US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

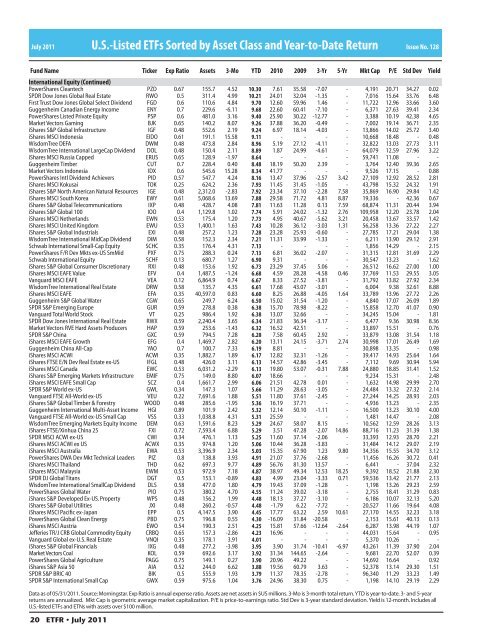

July 2011 U.S.-<strong>Listed</strong> <strong>ETFs</strong> <strong>Sorted</strong> <strong>by</strong> <strong>Asset</strong> <strong>Class</strong> <strong>and</strong> <strong>Year</strong>-<strong>to</strong>-<strong>Date</strong> <strong>Return</strong><br />

Issue No. 128<br />

Fund Name Ticker Exp Ratio <strong>Asset</strong>s 3-Mo YTD 2010 2009 3-Yr 5-Yr Mkt Cap P/E Std Dev<br />

International Equity (Continued)<br />

PowerShares Cleantech PZD 0.67 155.7 4.52 10.30 7.61 35.58 -7.07 - 4,191 20.71 34.27 0.02<br />

SPDR Dow Jones Global Real state RWO 0.5 311.4 4.99 10.21 24.01 32.04 -1.35 - 7,016 15.64 33.76 6.48<br />

irst Trust Dow Jones Global Select Diien GD 0.6 110.6 4.84 9.70 12.60 59.96 1.46 - 11,722 12.96 33.66 3.60<br />

Guenheim Canaian nery Income 0.7 229.6 -6.11 9.68 22.60 60.41 -7.10 - 6,371 27.63 39.41 2.34<br />

PowerShares Liste Priate uity PSP 0.6 481.0 3.16 9.40 25.90 30.22 -12.77 - 3,388 10.19 42.38 4.65<br />

aret Vec<strong>to</strong>rs Gamin BJ 0.65 140.2 8.07 9.26 37.88 36.20 -0.49 - 7,002 19.14 36.71 2.35<br />

iShares S&P Global Infrastructure IG 0.48 552.6 2.19 9.24 6.97 18.14 -4.03 - 13,866 14.02 25.72 3.40<br />

iShares SCI Inonesia IDO 0.61 191.1 15.58 9.11 - - - - 10,668 18.48 - 0.48<br />

WisomTree DA DW 0.48 473.8 2.84 8.96 5.19 27.12 -4.11 - 32,822 13.03 27.73 3.11<br />

WisomTree International LareCa Diien DOL 0.48 150.4 2.11 8.89 1.87 24.99 -4.61 - 64,079 12.59 27.96 3.22<br />

iShares SCI Russia Cae R<strong>US</strong> 0.65 128.9 -1.97 8.64 - - - - 59,741 11.08 - -<br />

Guenheim Timber CUT 0.7 228.4 0.40 8.48 18.19 50.20 2.39 - 3,764 12.40 39.36 2.65<br />

aret Vec<strong>to</strong>rs Inonesia IDX 0.6 545.6 15.28 8.34 41.77 - - - 9,526 17.15 - 0.88<br />

PowerShares Intl Diien Achieers PID 0.57 547.7 4.24 8.16 13.47 37.96 -2.57 3.42 27,109 12.92 28.52 2.81<br />

iShares SCI ousai TO 0.25 624.2 2.36 7.93 11.45 31.45 -1.05 - 43,798 15.32 24.32 1.91<br />

iShares S&P orth American atural Resources IG 0.48 2,312.0 -2.83 7.92 23.34 37.10 -2.28 7.58 35,869 16.90 29.84 1.42<br />

iShares SCI South orea W 0.61 5,068.6 13.69 7.88 29.58 71.72 4.81 8.87 19,336 - 42.36 0.67<br />

iShares S&P Global Telecommunications IXP 0.48 428.7 4.08 7.81 11.63 11.28 0.13 7.59 68,874 11.31 20.44 3.94<br />

iShares S&P Global 100 IOO 0.4 1,129.8 1.02 7.74 5.91 24.02 -1.32 2.76 109,958 12.20 23.78 2.04<br />

iShares SCI etherlans W 0.53 175.4 1.20 7.73 4.95 40.67 -5.62 3.21 20,458 13.67 33.57 1.42<br />

iShares SCI Unite inom WU 0.53 1,400.1 1.63 7.43 10.28 36.12 -3.03 1.31 56,258 13.36 27.22 2.27<br />

iShares S&P Global Inustrials XI 0.48 257.2 1.23 7.28 23.28 25.93 -0.60 - 27,785 17.21 29.04 1.38<br />

