

total quantity ofloans supplied by lenders across the rwo markets.<br />

In shott, international flows of capital are like international flows of goods and<br />

services. Capita-l moves from places where it would be cheap in the absence ofintemadonal<br />

capital flows to places where it would be expensive in the absence ofsuch flows.<br />

The Open <strong>Econ</strong>omy: lnternational Trade and Finance