Directors' Report: Governance - British American Tobacco

Directors' Report: Governance - British American Tobacco

Directors' Report: Governance - British American Tobacco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.bat.com/annualreport2009<br />

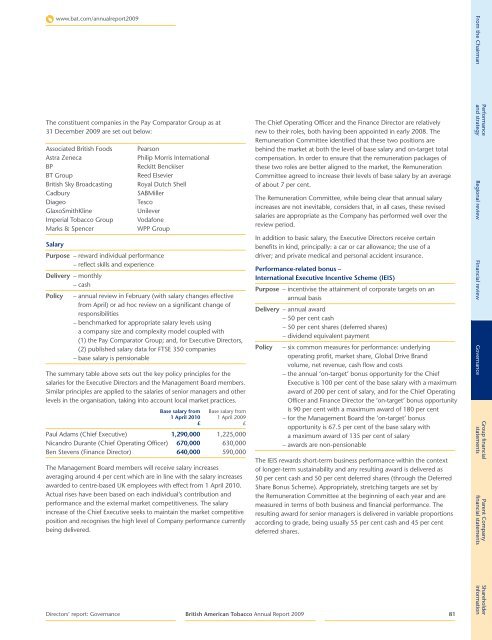

The constituent companies in the Pay Comparator Group as at<br />

31 December 2009 are set out below:<br />

Associated <strong>British</strong> Foods Pearson<br />

Astra Zeneca Philip Morris International<br />

BP Reckitt Benckiser<br />

BT Group Reed Elsevier<br />

<strong>British</strong> Sky Broadcasting Royal Dutch Shell<br />

Cadbury SABMiller<br />

Diageo Tesco<br />

GlaxoSmithKline Unilever<br />

Imperial <strong>Tobacco</strong> Group Vodafone<br />

Marks & Spencer WPP Group<br />

Salary<br />

Purpose – reward individual performance<br />

– reflect skills and experience<br />

Delivery – monthly<br />

– cash<br />

Policy – annual review in February (with salary changes effective<br />

from April) or ad hoc review on a significant change of<br />

responsibilities<br />

– benchmarked for appropriate salary levels using<br />

a company size and complexity model coupled with<br />

(1) the Pay Comparator Group; and, for Executive Directors,<br />

(2) published salary data for FTSE 350 companies<br />

– base salary is pensionable<br />

The summary table above sets out the key policy principles for the<br />

salaries for the Executive Directors and the Management Board members.<br />

Similar principles are applied to the salaries of senior managers and other<br />

levels in the organisation, taking into account local market practices.<br />

Base salary from Base salary from<br />

1 April 2010 1 April 2009<br />

£ £<br />

Paul Adams (Chief Executive) 1,290,000 1,225,000<br />

Nicandro Durante (Chief Operating Officer) 670,000 630,000<br />

Ben Stevens (Finance Director) 640,000 590,000<br />

The Management Board members will receive salary increases<br />

averaging around 4 per cent which are in line with the salary increases<br />

awarded to centre-based UK employees with effect from 1 April 2010.<br />

Actual rises have been based on each individual’s contribution and<br />

performance and the external market competitiveness. The salary<br />

increase of the Chief Executive seeks to maintain the market competitive<br />

position and recognises the high level of Company performance currently<br />

being delivered.<br />

Directors’ report: <strong>Governance</strong><br />

<strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> Annual <strong>Report</strong> 2009<br />

The Chief Operating Officer and the Finance Director are relatively<br />

new to their roles, both having been appointed in early 2008. The<br />

Remuneration Committee identified that these two positions are<br />

behind the market at both the level of base salary and on-target total<br />

compensation. In order to ensure that the remuneration packages of<br />

these two roles are better aligned to the market, the Remuneration<br />

Committee agreed to increase their levels of base salary by an average<br />

of about 7 per cent.<br />

The Remuneration Committee, while being clear that annual salary<br />

increases are not inevitable, considers that, in all cases, these revised<br />

salaries are appropriate as the Company has performed well over the<br />

review period.<br />

In addition to basic salary, the Executive Directors receive certain<br />

benefits in kind, principally: a car or car allowance; the use of a<br />

driver; and private medical and personal accident insurance.<br />

Performance-related bonus –<br />

International Executive Incentive Scheme (IEIS)<br />

Purpose – incentivise the attainment of corporate targets on an<br />

annual basis<br />

Delivery – annual award<br />

– 50 per cent cash<br />

– 50 per cent shares (deferred shares)<br />

– dividend equivalent payment<br />

Policy – six common measures for performance: underlying<br />

operating profit, market share, Global Drive Brand<br />

volume, net revenue, cash flow and costs<br />

– the annual ‘on-target’ bonus opportunity for the Chief<br />

Executive is 100 per cent of the base salary with a maximum<br />

award of 200 per cent of salary, and for the Chief Operating<br />

Officer and Finance Director the ‘on-target’ bonus opportunity<br />

is 90 per cent with a maximum award of 180 per cent<br />

– for the Management Board the ‘on-target’ bonus<br />

opportunity is 67.5 per cent of the base salary with<br />

a maximum award of 135 per cent of salary<br />

– awards are non-pensionable<br />

The IEIS rewards short-term business performance within the context<br />

of longer-term sustainability and any resulting award is delivered as<br />

50 per cent cash and 50 per cent deferred shares (through the Deferred<br />

Share Bonus Scheme). Appropriately, stretching targets are set by<br />

the Remuneration Committee at the beginning of each year and are<br />

measured in terms of both business and financial performance. The<br />

resulting award for senior managers is delivered in variable proportions<br />

according to grade, being usually 55 per cent cash and 45 per cent<br />

deferred shares.<br />

81<br />

From the Chairman<br />

Performance<br />

and strategy Regional review Financial review <strong>Governance</strong><br />

Group financial<br />

statements<br />

Parent Company<br />

financial statements<br />

Shareholder<br />

information