IPR - Institute for Policy Research - Northwestern University

IPR - Institute for Policy Research - Northwestern University

IPR - Institute for Policy Research - Northwestern University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Education <strong>Policy</strong><br />

childhood education centers as a vehicle <strong>for</strong> supporting<br />

parents’ continuing educational development. The<br />

Gates initiative seeks to double the number of lowincome<br />

students who attend college and earn degrees<br />

by 2025, an increase of more than 250,000 graduates<br />

per year. Chase-Lansdale is collaborating with the<br />

Ounce of Prevention Fund and Jeanne Brooks-Gunn<br />

of Columbia <strong>University</strong>.<br />

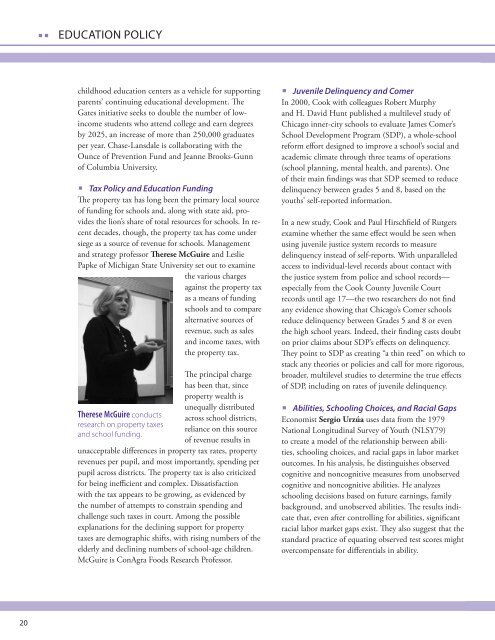

< Tax <strong>Policy</strong> and Education Funding<br />

The property tax has long been the primary local source<br />

of funding <strong>for</strong> schools and, along with state aid, provides<br />

the lion’s share of total resources <strong>for</strong> schools. In recent<br />

decades, though, the property tax has come under<br />

siege as a source of revenue <strong>for</strong> schools. Management<br />

and strategy professor Therese McGuire and Leslie<br />

Papke of Michigan State <strong>University</strong> set out to examine<br />

the various charges<br />

against the property tax<br />

as a means of funding<br />

schools and to compare<br />

alternative sources of<br />

revenue, such as sales<br />

and income taxes, with<br />

the property tax.<br />

Therese McGuire conducts<br />

research on property taxes<br />

and school funding.<br />

The principal charge<br />

has been that, since<br />

property wealth is<br />

unequally distributed<br />

across school districts,<br />

reliance on this source<br />

of revenue results in<br />

unacceptable differences in property tax rates, property<br />

revenues per pupil, and most importantly, spending per<br />

pupil across districts. The property tax is also criticized<br />

<strong>for</strong> being inefficient and complex. Dissatisfaction<br />

with the tax appears to be growing, as evidenced by<br />

the number of attempts to constrain spending and<br />

challenge such taxes in court. Among the possible<br />

explanations <strong>for</strong> the declining support <strong>for</strong> property<br />

taxes are demographic shifts, with rising numbers of the<br />

elderly and declining numbers of school-age children.<br />

McGuire is ConAgra Foods <strong>Research</strong> Professor.<br />

< Juvenile Delinquency and Comer<br />

In 2000, Cook with colleagues Robert Murphy<br />

and H. David Hunt published a multilevel study of<br />

Chicago inner-city schools to evaluate James Comer’s<br />

School Development Program (SDP), a whole-school<br />

re<strong>for</strong>m ef<strong>for</strong>t designed to improve a school’s social and<br />

academic climate through three teams of operations<br />

(school planning, mental health, and parents). One<br />

of their main findings was that SDP seemed to reduce<br />

delinquency between grades 5 and 8, based on the<br />

youths’ self-reported in<strong>for</strong>mation.<br />

In a new study, Cook and Paul Hirschfield of Rutgers<br />

examine whether the same effect would be seen when<br />

using juvenile justice system records to measure<br />

delinquency instead of self-reports. With unparalleled<br />

access to individual-level records about contact with<br />

the justice system from police and school records—<br />

especially from the Cook County Juvenile Court<br />

records until age 17—the two researchers do not find<br />

any evidence showing that Chicago’s Comer schools<br />

reduce delinquency between Grades 5 and 8 or even<br />

the high school years. Indeed, their finding casts doubt<br />

on prior claims about SDP’s effects on delinquency.<br />

They point to SDP as creating “a thin reed” on which to<br />

stack any theories or policies and call <strong>for</strong> more rigorous,<br />

broader, multilevel studies to determine the true effects<br />

of SDP, including on rates of juvenile delinquency.<br />

< Abilities, Schooling Choices, and Racial Gaps<br />

Economist Sergio Urzúa uses data from the 1979<br />

National Longitudinal Survey of Youth (NLSY79)<br />

to create a model of the relationship between abilities,<br />

schooling choices, and racial gaps in labor market<br />

outcomes. In his analysis, he distinguishes observed<br />

cognitive and noncognitive measures from unobserved<br />

cognitive and noncognitive abilities. He analyzes<br />

schooling decisions based on future earnings, family<br />

background, and unobserved abilities. The results indicate<br />

that, even after controlling <strong>for</strong> abilities, significant<br />

racial labor market gaps exist. They also suggest that the<br />

standard practice of equating observed test scores might<br />

overcompensate <strong>for</strong> differentials in ability.<br />

20