WisomTree International iCa Diien DI 0.58 152.3 2.34 7.21 11.31 33.99 -1.33 - 6,211 13.90 29.12 2.91<br />

Schwab International Small-Ca uity SCHC 0.35 176.4 4.31 7.13 - - - - 1,856 14.29 - 2.15<br />

PowerShares R De ts e-<strong>US</strong> Smi PX 0.75 288.3 0.24 7.13 6.81 36.02 -2.07 - 31,315 12.81 31.69 2.29<br />

Schwab International uity SCH 0.13 680.7 1.27 6.90 9.31 - - - 30,547 13.23 - 1.62<br />

iShares S&P Global Consumer Discretionary RXI 0.48 153.6 1.92 6.73 23.29 37.45 5.06 - 26,512 16.62 27.00 1.00<br />

iShares SCI A Value V 0.4 1,487.5 -1.24 6.68 4.59 28.28 -4.58 0.46 37,769 11.53 29.55 3.05<br />

Vanuar SCI A VA 0.12 6,864.9 0.74 6.67 8.33 27.52 -3.81 - 31,792 13.82 27.92 2.34<br />

WisomTree International Real state DRW 0.58 135.7 4.35 6.61 17.68 43.07 -3.01 - 6,004 9.38 32.61 8.88<br />

iShares SCI A A 0.35 40,597.0 0.83 6.60 8.25 26.88 -4.05 1.64 33,789 13.96 27.72 2.26<br />

Guenheim S&P Global Water CGW 0.65 249.7 6.24 6.50 15.02 31.54 -1.20 - 4,840 17.07 26.09 1.89<br />

SPDR S&P merin uroe GUR 0.59 278.8 0.38 6.38 15.70 78.98 -8.22 - 15,858 12.70 41.07 0.90<br />

Vanuar Total Worl S<strong>to</strong>c VT 0.25 986.4 1.92 6.38 13.07 32.66 - - 34,245 15.04 - 1.81<br />

SPDR Dow Jones International Real state RWX 0.59 2,240.4 3.65 6.34 21.83 36.34 -3.17 - 6,477 9.36 30.98 8.36<br />

aret Vec<strong>to</strong>rs RV Har <strong>Asset</strong>s Proucers HAP 0.59 253.6 -1.43 6.32 16.52 42.51 - - 33,897 15.51 - 0.76<br />

SPDR S&P China GXC 0.59 794.5 7.28 6.28 7.58 60.45 2.92 - 33,879 13.08 31.54 1.18<br />

iShares SCI A Growth G 0.4 1,469.7 2.82 6.20 13.11 24.15 -3.71 2.74 30,998 17.01 26.49 1.69<br />

Guenheim China All-Ca AO 0.7 100.7 7.33 6.19 8.81 - - - 30,898 13.35 - 0.98<br />

iShares SCI ACWI ACWI 0.35 1,882.7 1.89 6.17 12.82 32.31 -1.26 - 39,417 14.93 25.64 1.64<br />

iShares TS De Real state e-<strong>US</strong> IGL 0.48 426.0 3.11 6.13 14.57 42.86 -3.45 - 7,112 9.69 30.94 5.94<br />

iShares SCI Canaa WC 0.53 6,031.2 -2.29 6.13 19.80 53.07 -0.31 7.88 24,880 18.85 31.41 1.52<br />

iShares S&P merin arets Infrastructure I 0.75 149.0 8.80 6.07 18.66 - - - 9,234 15.31 - 2.48<br />

iShares SCI A Small Ca SCZ 0.4 1,661.7 2.99 6.06 21.51 42.78 0.01 - 1,632 14.98 29.99 2.70<br />

SPDR S&P Worl e-<strong>US</strong> GWL 0.34 147.3 1.07 5.66 11.29 28.63 -3.05 - 24,484 13.32 27.32 2.14<br />

Vanuar TS All-Worl e-<strong>US</strong> VU 0.22 7,691.6 1.88 5.51 11.80 37.61 -2.45 - 27,244 14.25 28.93 2.03<br />

iShares S&P Global Timber & orestry WOOD 0.48 285.6 -1.95 5.36 16.19 37.71 - - 4,936 13.23 - 2.35<br />

Guenheim International ulti-<strong>Asset</strong> Income HGI 0.89 101.9 2.42 5.32 12.14 50.10 -1.11 - 16,500 13.23 30.10 4.00<br />

Vanuar TS All-Worl e-<strong>US</strong> Small Ca VSS 0.33 1,038.8 4.31 5.31 25.59 - - - 1,481 14.47 - 2.08<br />

