PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

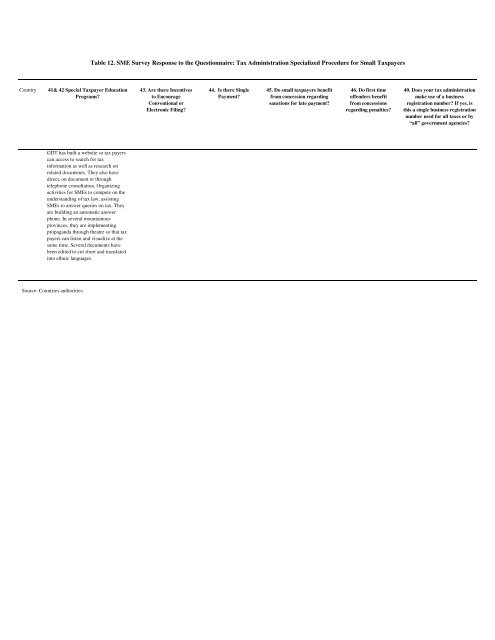

Table 12. SME Survey Response to the Questionnaire: <strong>Tax</strong> Administration Specialized Procedure for Small <strong>Tax</strong>payers<br />

Country<br />

41& 42 Special <strong>Tax</strong>payer Education<br />

Programs?<br />

43. Are there Incentives<br />

to Encourage<br />

Conventional or<br />

Electronic Filing?<br />

44. Is there Single<br />

Payment?<br />

45. Do small taxpayers benefit<br />

from concession regarding<br />

sanctions for late payment?<br />

46. Do first time<br />

offenders benefit<br />

from concessions<br />

regarding penalties?<br />

40. Does your tax administration<br />

make use of a business<br />

registration number? If yes, is<br />

this a single business registration<br />

number used for all taxes or by<br />

“all” government agencies?<br />

GDT has built a website so tax payers<br />

can access to search for tax<br />

in<strong>format</strong>ion as well as research on<br />

related documents. They also have<br />

direct, on document or through<br />

telephone consultation. Organizing<br />

activities for SMEs to compete on the<br />

understanding of tax law, assisting<br />

SMEs to answer queries on tax. They<br />

are building an automatic answer<br />

phone. In several mountainous<br />

provinces, they are implementing<br />

propaganda through theatre so that tax<br />

payers can listen and visualize at the<br />

same time. Several documents have<br />

been edited to cut short and translated<br />

into ethnic languages.<br />

Source: Countries authorities.