Read the Chapter 4 E-Book

Read the Chapter 4 E-Book

Read the Chapter 4 E-Book

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

150 PART 2 Important Financial Concepts<br />

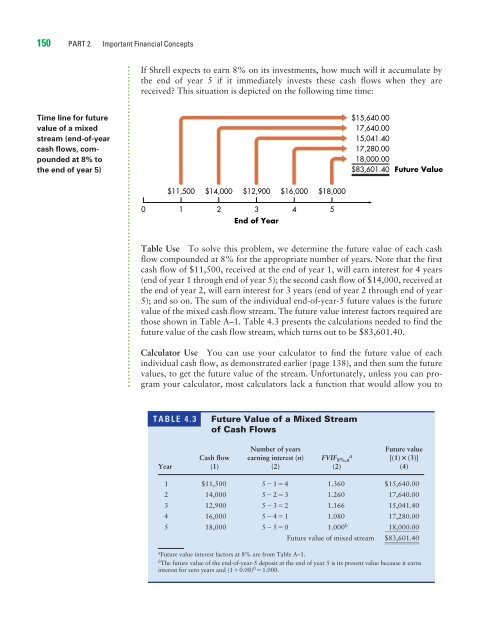

Time line for future<br />

value of a mixed<br />

stream (end-of-year<br />

cash flows, compounded<br />

at 8% to<br />

<strong>the</strong> end of year 5)<br />

If Shrell expects to earn 8% on its investments, how much will it accumulate by<br />

<strong>the</strong> end of year 5 if it immediately invests <strong>the</strong>se cash flows when <strong>the</strong>y are<br />

received? This situation is depicted on <strong>the</strong> following time time:<br />

$11,500 $14,000 $12,900 $16,000 $18,000<br />

0 1 2 3 4 5<br />

End of Year<br />

$15,640.00<br />

17,640.00<br />

15,041.40<br />

17,280.00<br />

18,000.00<br />

$83,601.40 Future Value<br />

Table Use To solve this problem, we determine <strong>the</strong> future value of each cash<br />

flow compounded at 8% for <strong>the</strong> appropriate number of years. Note that <strong>the</strong> first<br />

cash flow of $11,500, received at <strong>the</strong> end of year 1, will earn interest for 4 years<br />

(end of year 1 through end of year 5); <strong>the</strong> second cash flow of $14,000, received at<br />

<strong>the</strong> end of year 2, will earn interest for 3 years (end of year 2 through end of year<br />

5); and so on. The sum of <strong>the</strong> individual end-of-year-5 future values is <strong>the</strong> future<br />

value of <strong>the</strong> mixed cash flow stream. The future value interest factors required are<br />

those shown in Table A–1. Table 4.3 presents <strong>the</strong> calculations needed to find <strong>the</strong><br />

future value of <strong>the</strong> cash flow stream, which turns out to be $83,601.40.<br />

Calculator Use You can use your calculator to find <strong>the</strong> future value of each<br />

individual cash flow, as demonstrated earlier (page 138), and <strong>the</strong>n sum <strong>the</strong> future<br />

values, to get <strong>the</strong> future value of <strong>the</strong> stream. Unfortunately, unless you can program<br />

your calculator, most calculators lack a function that would allow you to<br />

TABLE 4.3 Future Value of a Mixed Stream<br />

of Cash Flows<br />

Number of years Future value<br />

Cash flow earning interest (n) FVIF 8%,n a [(1) (3)]<br />

Year (1) (2) (2) (4)<br />

1 $11,500 514 1.360 $15,640.00<br />

2 14,000 523 1.260 17,640.00<br />

3 12,900 532 1.166 15,041.40<br />

4 16,000 541 1.080 17,280.00<br />

5 18,000 550 1.000b 1 8 , 0 0 0 . 0 0 Future value of mixed stream<br />

<br />

$<br />

8 3 , 6 0 1 . 4 0 a Future value interest factors at 8% are from Table A–1.<br />

b The future value of <strong>the</strong> end-of-year-5 deposit at <strong>the</strong> end of year 5 is its present value because it earns<br />

interest for zero years and (10.08) 0 1.000.