Read the Chapter 4 E-Book

Read the Chapter 4 E-Book

Read the Chapter 4 E-Book

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LG6<br />

LG6<br />

LG6<br />

LG6<br />

CHAPTER 4 Time Value of Money 183<br />

10 years and will accumulate it by making annual (end-of-year) deposits into an<br />

account. The rate of interest is expected to be 10% for all future time periods.<br />

a. How large must <strong>the</strong> endowment be?<br />

b. How much must you deposit at <strong>the</strong> end of each of <strong>the</strong> next 10 years to accumulate<br />

<strong>the</strong> required amount?<br />

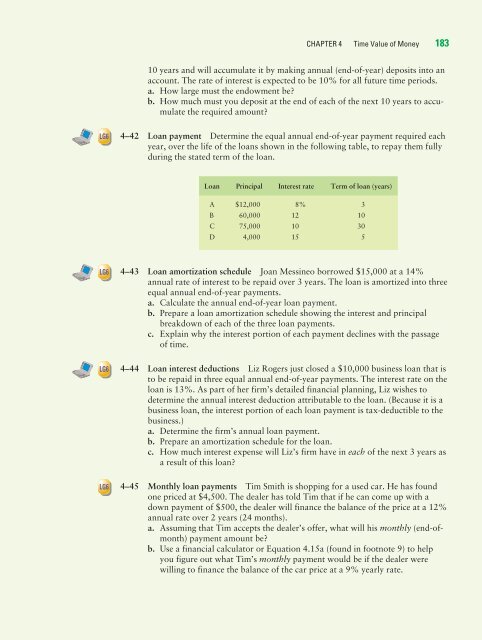

4–42 Loan payment Determine <strong>the</strong> equal annual end-of-year payment required each<br />

year, over <strong>the</strong> life of <strong>the</strong> loans shown in <strong>the</strong> following table, to repay <strong>the</strong>m fully<br />

during <strong>the</strong> stated term of <strong>the</strong> loan.<br />

Loan Principal Interest rate Term of loan (years)<br />

A $12,000 8% 3<br />

B 60,000 12 10<br />

C 75,000 10 30<br />

D 4,000 15 5<br />

4–43 Loan amortization schedule Joan Messineo borrowed $15,000 at a 14%<br />

annual rate of interest to be repaid over 3 years. The loan is amortized into three<br />

equal annual end-of-year payments.<br />

a. Calculate <strong>the</strong> annual end-of-year loan payment.<br />

b. Prepare a loan amortization schedule showing <strong>the</strong> interest and principal<br />

breakdown of each of <strong>the</strong> three loan payments.<br />

c. Explain why <strong>the</strong> interest portion of each payment declines with <strong>the</strong> passage<br />

of time.<br />

4–44 Loan interest deductions Liz Rogers just closed a $10,000 business loan that is<br />

to be repaid in three equal annual end-of-year payments. The interest rate on <strong>the</strong><br />

loan is 13%. As part of her firm’s detailed financial planning, Liz wishes to<br />

determine <strong>the</strong> annual interest deduction attributable to <strong>the</strong> loan. (Because it is a<br />

business loan, <strong>the</strong> interest portion of each loan payment is tax-deductible to <strong>the</strong><br />

business.)<br />

a. Determine <strong>the</strong> firm’s annual loan payment.<br />

b. Prepare an amortization schedule for <strong>the</strong> loan.<br />

c. How much interest expense will Liz’s firm have in each of <strong>the</strong> next 3 years as<br />

a result of this loan?<br />

4–45 Monthly loan payments Tim Smith is shopping for a used car. He has found<br />

one priced at $4,500. The dealer has told Tim that if he can come up with a<br />

down payment of $500, <strong>the</strong> dealer will finance <strong>the</strong> balance of <strong>the</strong> price at a 12%<br />

annual rate over 2 years (24 months).<br />

a. Assuming that Tim accepts <strong>the</strong> dealer’s offer, what will his monthly (end-ofmonth)<br />

payment amount be?<br />

b. Use a financial calculator or Equation 4.15a (found in footnote 9) to help<br />

you figure out what Tim’s monthly payment would be if <strong>the</strong> dealer were<br />

willing to finance <strong>the</strong> balance of <strong>the</strong> car price at a 9% yearly rate.