Tax Risk Management and Board Responsibility - International Tax ...

Tax Risk Management and Board Responsibility - International Tax ...

Tax Risk Management and Board Responsibility - International Tax ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

made on how aggressive tax management should be <strong>and</strong> what level of risk is acceptable for<br />

the company. Furthermore short term <strong>and</strong> long term effects have to be balanced properly.<br />

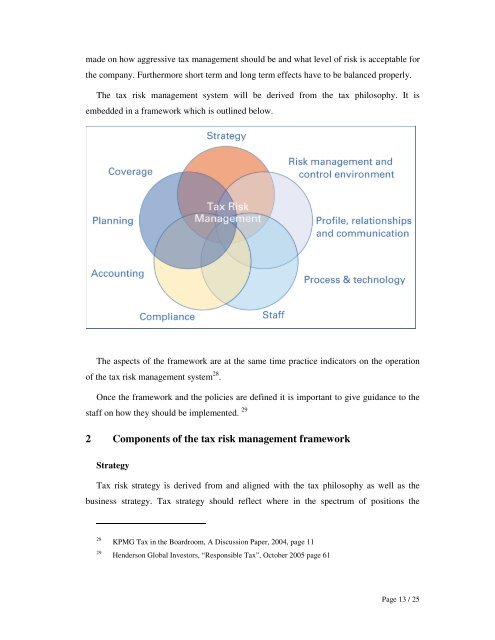

The tax risk management system will be derived from the tax philosophy. It is<br />

embedded in a framework which is outlined below.<br />

The aspects of the framework are at the same time practice indicators on the operation<br />

of the tax risk management system 28 .<br />

Once the framework <strong>and</strong> the policies are defined it is important to give guidance to the<br />

staff on how they should be implemented. 29<br />

2 Components of the tax risk management framework<br />

Strategy<br />

<strong>Tax</strong> risk strategy is derived from <strong>and</strong> aligned with the tax philosophy as well as the<br />

business strategy. <strong>Tax</strong> strategy should reflect where in the spectrum of positions the<br />

28<br />

29<br />

KPMG <strong>Tax</strong> in the <strong>Board</strong>room, A Discussion Paper, 2004, page 11<br />

Henderson Global Investors, “Responsible <strong>Tax</strong>”, October 2005 page 61<br />

Page 13 / 25