WisomTree merin arets uity Income D 0.63 1,591.6 8.23 5.29 24.67 58.07 8.15 - 10,562 12.59 28.26 3.13<br />

iShares TSXinhua China 25 XI 0.72 7,593.4 6.88 5.29 3.51 47.28 -2.07 14.86 88,716 11.23 31.39 1.38<br />

SPDR SCI ACWI e-<strong>US</strong> CWI 0.34 476.1 1.13 5.25 11.60 37.14 -2.06 - 33,393 12.93 28.70 2.21<br />

iShares SCI ACWI e <strong>US</strong> ACWX 0.35 974.8 1.20 5.06 10.44 36.28 -3.83 - 31,484 14.12 29.07 2.19<br />

iShares SCI Australia WA 0.53 3,396.9 2.34 5.03 15.35 67.90 1.23 9.80 34,356 15.55 34.70 3.12<br />

PowerShares DWA De t Technical Leaers PIZ 0.8 138.8 3.93 4.91 21.07 37.76 -2.68 - 11,456 16.26 30.72 0.41<br />

iShares SCI Thailan THD 0.62 697.3 9.77 4.89 56.76 81.30 13.57 - 6,441 - 37.04 2.32<br />

iShares SCI alaysia W 0.53 972.9 7.18 4.87 38.97 49.34 12.53 18.25 9,392 18.52 21.88 2.30<br />

SPDR DJ Global Titans DGT 0.5 153.1 -0.89 4.83 4.99 23.04 -3.33 0.71 59,536 13.42 21.77 2.13<br />

WisomTree International SmallCa Diien DLS 0.58 477.0 1.80 4.79 19.43 37.09 -1.28 - 1,198 13.26 29.23 2.59<br />

PowerShares Global Water PIO 0.75 380.2 4.70 4.55 11.24 39.02 -3.18 - 2,755 18.41 31.29 0.83<br />

iShares S&P Deeloe -<strong>US</strong>. Proerty WPS 0.48 156.2 1.99 4.48 18.13 37.27 -3.10 - 6,186 10.07 32.13 5.20<br />

iShares S&P Global Utilities JXI 0.48 260.2 -0.57 4.48 -1.79 6.22 -7.72 - 20,527 11.66 19.64 4.08<br />

iShares SCI Pacic e-Jaan PP 0.5 4,147.5 3.90 4.45 17.77 63.22 2.59 10.61 27,170 14.55 32.23 3.18<br />

PowerShares Global Clean nery PBD 0.75 196.8 0.55 4.30 -16.09 31.84 -20.58 - 2,153 15.61 40.13 0.13<br />

iShares SCI Austria WO 0.54 190.3 2.51 4.25 15.81 57.66 -12.64 -2.64 6,287 13.98 44.19 1.07<br />

Jefferies TRJ CRB Global Commoity uity CRBQ 0.65 157.3 -2.86 4.23 16.96 - - - 44,031 15.64 - 0.95<br />

Vanuar Global e-U.S. Real state VQI 0.35 178.1 3.91 4.01 - - - - 5,370 10.26 - -<br />

iShares S&P Global inancials IXG 0.48 277.2 -3.98 3.95 3.90 31.74 -10.41 -6.97 43,261 11.39 37.90 2.04<br />

aret Vec<strong>to</strong>rs Coal OL 0.59 692.6 3.17 3.92 31.34 144.65 -2.64 - 9,681 22.70 52.07 0.39<br />

PowerShares Global Ariculture PAGG 0.75 149.1 0.27 3.90 20.96 49.22 - - 14,692 16.64 - 0.92<br />

iShares S&P Asia 50 AIA 0.52 244.0 6.62 3.88 19.56 60.79 3.63 - 52,378 13.14 29.30 1.51<br />

SPDR S&P BRIC 40 BI 0.5 555.9 1.93 3.79 11.37 78.35 -2.78 - 96,340 11.29 33.23 1.49<br />

SPDR S&P International Small Ca GWX 0.59 975.6 1.04 3.76 24.96 38.30 0.75 - 1,198 14.10 29.19 2.29<br />

Data as of 05/31/2011. Source: Morningstar. Exp Ratio is annual expense ratio. <strong>Asset</strong>s are net assets in $<strong>US</strong> millions. 3-Mo is 3-month <strong>to</strong>tal return. YTD is year-<strong>to</strong>-date. 3- <strong>and</strong> 5-year<br />

returns are annualized. Mkt Cap is geometric average market capitalization. P/E is price-<strong>to</strong>-earnings ratio. Std Dev is 3-year st<strong>and</strong>ard deviation. Yield is 12-month. Includes all<br />

U.S.-listed <strong>ETFs</strong> <strong>and</strong> ETNs with assets over $100 million.<br />

20 ETFR • July 2011<br />

Yield