Directors' Report: Governance - British American Tobacco

Directors' Report: Governance - British American Tobacco

Directors' Report: Governance - British American Tobacco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.bat.com/annualreport2009<br />

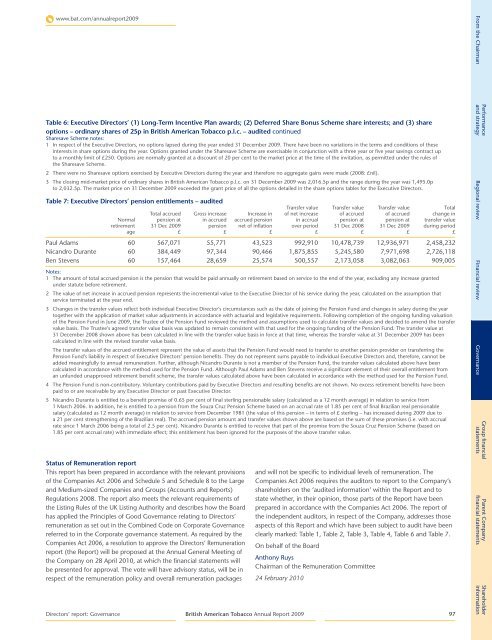

Table 6: Executive Directors’ (1) Long-Term Incentive Plan awards; (2) Deferred Share Bonus Scheme share interests; and (3) share<br />

options – ordinary shares of 25p in <strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> p.l.c. – audited continued<br />

Sharesave Scheme notes:<br />

1 In respect of the Executive Directors, no options lapsed during the year ended 31 December 2009. There have been no variations in the terms and conditions of these<br />

interests in share options during the year. Options granted under the Sharesave Scheme are exercisable in conjunction with a three year or five year savings contract up<br />

to a monthly limit of £250. Options are normally granted at a discount of 20 per cent to the market price at the time of the invitation, as permitted under the rules of<br />

the Sharesave Scheme.<br />

2 There were no Sharesave options exercised by Executive Directors during the year and therefore no aggregate gains were made (2008: £nil).<br />

3 The closing mid-market price of ordinary shares in <strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> p.l.c. on 31 December 2009 was 2,016.5p and the range during the year was 1,495.0p<br />

to 2,032.5p. The market price on 31 December 2009 exceeded the grant price of all the options detailed in the share options tables for the Executive Directors.<br />

Table 7: Executive Directors’ pension entitlements – audited<br />

Transfer value Transfer value Transfer value Total<br />

Total accrued Gross increase Increase in of net increase of accrued of accrued change in<br />

Normal pension at in accrued accrued pension in accrual pension at pension at transfer value<br />

retirement 31 Dec 2009 pension net of inflation over period 31 Dec 2008 31 Dec 2009 during period<br />

age £ £ £ £ £ £ £<br />

Paul Adams 60 567,071 55,771 43,523 992,910 10,478,739 12,936,971 2,458,232<br />

Nicandro Durante 60 384,449 97,344 90,466 1,875,855 5,245,580 7,971,698 2,726,118<br />

Ben Stevens 60 157,464 28,659 25,574 500,557 2,173,058 3,082,063 909,005<br />

Notes:<br />

1 The amount of total accrued pension is the pension that would be paid annually on retirement based on service to the end of the year, excluding any increase granted<br />

under statute before retirement.<br />

2 The value of net increase in accrued pension represents the incremental value to the Executive Director of his service during the year, calculated on the assumption that<br />

service terminated at the year end.<br />

3 Changes in the transfer values reflect both individual Executive Director’s circumstances such as the date of joining the Pension Fund and changes in salary during the year<br />

together with the application of market value adjustments in accordance with actuarial and legislative requirements. Following completion of the ongoing funding valuation<br />

of the Pension Fund in June 2009, the Trustee of the Pension Fund reviewed the method and assumptions used to calculate transfer values and decided to amend the transfer<br />

value basis. The Trustee’s agreed transfer value basis was updated to remain consistent with that used for the ongoing funding of the Pension Fund. The transfer value at<br />

