AP Econ Module 41 Capital Flows Balance Payments - Sunny Hills ...

AP Econ Module 41 Capital Flows Balance Payments - Sunny Hills ...

AP Econ Module 41 Capital Flows Balance Payments - Sunny Hills ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Equation <strong>41</strong>-3 is equivalent to Equation <strong>41</strong>-1: the current account plus the financial<br />

account-both equal to positive entries minus negarive enrries-is equal to zero.<br />

But what determines the current account and the financial account?<br />

Modeling the Financial Account<br />

A country's financial account measures its net sa.les ofassets, such as currencies, securi-<br />

ties, and Factories, to foreigners. Those assets are exchanged for a qpe ofcapital called<br />

fnancial capital, which is funds from savings that are available for investmenr spending.<br />

'We can thus thinl< ofthe financial account as a mea.sure of capiwlinfloas in the form of<br />

foreign savings that become available to finance domestic investment spending.<br />

What determines these capital inflows?<br />

Part ofour explanation will have to wait for a little while because some internarional<br />

capital flows are created by govemments and central banks, which somecimes act very<br />

differendy from private investors. But we can gain insight into the motivations for capital<br />

flows that are the result of private decisions by using rh e loanablc funds rnodel we developed<br />

previously. In using this model, we make two important simplifications:<br />

r Ve simplify the reality ofinternational capital flows by assuming that all flows are<br />

in the form ofloans. In reality, capital flows take many forms, including purchases<br />

of shares of stock in foreign companies and foreign real esttte as well as foreign direct<br />

investment, in which companies build factories or acquire other productive assets<br />

abroad.<br />

r We also ignore the effects ofexpected, changes in exchange ra,tet the relative values<br />

of different national currencies. We'll analyze the determination of exchange<br />

rates later.<br />

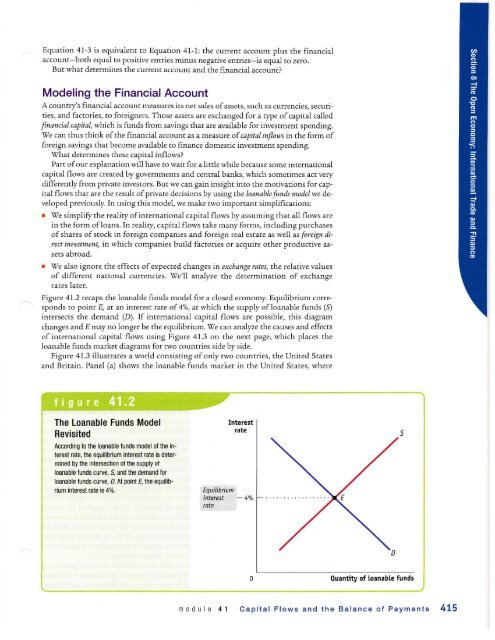

Figure <strong>41</strong>.2 recaps the loanable funds model for a closed economy. Equilibrium corresponds<br />

to point 4 at an interest rate of4%, at which the supply ofloanable funds (S)<br />

intersects the demand (D). If intemational capital flows are possible, this diagram<br />

changes and E may no longer be the equilibrium. We can anaJyze the causes and effects<br />

of intemational capital flows using Figure <strong>41</strong>.3 on the next page, which places the<br />

loanable funds market diagrams for two counries side by side.<br />

Figure 4L3 illustrates a world consisting ofonly two countries, the United States<br />

and Britain. Panel (a) shows the loanable funds market in the United States, where<br />

The Loanable Funds Model<br />

Revisited<br />

According to tie loanabl8 tunds modolofthe in-<br />

terest rate, ft€ squilibrium interest rate is determlnod<br />

by fie intersection of the supply ol<br />

loanable funds curve, S, and the demand tor<br />

loanable funds curve, AAt point E the equilib-<br />

rium interest rah is 4%.<br />

Quantity of loanable funds<br />

module <strong>41</strong> <strong>Capital</strong> <strong>Flows</strong> and the <strong>Balance</strong> of <strong>Payments</strong> 475