Container Accounts

Container Accounts

Container Accounts

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3<br />

<strong>Container</strong> accounts<br />

Objectives<br />

After you have studied this chapter, you should:<br />

•<br />

•<br />

be able to distinguish between disposable containers and returnable containers<br />

know how to enter transactions relating to returnable containers in the journal<br />

3.1 The nature of containers<br />

A container is anything in which goods are contained. This may consist of a packet<br />

containing cigarettes, a large wooden crate containing tractor parts, or a liquid gas<br />

cylinder. Some will be returnable by the purchaser after use, an obvious example being<br />

the gas cylinder, while others such as the cigarette packet will be disposed of at will by<br />

the customer. The returnable containers will often be subject to a deposit being charged<br />

to the customer, a refund being allowed when the container is returned in good condition<br />

to the supplier.<br />

In suppliers’books it is therefore convenient to divide containers into those which are<br />

(1) not chargeable to the customers, and (2) those where a deposit charge is made to the<br />

customer.<br />

3.2 <strong>Container</strong>s not charged to customers<br />

Many containers will be treated as manufacturing expenses, e.g. cigarette packets, flour<br />

bags or tin cans containing foods. Theoretically they are a distribution expense if the<br />

contents and the containers are regarded as being two distinct items, and as such would<br />

be chargeable to the profit and loss account. However, in reality, the containers for such<br />

items are an integral part of the goods sold and are therefore chargeable to the<br />

manufacturing account. On the other hand, returnable cylinders in which goods are<br />

delivered would be chargeable to the profit and loss account.<br />

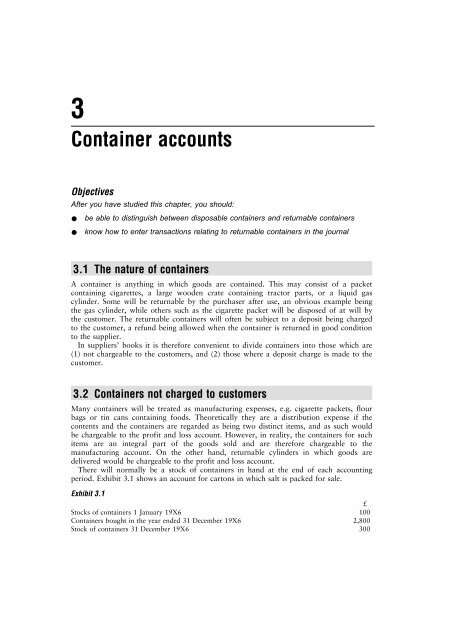

There will normally be a stock of containers in hand at the end of each accounting<br />

period. Exhibit 3.1 shows an account for cartons in which salt is packed for sale.<br />

Exhibit 3.1<br />

£<br />

Stocks of containers 1 January 19X6 100<br />

<strong>Container</strong>s bought in the year ended 31 December 19X6 2,800<br />

Stock of containers 31 December 19X6 300

48 Business Accounting 2<br />

<strong>Container</strong>s<br />

19X6 £ 19X6 £<br />

Jan 1 Stock b/d 100 Dec 31 Manufacturing account 2,600<br />

Dec 31 Cash (bought during the year) 2,800 ,, 31 Stock c/d 300<br />

2,900 2,900<br />

19X7<br />

Jan 1 Stock b/d 300<br />

For returnable containers on which deposits are not charged the question of whether or<br />

not accurate statistical records would be kept would depend on the nature and value of<br />

containers.<br />

3.3 <strong>Container</strong>s on which deposits are charged to customers<br />

There are containers which many purchasers would not return if they were not charged<br />

with a deposit refunded only on return. These are obviously containers which require<br />

more than a marginal effort to return, or those which could be put to alternative uses.<br />

The deposit chargeable must therefore be sufficient to discourage the purchaser from<br />

keeping the containers after use, but should not be so great as to deter him from buying<br />

the goods in the first place. In some instances, a time limit is fixed within which the<br />

container is to be returned to obtain a cancellation of the deposit charged. Common sense<br />

must, however, prevail, as it would be unwise to refuse to allow returns in circumstances<br />

which could bring about a worsening in the firm’s relationship with customers it wished<br />

to retain.<br />

Accounting for containers must therefore fulfil two needs, (a) it must enable some form<br />

of check on the stock of containers, and (b) it must reveal the amount of deposit<br />

returnable to customers. This can be satisfied, for (a) a containers stock account can be<br />

