here - Health Promotion Agency

here - Health Promotion Agency

here - Health Promotion Agency

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Rights and benefits<br />

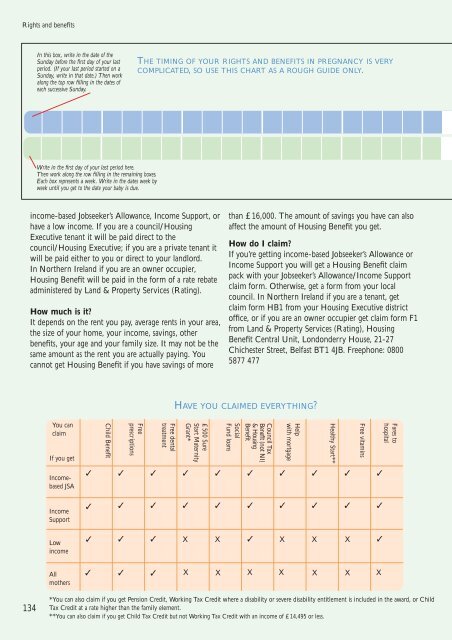

In this box, write in the date of the<br />

Sunday before the first day of your last<br />

period. (If your last period started on a<br />

Sunday, write in that date.) Then work<br />

along the top row filling in the dates of<br />

each successive Sunday.<br />

THE TIMING OF YOUR RIGHTS AND BENEFITS IN PREGNANCY IS VERY<br />

COMPLICATED, SO USE THIS CHART AS A ROUGH GUIDE ONLY.<br />

Write in the first day of your last period <strong>here</strong>.<br />

Then work along the row filling in the remaining boxes.<br />

Each box represents a week. Write in the dates week by<br />

week until you get to the date your baby is due.<br />

income-based Jobseeker’s Allowance, Income Support, or<br />

have a low income. If you are a council/Housing<br />

Executive tenant it will be paid direct to the<br />

council/Housing Executive; if you are a private tenant it<br />

will be paid either to you or direct to your landlord.<br />

In Northern Ireland if you are an owner occupier,<br />

Housing Benefit will be paid in the form of a rate rebate<br />

administered by Land & Property Services (Rating).<br />

How much is it?<br />

It depends on the rent you pay, average rents in your area,<br />

the size of your home, your income, savings, other<br />

benefits, your age and your family size. It may not be the<br />

same amount as the rent you are actually paying. You<br />

cannot get Housing Benefit if you have savings of more<br />

than £16,000. The amount of savings you have can also<br />

affect the amount of Housing Benefit you get.<br />

How do I claim?<br />

If you’re getting income-based Jobseeker’s Allowance or<br />

Income Support you will get a Housing Benefit claim<br />

pack with your Jobseeker’s Allowance/Income Support<br />

claim form. Otherwise, get a form from your local<br />

council. In Northern Ireland if you are a tenant, get<br />

claim form HB1 from your Housing Executive district<br />

office, or if you are an owner occupier get claim form F1<br />

from Land & Property Services (Rating), Housing<br />

Benefit Central Unit, Londonderry House, 21-27<br />

Chichester Street, Belfast BT1 4JB. Freephone: 0800<br />

5877 477<br />

HAVE YOU CLAIMED EVERYTHING?<br />

You can<br />

claim<br />

If you get<br />

Child Benefit<br />

Free<br />

prescriptions<br />

Free dental<br />

treatment<br />

£500 Sure<br />

Start Maternity<br />

Grant*<br />

Social<br />

Fund loans<br />

Council Tax<br />

Benefit (not NI)<br />

& Housing<br />

Benefit<br />

Help<br />

with mortgage<br />

<strong>Health</strong>y Start**<br />

Free vitamins<br />

Fares to<br />

hospital<br />

Incomebased<br />

JSA<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

Income<br />

Support<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

✓<br />

Low<br />

income<br />

✓<br />

✓<br />

✓<br />

X<br />

X<br />

✓<br />

X<br />

X<br />

X<br />

✓<br />

All<br />

mothers<br />

✓ ✓ ✓ X X X X X X X<br />

134<br />

*You can also claim if you get Pension Credit, Working Tax Credit w<strong>here</strong> a disability or severe disability entitlement is included in the award, or Child<br />

Tax Credit at a rate higher than the family element.<br />

**You can also claim if you get Child Tax Credit but not Working Tax Credit with an income of £14,495 or less.