Tax Risk Management and Board Responsibility - International Tax ...

Tax Risk Management and Board Responsibility - International Tax ...

Tax Risk Management and Board Responsibility - International Tax ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

decision as to the jurisdiction in which a production site is located will determine the<br />

amount of labour taxes, transfer pricing requirements <strong>and</strong> customs duties.<br />

In addition external factors such as market development, position of competitors,<br />

expectations of customers <strong>and</strong> investors, as well as differences in national tax systems, will<br />

have an influence on the tax direction of a business.<br />

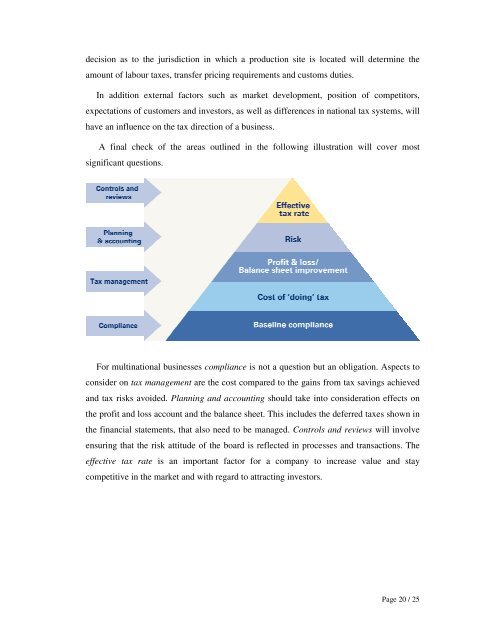

A final check of the areas outlined in the following illustration will cover most<br />

significant questions.<br />

For multinational businesses compliance is not a question but an obligation. Aspects to<br />

consider on tax management are the cost compared to the gains from tax savings achieved<br />

<strong>and</strong> tax risks avoided. Planning <strong>and</strong> accounting should take into consideration effects on<br />

the profit <strong>and</strong> loss account <strong>and</strong> the balance sheet. This includes the deferred taxes shown in<br />

the financial statements, that also need to be managed. Controls <strong>and</strong> reviews will involve<br />

ensuring that the risk attitude of the board is reflected in processes <strong>and</strong> transactions. The<br />

effective tax rate is an important factor for a company to increase value <strong>and</strong> stay<br />

competitive in the market <strong>and</strong> with regard to attracting investors.<br />

Page 20 / 25