US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

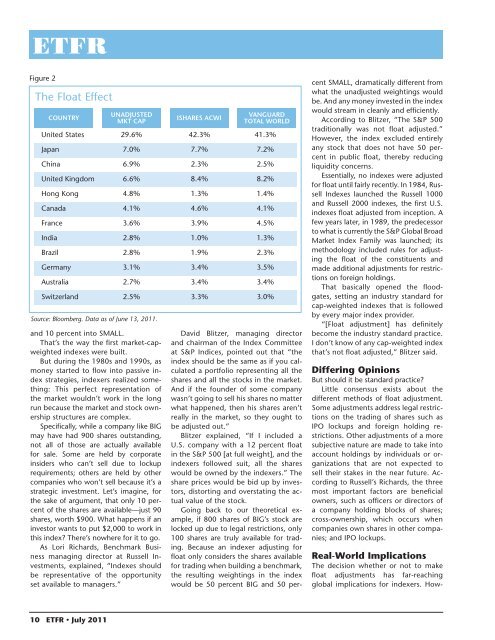

Figure 2<br />

The Float Effect<br />

COUNTRY<br />

UNADJ<strong>US</strong>TED<br />

MKT CAP<br />

United States 29.6% 42.3% 41.3%<br />

Japan 7.0% 7.7% 7.2%<br />

China 6.9% 2.3% 2.5%<br />

United Kingdom 6.6% 8.4% 8.2%<br />

Hong Kong 4.8% 1.3% 1.4%<br />

Canada 4.1% 4.6% 4.1%<br />

France 3.6% 3.9% 4.5%<br />

India 2.8% 1.0% 1.3%<br />

Brazil 2.8% 1.9% 2.3%<br />

Germany 3.1% 3.4% 3.5%<br />

Australia 2.7% 3.4% 3.4%<br />

Switzerl<strong>and</strong> 2.5% 3.3% 3.0%<br />

Source: Bloomberg. Data as of June 13, 2011.<br />

<strong>and</strong> 10 percent in<strong>to</strong> SMALL.<br />

That’s the way the first market-capweighted<br />

indexes were built.<br />

But during the 1980s <strong>and</strong> 1990s, as<br />

money started <strong>to</strong> flow in<strong>to</strong> passive index<br />

strategies, indexers realized something:<br />

This perfect representation of<br />

the market wouldn’t work in the long<br />

run because the market <strong>and</strong> s<strong>to</strong>ck ownership<br />

structures are complex.<br />

Specifically, while a company like BIG<br />

may have had 900 shares outst<strong>and</strong>ing,<br />

not all of those are actually available<br />

for sale. Some are held <strong>by</strong> corporate<br />

insiders who can’t sell due <strong>to</strong> lockup<br />

requirements; others are held <strong>by</strong> other<br />

companies who won’t sell because it’s a<br />

strategic investment. Let’s imagine, for<br />

the sake of argument, that only 10 percent<br />

of the shares are available—just 90<br />

shares, worth $900. What happens if an<br />

inves<strong>to</strong>r wants <strong>to</strong> put $2,000 <strong>to</strong> work in<br />

this index? There’s nowhere for it <strong>to</strong> go.<br />

As Lori Richards, Benchmark Business<br />

managing direc<strong>to</strong>r at Russell Investments,<br />

explained, “Indexes should<br />

be representative of the opportunity<br />

set available <strong>to</strong> managers.”<br />

ISHARES ACWI<br />

VANGUARD<br />

TOTAL WORLD<br />

David Blitzer, managing direc<strong>to</strong>r<br />

<strong>and</strong> chairman of the Index Committee<br />

at S&P Indices, pointed out that “the<br />

index should be the same as if you calculated<br />

a portfolio representing all the<br />

shares <strong>and</strong> all the s<strong>to</strong>cks in the market.<br />

And if the founder of some company<br />

wasn’t going <strong>to</strong> sell his shares no matter<br />

what happened, then his shares aren’t<br />

really in the market, so they ought <strong>to</strong><br />

be adjusted out.”<br />

Blitzer explained, “If I included a<br />

U.S. company with a 12 percent float<br />

in the S&P 500 [at full weight], <strong>and</strong> the<br />

indexers followed suit, all the shares<br />

would be owned <strong>by</strong> the indexers.” The<br />

share prices would be bid up <strong>by</strong> inves<strong>to</strong>rs,<br />

dis<strong>to</strong>rting <strong>and</strong> overstating the actual<br />

value of the s<strong>to</strong>ck.<br />

Going back <strong>to</strong> our theoretical example,<br />

if 800 shares of BIG’s s<strong>to</strong>ck are<br />

locked up due <strong>to</strong> legal restrictions, only<br />

100 shares are truly available for trading.<br />

Because an indexer adjusting for<br />

float only considers the shares available<br />

for trading when building a benchmark,<br />

the resulting weightings in the index<br />

would be 50 percent BIG <strong>and</strong> 50 percent<br />

SMALL, dramatically different from<br />

what the unadjusted weightings would<br />

be. And any money invested in the index<br />

would stream in cleanly <strong>and</strong> efficiently.<br />

According <strong>to</strong> Blitzer, “The S&P 500<br />

traditionally was not float adjusted.”<br />

However, the index excluded entirely<br />

any s<strong>to</strong>ck that does not have 50 percent<br />

in public float, there<strong>by</strong> reducing<br />

liquidity concerns.<br />

Essentially, no indexes were adjusted<br />

for float until fairly recently. In 1984, Russell<br />

Indexes launched the Russell 1000<br />

<strong>and</strong> Russell 2000 indexes, the first U.S.<br />

indexes float adjusted from inception. A<br />

few years later, in 1989, the predecessor<br />

<strong>to</strong> what is currently the S&P Global Broad<br />

Market Index Family was launched; its<br />

methodology included rules for adjusting<br />

the float of the constituents <strong>and</strong><br />

made additional adjustments for restrictions<br />

on foreign holdings.<br />

That basically opened the floodgates,<br />

setting an industry st<strong>and</strong>ard for<br />

cap-weighted indexes that is followed<br />

<strong>by</strong> every major index provider.<br />

“[Float adjustment] has definitely<br />

become the industry st<strong>and</strong>ard practice.<br />

I don’t know of any cap-weighted index<br />

that’s not float adjusted,” Blitzer said.<br />

Differing Opinions<br />

But should it be st<strong>and</strong>ard practice?<br />

Little consensus exists about the<br />

different methods of float adjustment.<br />

Some adjustments address legal restrictions<br />

on the trading of shares such as<br />

IPO lockups <strong>and</strong> foreign holding restrictions.<br />

Other adjustments of a more<br />

subjective nature are made <strong>to</strong> take in<strong>to</strong><br />

account holdings <strong>by</strong> individuals or organizations<br />

that are not expected <strong>to</strong><br />

sell their stakes in the near future. According<br />

<strong>to</strong> Russell’s Richards, the three<br />

most important fac<strong>to</strong>rs are beneficial<br />

owners, such as officers or direc<strong>to</strong>rs of<br />

a company holding blocks of shares;<br />

cross-ownership, which occurs when<br />

companies own shares in other companies;<br />

<strong>and</strong> IPO lockups.<br />

Real-World Implications<br />

The decision whether or not <strong>to</strong> make<br />

float adjustments has far-reaching<br />

global implications for indexers. How-<br />

10 ETFR • July 2011