31 December 2008 shown above has been calculated in line with the transfer value basis in force at that time, whereas the transfer value at 31 December 2009 has been<br />

calculated in line with the revised transfer value basis.<br />

The transfer values of the accrued entitlement represent the value of assets that the Pension Fund would need to transfer to another pension provider on transferring the<br />

Pension Fund’s liability in respect of Executive Directors’ pension benefits. They do not represent sums payable to individual Executive Directors and, therefore, cannot be<br />

added meaningfully to annual remuneration. Further, although Nicandro Durante is not a member of the Pension Fund, the transfer values calculated above have been<br />

calculated in accordance with the method used for the Pension Fund. Although Paul Adams and Ben Stevens receive a significant element of their overall entitlement from<br />

an unfunded unapproved retirement benefit scheme, the transfer values calculated above have been calculated in accordance with the method used for the Pension Fund.<br />

4 The Pension Fund is non-contributory. Voluntary contributions paid by Executive Directors and resulting benefits are not shown. No excess retirement benefits have been<br />

paid to or are receivable by any Executive Director or past Executive Director.<br />

5 Nicandro Durante is entitled to a benefit promise of 0.65 per cent of final sterling pensionable salary (calculated as a 12 month average) in relation to service from<br />

1 March 2006. In addition, he is entitled to a pension from the Souza Cruz Pension Scheme based on an accrual rate of 1.85 per cent of final Brazilian real pensionable<br />

salary (calculated as 12 month average) in relation to service from December 1981 (the value of this pension – in terms of £ sterling – has increased during 2009 due to<br />

a 21 per cent strengthening of the Brazilian real). The accrued pension amount and transfer values shown above are based on the sum of these promises (i.e. with accrual<br />

rate since 1 March 2006 being a total of 2.5 per cent). Nicandro Durante is entitled to receive that part of the promise from the Souza Cruz Pension Scheme (based on<br />

1.85 per cent accrual rate) with immediate effect; this entitlement has been ignored for the purposes of the above transfer value.<br />

Status of Remuneration report<br />

This report has been prepared in accordance with the relevant provisions<br />

of the Companies Act 2006 and Schedule 5 and Schedule 8 to the Large<br />

and Medium-sized Companies and Groups (Accounts and <strong>Report</strong>s)<br />

Regulations 2008. The report also meets the relevant requirements of<br />

the Listing Rules of the UK Listing Authority and describes how the Board<br />

has applied the Principles of Good <strong>Governance</strong> relating to Directors’<br />

remuneration as set out in the Combined Code on Corporate <strong>Governance</strong><br />

referred to in the Corporate governance statement. As required by the<br />

Companies Act 2006, a resolution to approve the Directors’ Remuneration<br />

report (the <strong>Report</strong>) will be proposed at the Annual General Meeting of<br />

the Company on 28 April 2010, at which the financial statements will<br />

be presented for approval. The vote will have advisory status, will be in<br />

respect of the remuneration policy and overall remuneration packages<br />

Directors’ report: <strong>Governance</strong><br />

<strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> Annual <strong>Report</strong> 2009<br />

and will not be specific to individual levels of remuneration. The<br />

Companies Act 2006 requires the auditors to report to the Company’s<br />

shareholders on the ‘audited information’ within the <strong>Report</strong> and to<br />

state whether, in their opinion, those parts of the <strong>Report</strong> have been<br />

prepared in accordance with the Companies Act 2006. The report of<br />

the independent auditors, in respect of the Company, addresses those<br />

aspects of this <strong>Report</strong> and which have been subject to audit have been<br />

clearly marked: Table 1, Table 2, Table 3, Table 4, Table 6 and Table 7.<br />

On behalf of the Board<br />

Anthony Ruys<br />

Chairman of the Remuneration Committee<br />

24 February 2010<br />

97<br />

From the Chairman<br />

Performance<br />

and strategy Regional review Financial review <strong>Governance</strong><br />

Group financial<br />

statements<br />

Parent Company<br />

financial statements<br />

Shareholder<br />

information