Tax Risk Management and Board Responsibility - International Tax ...

Tax Risk Management and Board Responsibility - International Tax ...

Tax Risk Management and Board Responsibility - International Tax ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Direction<br />

The tax philosophy has to be determined by the board, documented, communicated <strong>and</strong><br />

implemented. It should be derived from <strong>and</strong> aligned with the overall management strategy.<br />

One of the aspects that need to be taken into account is the general risk appetite of the<br />

board which will be reflected in the tax risk attitude chosen. As the surveys have shown the<br />

majority of board members would take a conservative view.<br />

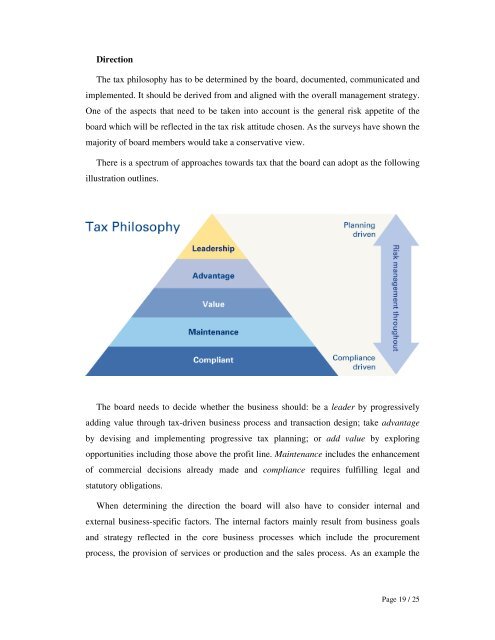

There is a spectrum of approaches towards tax that the board can adopt as the following<br />

illustration outlines.<br />

The board needs to decide whether the business should: be a leader by progressively<br />

adding value through tax-driven business process <strong>and</strong> transaction design; take advantage<br />

by devising <strong>and</strong> implementing progressive tax planning; or add value by exploring<br />

opportunities including those above the profit line. Maintenance includes the enhancement<br />

of commercial decisions already made <strong>and</strong> compliance requires fulfilling legal <strong>and</strong><br />

statutory obligations.<br />

When determining the direction the board will also have to consider internal <strong>and</strong><br />

external business-specific factors. The internal factors mainly result from business goals<br />

<strong>and</strong> strategy reflected in the core business processes which include the procurement<br />

process, the provision of services or production <strong>and</strong> the sales process. As an example the<br />

Page 19 / 25