PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

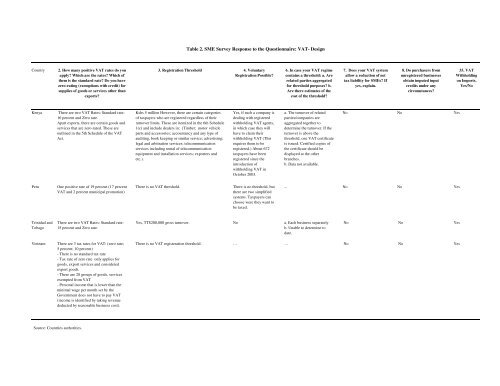

Table 2. SME Survey Response to the Questionnaire: VAT- Design<br />

Country<br />

2. How many positive VAT rates do you<br />

apply? Which are the rates? Which of<br />

them is the standard rate? Do you have<br />

zero-rating (exemptions with credit) for<br />

supplies of goods or services other than<br />

exports?<br />

3. Registration Threshold 4. Voluntary<br />

Registration Possible?<br />

6. In case your VAT regime<br />

contains a threshold: a. Are<br />

related parties aggregated<br />

for threshold purposes? b.<br />

Are there estimates of the<br />

cost of the threshold?<br />

7. Does your VAT system<br />

allow a reduction of net<br />

tax liability for SMEs? If<br />

yes, explain.<br />

8. Do purchasers from<br />

unregistered businesses<br />

obtain imputed input<br />

credits under any<br />

circumstances?<br />

35. VAT<br />

Withholding<br />

on Imports,<br />

Yes/No<br />

Kenya There are two VAT Rates: Standard rate-<br />

16 percent and Zero rate.<br />

Apart exports, there are certain goods and<br />

services that are zero-rated. These are<br />

outlined in the 5th Schedule of the VAT<br />

Act.<br />

Kshs 5 million However, there are certain categories<br />

of taxpayers who are registered regardless of their<br />

turnover limits. These are itemized in the 6th Schedule<br />

1(c) and include dealers in: (Timber; motor vehicle<br />

parts and accessories; accountancy and any type of<br />

auditing, book keeping or similar service; advertising;<br />

legal and arbitration services; telecommunication<br />

services including rental of telecommunication<br />

equipment and installation services; exporters and<br />

etc.).<br />

Yes, if such a company is<br />

dealing with registered<br />

withholding VAT agents,<br />

in which case they will<br />

have to claim their<br />

withholding VAT (This<br />

requires them to be<br />

registered.) About 672<br />

taxpayers have been<br />

registered since the<br />

introduction of<br />

withholding VAT in<br />

October 2003.<br />

a. The turnover of related<br />

parties/companies are<br />

aggregated together to<br />

determine the turnover. If the<br />

turnover is above the<br />

threshold, one VAT certificate<br />

is issued. Certified copies of<br />

the certificate should be<br />

displayed at the other<br />

branches.<br />

b. Data not available.<br />

No No Yes<br />

Peru<br />

One positive rate of 19 percent (17 percent<br />

VAT and 2 percent municipal promotion)<br />

There is no VAT threshold.<br />

There is no threshold, but<br />

there are two simplified<br />

systems. <strong>Tax</strong>payers can<br />

choose were they want to<br />

be taxed.<br />

... No No Yes<br />

Trinidad and<br />

Tobago<br />

There are two VAT Rates: Standard rate-<br />

15 percent and Zero rate.<br />

Yes, TT$200,000 gross turnover. No a. Each business separately<br />

b. Unable to determine to<br />

date.<br />

No No Yes<br />

Vietnam<br />

There are 3 tax rates for VAT: (zero rate;<br />

5 percent; 10 percent)<br />

- There is no standard tax rate<br />

- <strong>Tax</strong> rate of zero rate only applies for<br />

goods, export services and considered<br />

export goods.<br />

- There are 28 groups of goods, services<br />

exempted from VAT<br />

- Personal income that is lower than the<br />

minimal wage per month set by the<br />

Government does not have to pay VAT<br />

(income is identified by taking revenue<br />

deducted by reasonable business cost).<br />

There is no VAT registeration threshold. … … No No Yes<br />

Source: Countries authorities.