PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

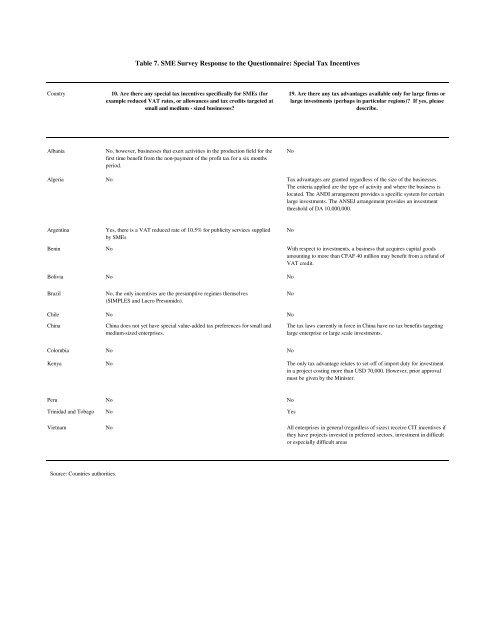

Table 7. SME Survey Response to the Questionnaire: Special <strong>Tax</strong> Incentives<br />

Country<br />

10. Are there any special tax incentives specifically for SMEs (for<br />

example reduced VAT rates, or allowances and tax credits targeted at<br />

small and medium - sized businesses?<br />

19. Are there any tax advantages available only for large firms or<br />

large investments (perhaps in particular regions)? If yes, please<br />

describe.<br />

Albania<br />

No, however, businesses that exert activities in the production field for the<br />

first time benefit from the non-payment of the profit tax for a six months<br />

period.<br />

No<br />

Algeria No <strong>Tax</strong> advantages are granted regardless of the size of the businesses.<br />

The criteria applied are the type of activity and where the business is<br />

located. The ANDI arrangement provides a specific system for certain<br />

large investments. The ANSEJ arrangement provides an investment<br />

threshold of DA 10,000,000.<br />

Argentina<br />

Yes, there is a VAT reduced rate of 10.5% for publicity services supplied<br />

by SMEs<br />

No<br />

Benin No With respect to investments, a business that acquires capital goods<br />

amounting to more than CFAF 40 million may benefit from a refund of<br />

VAT credit.<br />

Bolivia No No<br />

Brazil<br />

No, the only incentives are the presumptive regimes themselves<br />

(SIMPLES and Lucro Presumido).<br />

No<br />

Chile No No<br />

China<br />

China does not yet have special value-added tax preferences for small and<br />

medium-sized enterprises.<br />

The tax laws currently in force in China have no tax benefits targeting<br />

large enterprise or large scale investments.<br />

Colombia No No<br />

Kenya No The only tax advantage relates to set-off of import duty for investment<br />

in a project costing more than USD 70,000. However, prior approval<br />

must be given by the Minister.<br />

Peru No No<br />

Trinidad and Tobago No Yes<br />

Vietnam No All enterprises in general (regardless of sizes) receive CIT incentives if<br />

they have projects invested in preferred sectors, investment in difficult<br />

or especially difficult areas<br />

Source: Countries authorities.