kept, and for (b) a containers suspense account may be opened.<br />

Volume 1 has already illustrated the need for the depreciation of containers to be<br />

provided normally by the revaluation method. The containers stock account will therefore<br />

provide for the depreciation element by the process of revaluing the containers at the end<br />

of each accounting period. Each container account may also include, in addition to the £<br />

columns, further columns for quantities and for the monetary rates at which the<br />

transactions are carried out.<br />

3.4 Comprehensive example where a deposit is chargeable<br />

Exhibit 3.2<br />

A new firm, IVY and Co, sells its goods in crates on which a deposit is chargeable to the<br />

customer, a credit being allowed on their return within three months.<br />

During the year ended 31 December 19X5:<br />

A 50 crates were bought for £3 each.<br />

B 180 crates were sent to customers, these being charged to their accounts at £4<br />

deposit each. (You may well wonder how 180 crates can be sent out when only<br />

50 have been bought by IVY and Co. The figure of 180 consists of recounting<br />

the same crates, as they are sent out and returned several times each year.)

C 150 crates were returned by customers, credits being entered in their accounts for<br />

£4 each.<br />

D 10 crates were kept by customers beyond the three months’limit, and they<br />

therefore forfeited their right to return them to obtain a refund of the deposit.<br />

E 2 crates were damaged and were sold for £1 each.<br />

On 31 December 19X5 the following facts are relevant:<br />

F There were 20 returnable crates with customers.<br />

G There were 18 crates at IVY’s warehouse.<br />

The stock of crates at 31 December 19X5 are to be valued at £2 each to provide for<br />

depreciation through usage.<br />

The identifying letters A to G are shown against the recorded transactions in the<br />

accounts that now follow.<br />

<strong>Container</strong>s Stock<br />

Rate No. Rate No.<br />

£ £ £ £<br />

19X5<br />

19X5<br />

Dec 31 Cash (bought during Dec 31 <strong>Container</strong>s suspense:<br />

the year) A 3 50 150 kept by customers D 4 10 40<br />

,, 31 Cash: damaged crates<br />

E 1 2 2<br />

,, 31 Profit and loss: cost<br />

of container usage 32<br />

,, 31 Stock c/d<br />

In warehouse G 2 18 36<br />

At customers F 2 20 40<br />

50 150 50 150<br />

19X6<br />

Jan<br />

1 Stock b/d<br />

In warehouse G 2 18 36<br />

At customers F 2 20 40<br />

<strong>Container</strong>s Suspense<br />

Rate No. Rate No.<br />

£ £ £ £<br />

19X5<br />

19X5<br />

Dec 31 Sales ledger: crates Dec 31 Sales ledger: crates<br />

credited to customers’charged to customers’<br />

accounts on return C 4 150 600 accounts B 4 180 720<br />

,, 31 <strong>Container</strong>s stock:<br />

kept by customers D 4 10 40<br />

,, 31 Deposits on crates<br />

returnable c/d F 4 20 80<br />

180 720 180 720<br />

19X6<br />

Jan<br />

The balance sheet will show the balances in the following manner:<br />

<strong>Container</strong> accounts 49<br />

1 Deposits on crates<br />

returnable b/d F 4 20 80

50 Business Accounting 2<br />

IVY&Co<br />

Balance Sheet as at 31 December 19X5<br />

Current assets £<br />

Crates – at valuation 76<br />

Current liabilities<br />

<strong>Container</strong>s . suspense – deposits returnable 80<br />

3.5 Comprehensive example where there is a true charge<br />

Sometimes containers are charged out to customers at an initial price greater than that<br />

allowed on their return. The difference represents a hiring charge. If the same data is<br />

taken as in Exhibit 3.2 but, instead of £4 being allowed on return, it had been been<br />

