PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

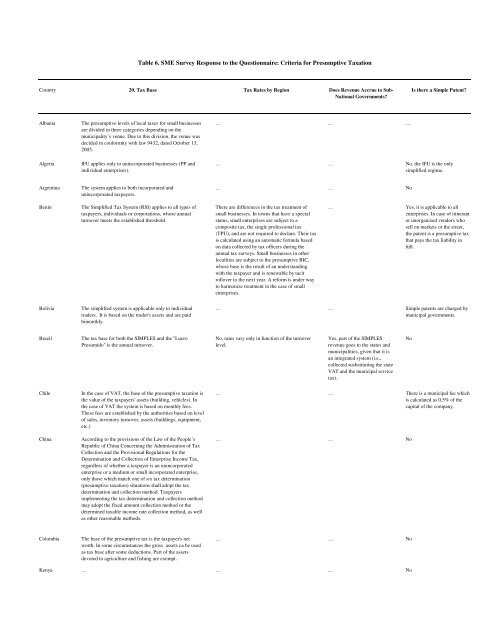

Table 6. SME Survey Response to the Questionnaire: Criteria for Presumptive <strong>Tax</strong>ation<br />

Country 20. <strong>Tax</strong> Base <strong>Tax</strong> Rates by Region Does Revenue Accrue to Sub-<br />

National Governments?<br />

Is there a Simple Patent?<br />

Albania<br />

Algeria<br />

The presumptive levels of local taxes for small businesses<br />

are divided in three categories depending on the<br />

municipality’s venue. Due to this division, the venue was<br />

decided in conformity with law 9432, dated October 13,<br />

2005.<br />

IFU applies only to unincorporated businesses (PP and<br />

individual enterprises).<br />

… … …<br />

… … No, the IFU is the only<br />

simplified regime.<br />

Argentina<br />

The system applies to both incorporated and<br />

unincorporated taxpayers.<br />

… … No<br />

Benin<br />

The Simplified <strong>Tax</strong> System (RSI) applies to all types of<br />

taxpayers, individuals or corporations, whose annual<br />

turnover meets the established threshold.<br />

There are differences in the tax treatment of<br />

small businesses. In towns that have a special<br />

status, small enterprises are subject to a<br />

composite tax, the single professional tax<br />

(TPU), and are not required to declare. Their tax<br />

is calculated using an automatic formula based<br />

on data collected by tax officers during the<br />

annual tax surveys. Small businesses in other<br />

localities are subject to the presumptive BIC,<br />

whose base is the result of an understanding<br />

with the taxpayer and is renewable by tacit<br />

rollover to the next year. A reform is under way<br />

to harmonize treatment in the case of small<br />

enterprises.<br />

…<br />

Yes, it is applicable to all<br />

enterprises. In case of itinerant<br />

or unorganized vendors who<br />

sell on markets or the street,<br />

the patent is a presumptive tax<br />

that pays the tax liability in<br />

full.<br />

Bolivia<br />

The simplified system is applicable only to individual<br />

traders. It is based on the trader's assets and are paid<br />

bimonthly.<br />

… … Simple patents are charged by<br />

municipal governments.<br />

Brazil<br />

The tax base for both the SIMPLES and the "Lucro<br />

Presumido" is the annual turnover.<br />

No, rates vary only in function of the turnover<br />

level.<br />

Yes, part of the SIMPLES<br />

revenue goes to the states and<br />

municipalities, given that it is<br />

an integrated system (i.e.,<br />

collected susbstituting the state<br />

VAT and the municipal service<br />

tax).<br />

No<br />

Chile<br />

China<br />

In the case of VAT, the base of the presumptive taxation is<br />

the value of the taxpayers' assets (building, vehicles). In<br />

the case of VAT the system is based on monthly fees.<br />

These fees are established by the authorities based on level<br />

of sales, inventory turnover, assets (buildings, equipment,<br />

etc.)<br />

According to the provisions of the Law of the People’s<br />

Republic of China Concerning the Administration of <strong>Tax</strong><br />

Collection and the Provisional Regulations for the<br />

Determination and Collection of Enterprise Income <strong>Tax</strong>,<br />

regardless of whether a taxpayer is an unincorporated<br />

enterprise or a medium or small incorporated enterprise,<br />

only those which match one of six tax determination<br />

(presumptive taxation) situations shall adopt the tax<br />

determination and collection method. <strong>Tax</strong>payers<br />

implementing the tax determination and collection method<br />

may adopt the fixed amount collection method or the<br />

determined taxable income rate collection method, as well<br />

as other reasonable methods.<br />

… … There is a municipal fee which<br />

is calculated as 0.5% of the<br />

capital of the company.<br />

… … No<br />

Colombia<br />

The base of the presumptive tax is the taxpayer's net<br />

worth. In some circumstances the gross assets ca be used<br />

as tax base after some deductions. Part of the assets<br />

devoted to agriculture and fishing are exempt.<br />

… … No<br />

Kenya … … … No