HSBC Bank USA, N.A. - FatWallet

HSBC Bank USA, N.A. - FatWallet

HSBC Bank USA, N.A. - FatWallet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

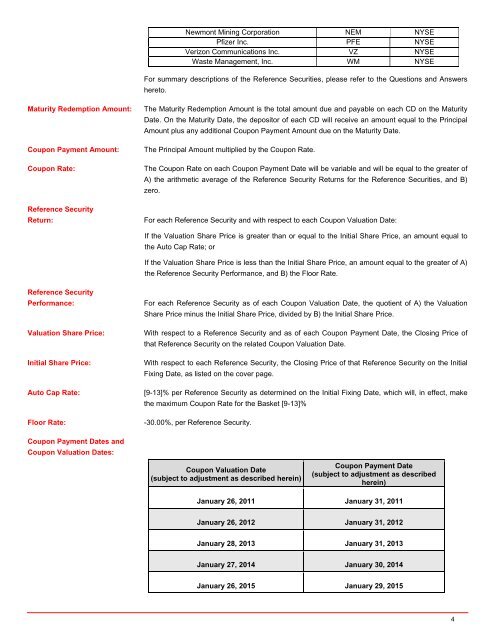

Newmont Mining Corporation NEM NYSE<br />

Pfizer Inc. PFE NYSE<br />

Verizon Communications Inc. VZ NYSE<br />

Waste Management, Inc. WM NYSE<br />

For summary descriptions of the Reference Securities, please refer to the Questions and Answers<br />

hereto.<br />

Maturity Redemption Amount: The Maturity Redemption Amount is the total amount due and payable on each CD on the Maturity<br />

Date. On the Maturity Date, the depositor of each CD will receive an amount equal to the Principal<br />

Amount plus any additional Coupon Payment Amount due on the Maturity Date.<br />

Coupon Payment Amount: The Principal Amount multiplied by the Coupon Rate.<br />

Coupon Rate: The Coupon Rate on each Coupon Payment Date will be variable and will be equal to the greater of<br />

A) the arithmetic average of the Reference Security Returns for the Reference Securities, and B)<br />

zero.<br />

Reference Security<br />

Return: For each Reference Security and with respect to each Coupon Valuation Date:<br />

If the Valuation Share Price is greater than or equal to the Initial Share Price, an amount equal to<br />

the Auto Cap Rate; or<br />

If the Valuation Share Price is less than the Initial Share Price, an amount equal to the greater of A)<br />

the Reference Security Performance, and B) the Floor Rate.<br />

Reference Security<br />

Performance: For each Reference Security as of each Coupon Valuation Date, the quotient of A) the Valuation<br />

Share Price minus the Initial Share Price, divided by B) the Initial Share Price.<br />

Valuation Share Price: With respect to a Reference Security and as of each Coupon Payment Date, the Closing Price of<br />

that Reference Security on the related Coupon Valuation Date.<br />

Initial Share Price: With respect to each Reference Security, the Closing Price of that Reference Security on the Initial<br />

Fixing Date, as listed on the cover page.<br />

Auto Cap Rate: [9-13]% per Reference Security as determined on the Initial Fixing Date, which will, in effect, make<br />

the maximum Coupon Rate for the Basket [9-13]%<br />

Floor Rate: -30.00%, per Reference Security.<br />

Coupon Payment Dates and<br />

Coupon Valuation Dates:<br />

Coupon Valuation Date<br />

(subject to adjustment as described herein)<br />

Coupon Payment Date<br />

(subject to adjustment as described<br />

herein)<br />

January 26, 2011 January 31, 2011<br />

January 26, 2012 January 31, 2012<br />

January 28, 2013 January 31, 2013<br />

January 27, 2014 January 30, 2014<br />

January 26, 2015 January 29, 2015<br />

4