restricted to £3, the accounts would have appeared as follows:<br />

<strong>Container</strong>s Stock<br />

Rate No. Rate No.<br />

£ £ £ £<br />

19X5<br />

19X5<br />

Dec 31 Cash (bought during Dec 31 <strong>Container</strong>s suspense:<br />

the year) 3 50 150 kept by customers 3 10 30<br />

,, 31 Profit and loss: profit ,, 31 Cash: damaged<br />

on container usage 138 crates 1 2 2<br />

,, 31 <strong>Container</strong>s suspense:<br />

Hiring charge 180<br />

,, 31 Stock c/d<br />

In warehouse 2 18 36<br />

At customers 2 20 40<br />

50 288 50 288<br />

19X6<br />

Jan<br />

1 Stock b/d<br />

In warehouse 2 18 36<br />

At customers 2 20 40<br />

<strong>Container</strong>s Suspense<br />

Rate No. Rate No.<br />

£ £ £ £<br />

19X5<br />

19X5<br />

Dec 31 Sales ledger: crates Dec 31 Sales ledger: crates<br />

credited to customers’charged to customers’<br />

accounts on return 150 450 accounts 4 180 720<br />

,, 31 <strong>Container</strong>s stock:<br />

kept by customers 3 10 30<br />

,, 31 <strong>Container</strong>s stock<br />

hiring charge 180<br />

,, 31 Deposits on crates<br />

Returnable 3 20 60<br />

180 720 180 720<br />

19X6<br />

Jan<br />

1 Deposits on crates<br />

returnable b/d 3 20 60

<strong>Container</strong> accounts 51<br />

The balance sheet would have appeared in the following manner:<br />

IVY&Co<br />

Balance Sheet as at 31 December 19X5<br />

Current assets £<br />

Crates – at valuation 76<br />

Current liabilities<br />

<strong>Container</strong>s suspense – deposits returnable 60<br />

Main points to remember<br />

1 <strong>Container</strong>s will either be disposable and treated as part of the cost of sales, or they<br />

will be returnable and involve the taking and returning (possibly only part) of a<br />

deposit.<br />

2 Accounting for containers must enable some form of check on the stock of containers<br />

and must reveal the amount of returnable customer deposits held.<br />

3 Both a container stock account and a container suspense account are used in order to<br />

record details relating to returnable containers.<br />

Review questions<br />

3.1 D Clark’s manufactures are sold in boxes which are returnable. They are charged out to<br />

customers at £8 each and credit of £6 is given for each box returned within two months. For the<br />

purpose of the annual accounts, the value of boxes in the factory and those in customers’hands,<br />

which had been invoiced within two months, was taken as being £1.50 each. The quantities of these<br />

on 31 January 19X3 were 600 and 4,000 respectively.<br />

The following were the transactions as regards boxes during the year ended 31 January 19X4<br />

• Purchases – 5,000 at £2 each<br />

• Invoiced to customers – 17,000<br />

• Returned by customers – 14,000<br />

• 450 could no longer be used and were sold, realising £100.<br />

The number of boxes invoiced after 30 November 19X3 and still in customers’hands on 31<br />

January 19X4 was 6,200.<br />

Required:<br />

Write up the accounts in the books of D Clark to record these transactions and to show the profit<br />

on boxes and the quantities involved.<br />

3.2 A company makes a charge to its customers for cases in which the product is delivered. If<br />

they are returned in good condition within two months a refund is made.<br />

At the start of the year there were 9,600 cases in stock at the company’s warehouse and 6,100 in<br />

the hands of customers supplied within the previous two months. The company bought 18,000 new<br />

cases during the year and following a dispute with a supplier returned 4,000 new cases for which a<br />

credit note of £11,610 was received. At 31 December 19X6 there were still in the hands of<br />

customers 4,800 supplied during the previous two months.<br />

During the year 19X6, 47,600 cases were sent to customers and 43,100 returned by them. The<br />

company scrapped 3,500 damaged cases and sold the timber for £55. A physical check of cases in<br />

stock in 31 December 19X6 revealed an unaccounted deficit of 420 cases.

52 Business Accounting 2<br />

• New cases cost £3 each<br />

• Cases were charged out to customers at £5 each<br />

• Customers were credited £4 on the return of each case<br />

• Cases were valued for stocktaking at £2 each<br />

Show the accounts in the books for 19X6 to record the above, and the balances of cases, in<br />

quantities and values at 31 December 19X6.<br />

You are required to deduce the following missing information from the details above:<br />

(a) The number of cases kept by customers over the two-month limit for returning them.<br />

(b) The number of cases in the warehouse on 31 December 19X6.<br />

3.3 S Limited delivers its product to customers in returnable containers. These are invoiced to the<br />

customer at £20 each and, if returned in good condition within six months, are credited in full. The<br />

containers are purchased for £10 each.<br />

At 30 June 19X6, there were 2,000 containers held in S Limited’s warehouse and provision was<br />

made in the 19X6 accounts for an estimated liability in respect of 5,500 containers in customers’<br />

hands. During 19X7, 1,250 new containers were purchased and 120 were scrapped.<br />

