PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

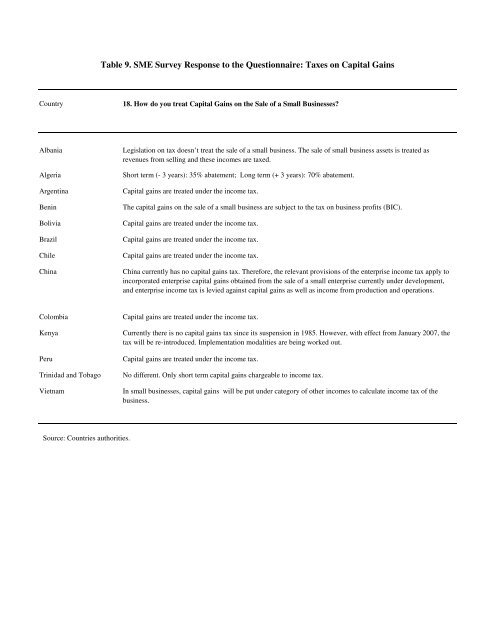

Table 9. SME Survey Response to the Questionnaire: <strong>Tax</strong>es on Capital Gains<br />

Country<br />

18. How do you treat Capital Gains on the Sale of a Small Businesses?<br />

Albania<br />

Algeria<br />

Argentina<br />

Benin<br />

Bolivia<br />

Brazil<br />

Chile<br />

China<br />

Legislation on tax doesn’t treat the sale of a small business. The sale of small business assets is treated as<br />

revenues from selling and these incomes are taxed.<br />

Short term (- 3 years): 35% abatement; Long term (+ 3 years): 70% abatement.<br />

Capital gains are treated under the income tax.<br />

The capital gains on the sale of a small business are subject to the tax on business profits (BIC).<br />

Capital gains are treated under the income tax.<br />

Capital gains are treated under the income tax.<br />

Capital gains are treated under the income tax.<br />

China currently has no capital gains tax. Therefore, the relevant provisions of the enterprise income tax apply to<br />

incorporated enterprise capital gains obtained from the sale of a small enterprise currently under development,<br />

and enterprise income tax is levied against capital gains as well as income from production and operations.<br />

Colombia<br />

Kenya<br />

Peru<br />

Trinidad and Tobago<br />

Vietnam<br />

Capital gains are treated under the income tax.<br />

Currently there is no capital gains tax since its suspension in 1985. However, with effect from January 2007, the<br />

tax will be re-introduced. Implementation modalities are being worked out.<br />

Capital gains are treated under the income tax.<br />

No different. Only short term capital gains chargeable to income tax.<br />

In small businesses, capital gains will be put under category of other incomes to calculate income tax of the<br />

business.<br />

Source: Countries authorities.