US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Why I Own: VIG<br />

Vanguard Dividend<br />

Appreciation ETF<br />

Name: Ben Tobias<br />

Title: President<br />

Firm: Tobias Financial Advisors<br />

Founded: 1980<br />

Location: Florida<br />

AUM: $180 million<br />

All <strong>ETFs</strong>? No<br />

ETFR: What is your favorite ETF at the<br />

moment?<br />

Tobias: Well, I’ll give you a choice: DLN<br />

[WisdomTree LargeCap Dividend Fund]<br />

or VIG [Vanguard Dividend Appreciation<br />

ETF]. They’re both very similar, <strong>and</strong><br />

they select s<strong>to</strong>cks based on dividends.<br />

ETFR: What made you decide <strong>to</strong> buy<br />

in<strong>to</strong> VIG?<br />

Tobias: Basically, I’ve always thought<br />

that value is more appropriate for the<br />

kind of portfolios that we run than<br />

growth; there’s just a little bit less volatility.<br />

Moreover, our client base has a<br />

lot of preretirees <strong>and</strong> retirees, <strong>and</strong> income<br />

is a little bit more important than<br />

just capital gains. In the long run, I truly<br />

believe that value performs better than<br />

growth, <strong>and</strong> that the dividend yield is<br />

a large component of that. This is especially<br />

so in the case of VIG in terms<br />

of dividend increases: With VIG, the<br />

actual dollar amount of the dividend<br />

increases, but the percentage of the<br />

value doesn’t necessarily go up. Plus,<br />

over the long run, you can do a little<br />

bit better with a little bit less volatility.<br />

And as with most <strong>ETFs</strong> that we use,<br />

we like <strong>to</strong> use low expense ratios.<br />

ETFR: How does VIG help you overweight<br />

value?<br />

Tobias: Actually, these funds <strong>and</strong> the<br />

DFAs [Dimensional Fund Advisors] are<br />

almost all of our portfolios. You know,<br />

that’s most of where we go in. My<br />

background is in certified public accounting,<br />

<strong>and</strong> since those days, I’ve<br />

always been partial <strong>to</strong> the companies<br />

that have shown consistent growth in<br />

dividends. I feel that that’s a good corporate<br />

responsibility that every company<br />

should have. And I think the results<br />

speak for themselves over time.<br />

We do a lot of rebalancing. Rebalancing<br />

with <strong>ETFs</strong> makes life a little bit<br />

easier as far as doing the trades, <strong>and</strong><br />

sometimes setting prices, <strong>and</strong> things<br />

along those lines. Also—though hopefully<br />

we don’t have this for a while—<br />

the similarities <strong>and</strong> differences between<br />

these two <strong>ETFs</strong> mean that in the event<br />

that the market takes large swings, we<br />

could use these <strong>to</strong> book losses, <strong>and</strong> harvest<br />

tax losses in accounts where that is<br />

appropriate.<br />

ETFR: Looking at these two funds, DLN<br />

has a distribution yield of 2.43 percent—higher<br />

than VIG’s 2.13 percent—<br />

but the Vanguard product is much<br />

cheaper at only 18 basis points.<br />

Tobias: Yes, the pricing of the Vanguard<br />

fund is magnificent.<br />

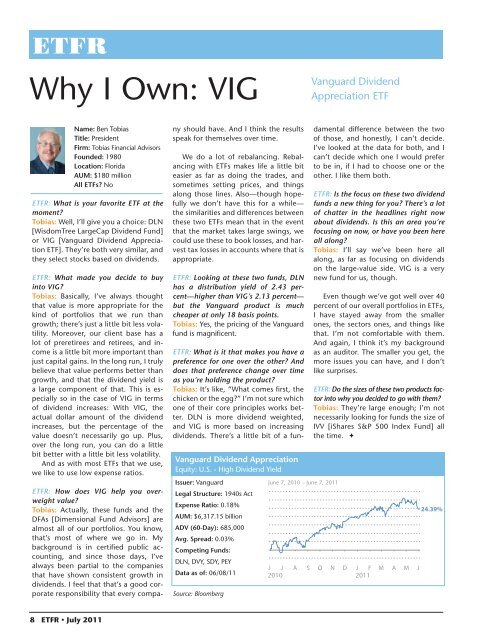

Vanguard Dividend Appreciation<br />

Equity: U.S. - High Dividend Yield<br />

Issuer: Vanguard<br />

Legal Structure: 1940s Act<br />

Expense Ratio: 0.18%<br />

AUM: $6,317.15 billion<br />

ADV (60-Day): 685,000<br />

Avg. Spread: 0.03%<br />

Competing Funds:<br />

DLN, DVY, SDY, PEY<br />

Data as of: 06/08/11<br />

Source: Bloomberg<br />

June 7, 2010 – June 7, 2011<br />

ETFR: What is it that makes you have a<br />

preference for one over the other? And<br />

does that preference change over time<br />

as you’re holding the product?<br />

Tobias: It’s like, “What comes first, the<br />

chicken or the egg?” I’m not sure which<br />

one of their core principles works better.<br />

DLN is more dividend weighted,<br />

<strong>and</strong> VIG is more based on increasing<br />

dividends. There’s a little bit of a fundamental<br />

difference between the two<br />

of those, <strong>and</strong> honestly, I can’t decide.<br />

I’ve looked at the data for both, <strong>and</strong> I<br />

can’t decide which one I would prefer<br />

<strong>to</strong> be in, if I had <strong>to</strong> choose one or the<br />

other. I like them both.<br />

ETFR: Is the focus on these two dividend<br />

funds a new thing for you? There’s a lot<br />

of chatter in the headlines right now<br />

about dividends. Is this an area you’re<br />

focusing on now, or have you been here<br />

all along?<br />

Tobias: I’ll say we’ve been here all<br />

along, as far as focusing on dividends<br />

on the large-value side. VIG is a very<br />

new fund for us, though.<br />

Even though we’ve got well over 40<br />

percent of our overall portfolios in <strong>ETFs</strong>,<br />

I have stayed away from the smaller<br />

ones, the sec<strong>to</strong>rs ones, <strong>and</strong> things like<br />

that. I’m not comfortable with them.<br />

And again, I think it’s my background<br />

as an audi<strong>to</strong>r. The smaller you get, the<br />

more issues you can have, <strong>and</strong> I don’t<br />

like surprises.<br />

ETFR: Do the sizes of these two products fac<strong>to</strong>r<br />

in<strong>to</strong> why you decided <strong>to</strong> go with them?<br />

Tobias: They’re large enough; I’m not<br />

necessarily looking for funds the size of<br />

IVV [iShares S&P 500 Index Fund] all<br />

the time. <br />

J J A S O N D J F M A M J<br />

2010<br />

2011<br />

24.39%<br />

8 ETFR • July 2011