8,750 containers were charged to customers and 9,050 containers were returned within the<br />

six-month period.<br />

At 30 June 19X7, the physical stocktaking showed 3,390 containers in the warehouse and<br />

information derived from customers indicated that there was a potential liability in respect of 4,950<br />

containers. The stocks of containers are valued at cost price.<br />

Required:<br />

Prepare the containers stock account and the containers suspense account necessary to record these<br />

transactions in the books of S Limited.<br />

(Chartered Institute of Management Accountants)<br />

3.4 Lagg Ltd sells its goods in cases. These cases are purchased by the company at £6 per case,<br />

but each case is written down to a standard book value (SBV) of £5 per case immediately it is<br />

purchased. For stocktaking purposes, all cases are valued at £5 per case irrespective of whether they<br />

are still in stock or in the hands of the customers. Cases are charged out to customers at £10 per<br />

case, but the customer is credited with £8 per case if the case is returned in good condition within<br />

three months of receipt.<br />

The following information relates to the year to 31 March 19X7:<br />

1 Stock of cases at 1 April 19X6: Cases<br />

In stock 1,000<br />

In hands of customers 1 January 19X6 3,000<br />

2 During the year, 2,000 cases were purchased.<br />

3 25,000 cases were issued to customers.<br />

4 23,000 cases were returned by customers within the time limit.<br />

5 1,500 cases were not returned within the time limit and were duly paid for by the customers.<br />

Cases still in the hands of customers at 31 March 19X7 had all been invoiced since 1 January<br />

19X7.<br />

6 100 cases kept in stock by Lagg had been damaged and were beyond repair.<br />

7 £1,400 had been spent on repairing some slightly damaged cases.<br />

8 50 other damaged cases had been sold for £2 per case.<br />

In order to keep an accurate record of its transactions in cases, Lagg maintains the following<br />

accounts:<br />

(i)<br />

(ii)<br />

a cases stock account in which cases are recorded at their standard book value;<br />

a cases suspense account in which cases in the hands of customers are recorded at their return<br />

price;

(iii) a cases sent to customers account in which cases sent to customers are recorded at their issue<br />

price; and<br />

(iv) a cases profit and loss account.<br />

Required:<br />

Write up the following accounts in the books of Lagg Ltd for the year to 31 March 19X7;<br />

(a) cases stock account;<br />

(b) cases suspense account;<br />

(c) cases sent to customers account; and<br />

(d) cases profit and loss account.<br />

(Association of Accounting Technicians)<br />

3.5A KRR Ltd sells goods in containers which are charged to customers at £2.00 each. Customers<br />

are credited with £1.25 for each container returned within four months.<br />

On 31 December 19X7, there were 1,580 containers on the company’s premises and 5,520<br />

containers, the time limit for the return of which has not expired, were held by customers.<br />

During 19X8:<br />

(i) KRR Ltd purchased 8,700 containers for £1 each.<br />

(ii) 26,460 containers were charged to customers.<br />

(iii) 23,720 containers were returned by customers and credited to them.<br />

On 31 December 19X8, customers held 6,000 containers, the time limit for the return of which had<br />

not expired.<br />

For purposes of the annual accounts of KRR Ltd, all stocks of containers on the company’s<br />

premises and returnable containers in the possession of customers are valued, at £1 each.<br />

You are required to show the container stock account and the container trading account for the<br />

year 19X8. These accounts should be provided with additional memorandum columns in which<br />

quantities are to be shown.<br />

(Institute of Chartered Secretaries and Administrators)<br />

3.6A The G Company supplies gas in expensive containers which are returnable after use. These<br />

containers cost £20 each and are charged out to customers on sale or return within six months at<br />

£26 each. Provided they are returned within the six months period they are credited at £23 each. As<br />

each container is returned it is inspected and overhauled at a cost of £2.<br />

At the end of the year the company values all returnable containers in customers’hands and<br />

containers held in stock at £16 each.<br />

You are advised that:<br />

At the At the<br />

Beginning of End of<br />

the Year theYear<br />

<strong>Container</strong>s held by the company 2,760 3,144<br />

Returnable containers held by customers 4,790 2,910<br />

During the year 3,100 new containers were purchased, 20,620 were invoiced to customers and<br />

17,960 were returned. On inspection 260 required additional repairs costing £325 and 56 had to be<br />

sold as scrap for £60.<br />

From the information given above prepare:<br />

(a)<br />

(b)<br />

returnable containers suspense account;<br />

an account showing the profit or loss on dealings in containers.<br />

(Chartered Institute of Management Accountants)<br />

<strong>Container</strong> accounts 53