Directors' Report: Governance - British American Tobacco

Directors' Report: Governance - British American Tobacco

Directors' Report: Governance - British American Tobacco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.bat.com/annualreport2009<br />

Since the award made in 2008, the performance schedule has been<br />

structured such that the same percentage of salary will vest for<br />

threshold performance for Executive Directors and the Management<br />

Board as for awards made prior to 2008. This was achieved by<br />

reducing the entry level vesting for median ranked performance for<br />

each portion of the TSR performance condition from 7.5 per cent to<br />

6 per cent of the award; and reducing the entry level vesting for EPS<br />

growth from 10 per cent to 8 per cent of the award. This maintains the<br />

positioning of the total remuneration package for ‘target’ performance,<br />

and increases the opportunity for higher levels of performance. This<br />

approach will also apply to the LTIP award to be made in 2010.<br />

Since 2005, participants have been entitled to receive a dividend<br />

equivalent payment to the value of the dividends that they would<br />

have received as shareholders on their vesting awards. The LTIP<br />

dividend equivalent payment continues to be important in aligning<br />

further the interests of senior management with those of shareholders.<br />

The values of the LTIP dividend equivalent payments for the Executive<br />

Directors are shown as individual emoluments in Tables 3 and 4.<br />

To the extent that the performance conditions have been satisfied<br />

following assessment by the Remuneration Committee, awards are<br />

normally exercisable between three and 10 years after they have been<br />

made. An award of shares lapses to the extent that the performance<br />

conditions are not satisfied in accordance with the measures set out<br />

above at the end of the three year performance period. Further, any<br />

such proportion of the award that lapses as a result does not attract<br />

the payment of the LTIP dividend equivalent payment.<br />

Performance<br />

The percentage of award vesting is based on a combination of TSR and<br />

earnings per share (EPS) performance conditions measured over a three<br />

year period. The Remuneration Committee considers that both of these<br />

measures are appropriate benchmarks of a company’s performance.<br />

This combination provides an important balance of measures relevant<br />

to the Group’s business and market conditions as well as providing<br />

a common goal for the Executive Directors, the Management Board<br />

members and shareholders. These performance conditions are set<br />

out in the above table and are considered in more detail below.<br />

TSR performance condition<br />

A total of 50 per cent of the total award is based on the Company’s<br />

TSR performance against two comparator groups (25 per cent for each<br />

measure): (1) the constituents of the London Stock Exchange’s FTSE<br />

100 Index at the beginning of the performance period; and (2) a peer<br />

group of international FMCG companies. In the event of upper quartile<br />

performance by the Company relative to the comparator groups above,<br />

25 per cent of the total award vests in full. From 2008, 6 per cent of the<br />

total award vests for median performance (7.5 per cent for the 2006 and<br />

2007 awards). There is pro rata vesting between these two points. The<br />

TSR portions of an LTIP award do not vest for below median performance.<br />

Directors’ report: <strong>Governance</strong><br />

<strong>British</strong> <strong>American</strong> <strong>Tobacco</strong> Annual <strong>Report</strong> 2009<br />

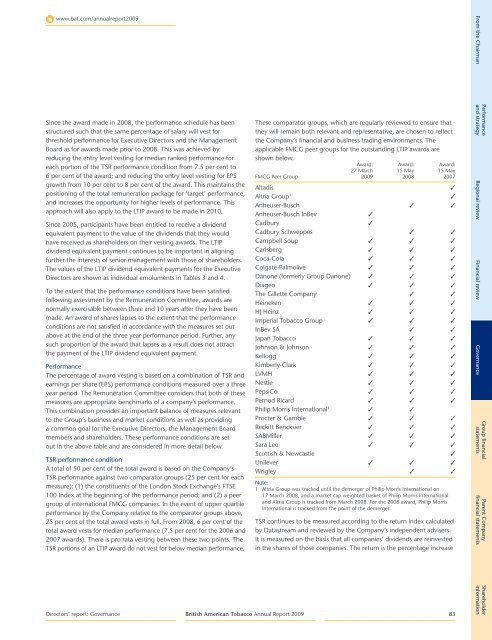

These comparator groups, which are regularly reviewed to ensure that<br />

they will remain both relevant and representative, are chosen to reflect<br />

the Company’s financial and business trading environments. The<br />

applicable FMCG peer groups for the outstanding LTIP awards are<br />

shown below.<br />

Award: Award: Award:<br />

27 March 15 May 15 May<br />

FMCG Peer Group 2009 2008 2007<br />

Altadis ✓<br />

Altria Group1 ✓<br />

Anheuser-Busch ✓ ✓<br />

Anheuser-Busch InBev ✓<br />

Cadbury ✓<br />

Cadbury Schweppes ✓ ✓<br />

Campbell Soup ✓ ✓ ✓<br />

Carlsberg ✓ ✓ ✓<br />

Coca-Cola ✓ ✓ ✓<br />

Colgate-Palmolive ✓ ✓ ✓<br />

Danone (formerly Group Danone) ✓ ✓ ✓<br />

Diageo ✓ ✓ ✓<br />

The Gillette Company ✓ ✓<br />

Heineken ✓ ✓ ✓<br />

HJ Heinz ✓ ✓ ✓<br />

Imperial <strong>Tobacco</strong> Group ✓ ✓ ✓<br />

InBev SA ✓ ✓<br />

Japan <strong>Tobacco</strong> ✓ ✓ ✓<br />

Johnson & Johnson ✓ ✓ ✓<br />

Kellogg ✓ ✓ ✓<br />

Kimberly-Clark ✓ ✓ ✓<br />

LVMH ✓ ✓ ✓<br />

Nestle ✓ ✓ ✓<br />

PepsiCo ✓ ✓ ✓<br />

Pernod Ricard ✓ ✓ ✓<br />

Philip Morris International1 ✓ ✓<br />

Procter & Gamble ✓ ✓ ✓<br />

Reckitt Bencksier ✓ ✓ ✓<br />

SABMiller ✓ ✓ ✓<br />

Sara Lee ✓ ✓ ✓<br />

Scottish & Newcastle ✓<br />

Unilever ✓ ✓ ✓<br />

Wrigley ✓ ✓<br />

Note:<br />

1 Altria Group was tracked until the demerger of Philip Morris International on<br />

17 March 2008, and a market cap weighted basket of Philip Morris International<br />

and Altria Group is tracked from March 2008. For the 2008 award, Philip Morris<br />

International is tracked from the point of the demerger.<br />

TSR continues to be measured according to the return index calculated<br />

by Datastream and reviewed by the Company’s independent advisers.<br />

It is measured on the basis that all companies’ dividends are reinvested<br />

in the shares of those companies. The return is the percentage increase<br />

83<br />

From the Chairman<br />

Performance<br />

and strategy Regional review Financial review <strong>Governance</strong><br />

Group financial<br />

statements<br />

Parent Company<br />

financial statements<br />

Shareholder<br />

information