Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

86 Consolidated financial statements<br />

––<br />

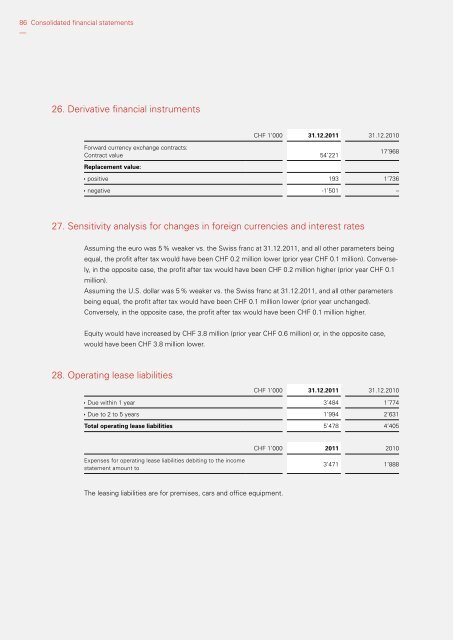

26. Derivative financial instruments<br />

CHF 1’000 31.12.<strong>2011</strong> 31.12.2010<br />

Forward currency exchange contracts:<br />

Contract value 54’221<br />

17’968<br />

Replacement value:<br />

positive 193 1’736<br />

negative -1’501 –<br />

27. Sensitivity analysis for changes in foreign currencies and interest rates<br />

Assuming the euro was 5 % weaker vs. the Swiss franc at 31.12.<strong>2011</strong>, and all other parameters being<br />

equal, the profit after tax would have been CHF 0.2 million lower (prior year CHF 0.1 million). Converse-<br />

ly, in the opposite case, the profit after tax would have been CHF 0.2 million higher (prior year CHF 0.1<br />

million).<br />

Assuming the U.S. dollar was 5 % weaker vs. the Swiss franc at 31.12.<strong>2011</strong>, and all other parameters<br />

being equal, the profit after tax would have been CHF 0.1 million lower (prior year unchanged).<br />

Conversely, in the opposite case, the profit after tax would have been CHF 0.1 million higher.<br />

Equity would have increased by CHF 3.8 million (prior year CHF 0.6 million) or, in the opposite case,<br />

would have been CHF 3.8 million lower.<br />

28. Operating lease liabilities<br />

CHF 1’000 31.12.<strong>2011</strong> 31.12.2010<br />

Due within 1 year 3’484 1’774<br />

Due to 2 to 5 years 1’994 2’631<br />

Total operating lease liabilities 5’478 4’405<br />

Expenses for operating lease liabilities debiting to the income<br />

statement amount to<br />

The leasing liabilities are for premises, cars and office equipment.<br />

CHF 1’000 <strong>2011</strong> 2010<br />

3’471 1’888