Read the Chapter 4 E-Book

Read the Chapter 4 E-Book

Read the Chapter 4 E-Book

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

156 PART 2 Important Financial Concepts<br />

2. For quarterly compounding:<br />

FV2$1001 42<br />

$100(1 0.02) 8 0.08<br />

$117.16<br />

4<br />

These results agree with <strong>the</strong> values for FV2 in Tables 4.5 and 4.6.<br />

If <strong>the</strong> interest were compounded monthly, weekly, or daily, m would equal 12,<br />

52, or 365, respectively.<br />

Using Computational Tools<br />

for Compounding More Frequently Than Annually<br />

We can use <strong>the</strong> future value interest factors for one dollar, given in Table A–1,<br />

when interest is compounded m times each year. Instead of indexing <strong>the</strong> table for<br />

i percent and n years, as we do when interest is compounded annually, we index<br />

it for (im) percent and (mn) periods. However, <strong>the</strong> table is less useful,<br />

because it includes only selected rates for a limited number of periods. Instead, a<br />

financial calculator or a computer and spreadsheet is typically required.<br />

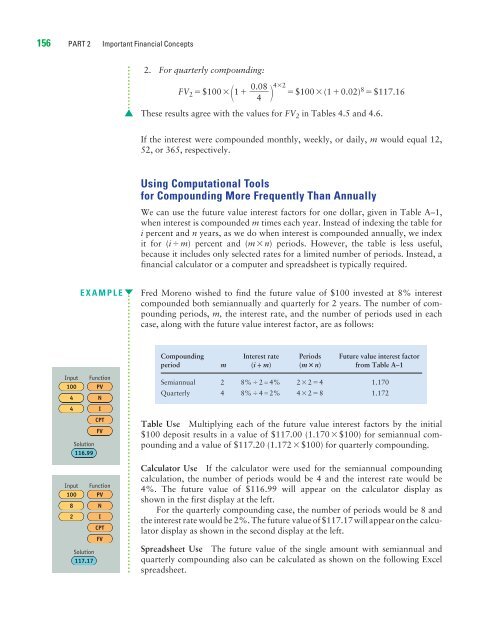

EXAMPLE Fred Moreno wished to find <strong>the</strong> future value of $100 invested at 8% interest<br />

compounded both semiannually and quarterly for 2 years. The number of compounding<br />

periods, m, <strong>the</strong> interest rate, and <strong>the</strong> number of periods used in each<br />

case, along with <strong>the</strong> future value interest factor, are as follows:<br />

Input Function<br />

100 PV<br />

4<br />

4<br />

Solution<br />

116.99<br />

N<br />

I<br />

CPT<br />

FV<br />

Input Function<br />

100 PV<br />

8<br />

2<br />

Solution<br />

117.17<br />

N<br />

I<br />

CPT<br />

FV<br />

Compounding Interest rate Periods Future value interest factor<br />

period m (i ÷ m) (mn) from Table A–1<br />

Semiannual 2 8% 24% 2 24 1.170<br />

Quarterly 4 8% 42% 4 28 1.172<br />

Table Use Multiplying each of <strong>the</strong> future value interest factors by <strong>the</strong> initial<br />

$100 deposit results in a value of $117.00 (1.170$100) for semiannual compounding<br />

and a value of $117.20 (1.172$100) for quarterly compounding.<br />

Calculator Use If <strong>the</strong> calculator were used for <strong>the</strong> semiannual compounding<br />

calculation, <strong>the</strong> number of periods would be 4 and <strong>the</strong> interest rate would be<br />

4%. The future value of $116.99 will appear on <strong>the</strong> calculator display as<br />

shown in <strong>the</strong> first display at <strong>the</strong> left.<br />

For <strong>the</strong> quarterly compounding case, <strong>the</strong> number of periods would be 8 and<br />

<strong>the</strong> interest rate would be 2%. The future value of $117.17 will appear on <strong>the</strong> calculator<br />

display as shown in <strong>the</strong> second display at <strong>the</strong> left.<br />

Spreadsheet Use The future value of <strong>the</strong> single amount with semiannual and<br />

quarterly compounding also can be calculated as shown on <strong>the</strong> following Excel<br />

spreadsheet.