Directors' Report: Governance - British American Tobacco

Directors' Report: Governance - British American Tobacco

Directors' Report: Governance - British American Tobacco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

www.bat.com/annualreport2009<br />

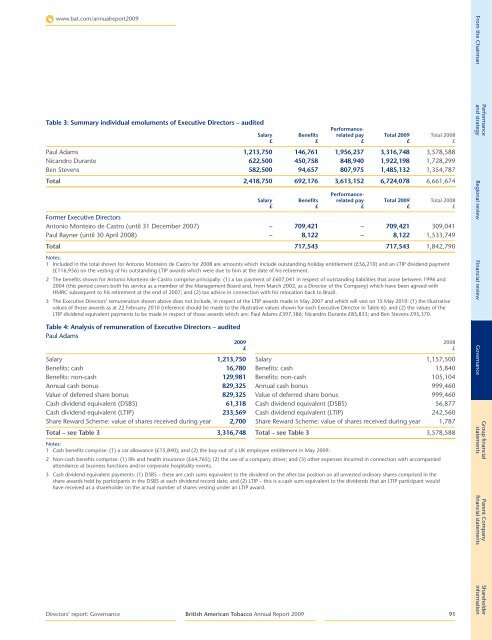

Table 3: Summary individual emoluments of Executive Directors – audited<br />

Salary Benefits<br />

Performancerelated<br />

pay Total 2009 Total 2008<br />

£ £ £ £ £<br />

Paul Adams 1,213,750 146,761 1,956,237 3,316,748 3,578,588<br />

Nicandro Durante 622,500 450,758 848,940 1,922,198 1,728,299<br />

Ben Stevens 582,500 94,657 807,975 1,485,132 1,354,787<br />

Total 2,418,750 692,176 3,613,152 6,724,078 6,661,674<br />

Performance-<br />

Salary Benefits related pay Total 2009 Total 2008<br />

£ £ £ £ £<br />

Former Executive Directors<br />

Antonio Monteiro de Castro (until 31 December 2007) – 709,421 – 709,421 309,041<br />

Paul Rayner (until 30 April 2008) – 8,122 – 8,122 1,533,749<br />

Total 717,543 717,543 1,842,790<br />

Notes:<br />

1 Included in the total shown for Antonio Monteiro de Castro for 2008 are amounts which include outstanding holiday entitlement (£56,210) and an LTIP dividend payment<br />

(£116,956) on the vesting of his outstanding LTIP awards which were due to him at the date of his retirement.<br />

2 The benefits shown for Antonio Monteiro de Castro comprise principally: (1) a tax payment of £607,041 in respect of outstanding liabilities that arose between 1996 and<br />

2004 (this period covers both his service as a member of the Management Board and, from March 2002, as a Director of the Company) which have been agreed with<br />

HMRC subsequent to his retirement at the end of 2007; and (2) tax advice in connection with his relocation back to Brazil.<br />

3 The Executive Directors’ remuneration shown above does not include, in respect of the LTIP awards made in May 2007 and which will vest on 15 May 2010: (1) the illustrative<br />

values of those awards as at 22 February 2010 (reference should be made to the illustrative values shown for each Executive Director in Table 6); and (2) the values of the<br />

LTIP dividend equivalent payments to be made in respect of those awards which are: Paul Adams £397,386; Nicandro Durante £85,833; and Ben Stevens £95,370.<br />

Table 4: Analysis of remuneration of Executive Directors – audited<br />

Paul Adams<br />

2009 2008<br />

£ £<br />

Salary 1,213,750 Salary 1,157,500<br />

Benefits: cash 16,780 Benefits: cash 15,840<br />

Benefits: non-cash 129,981 Benefits: non-cash 105,104<br />

Annual cash bonus 829,325 Annual cash bonus 999,460<br />

Value of deferred share bonus 829,325 Value of deferred share bonus 999,460<br />

Cash dividend equivalent (DSBS) 61,318 Cash dividend equivalent (DSBS) 56,877<br />

Cash dividend equivalent (LTIP) 233,569 Cash dividend equivalent (LTIP) 242,560<br />

Share Reward Scheme: value of shares received during year 2,700 Share Reward Scheme: value of shares received during year 1,787<br />

Total – see Table 3 3,316,748 Total – see Table 3 3,578,588<br />

Notes:<br />

1 Cash benefits comprise: (1) a car allowance (£15,840); and (2) the buy-out of a UK employee entitlement in May 2009.<br />

2 Non-cash benefits comprise: (1) life and health insurance (£64,765); (2) the use of a company driver; and (3) other expenses incurred in connection with accompanied<br />

attendance at business functions and/or corporate hospitality events.<br />

3 Cash dividend equivalent payments: (1) DSBS – these are cash sums equivalent to the dividend on the after-tax position on all unvested ordinary shares comprised in the<br />

share awards held by participants in the DSBS at each dividend record date; and (2) LTIP – this is a cash sum equivalent to the dividends that an LTIP participant would<br />

have received as a shareholder on the actual number of shares vesting under an LTIP award.<br />

Directors’ report: <strong>Governance</strong><br />

<strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> Annual <strong>Report</strong> 2009<br />

91<br />

From the Chairman<br />

Performance<br />

and strategy Regional review Financial review <strong>Governance</strong><br />

Group financial<br />

statements<br />

Parent Company<br />

financial statements<br />

Shareholder<br />

information