Слайд 0 - Gazprom

Слайд 0 - Gazprom

Слайд 0 - Gazprom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

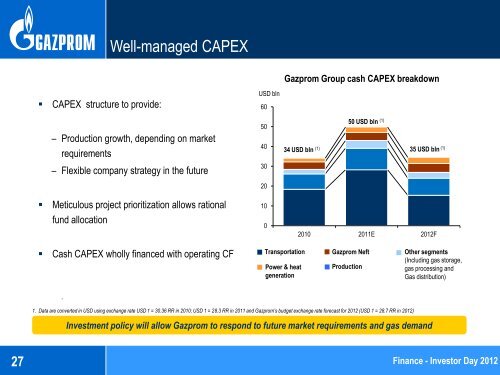

CAPEX structure to provide:<br />

.<br />

Well-managed CAPEX<br />

– Production growth, depending on market<br />

requirements<br />

– Flexible company strategy in the future<br />

Meticulous project prioritization allows rational<br />

fund allocation<br />

Cash CAPEX wholly financed with operating CF<br />

1. Data are converted in USD using exchange rate USD 1 = 30.36 RR in 2010; USD 1 = 28.3 RR in 2011 and <strong>Gazprom</strong>’s budget exchange rate forecast for 2012 (USD 1 = 28.7 RR in 2012)<br />

27 Finance - Investor Day 2012<br />

USD bln<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

50 USD bln (1)<br />

34 USD bln (1) 35 USD bln (1)<br />

Transportation<br />

Power & heat<br />

generation<br />

<strong>Gazprom</strong> Group cash CAPEX breakdown<br />

2010 2011E 2012F<br />

<strong>Gazprom</strong> Neft<br />

Production<br />

Other segments<br />

(Including gas storage,<br />

gas processing and<br />

Gas distribution)<br />

Investment policy will allow <strong>Gazprom</strong> to respond to future market requirements and gas demand