PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

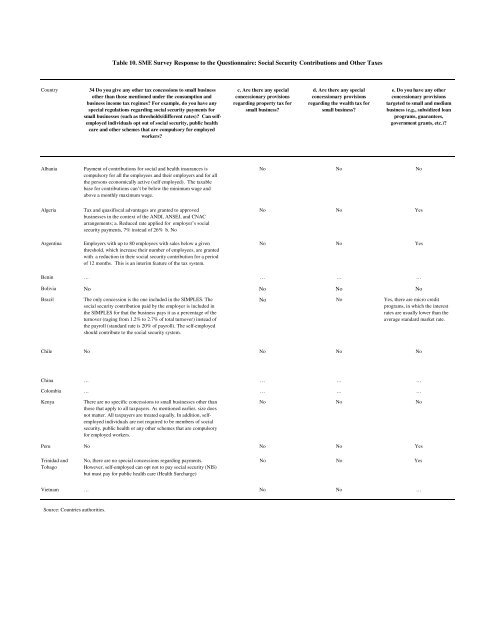

Table 10. SME Survey Response to the Questionnaire: Social Security Contributions and Other <strong>Tax</strong>es<br />

Country 34 Do you give any other tax concessions to small business<br />

other than those mentioned under the consumption and<br />

business income tax regimes? For example, do you have any<br />

special regulations regarding social security payments for<br />

small businesses (such as thresholds/different rates)? Can selfemployed<br />

individuals opt out of social security, public health<br />

care and other schemes that are compulsory for employed<br />

workers?<br />

c. Are there any special<br />

concessionary provisions<br />

regarding property tax for<br />

small business?<br />

d. Are there any special<br />

concessionary provisions<br />

regarding the wealth tax for<br />

small business?<br />

e. Do you have any other<br />

concessionary provisions<br />

targeted to small and medium<br />

business (e.g., subsidized loan<br />

programs, guarantees,<br />

government grants, etc.)?<br />

Albania<br />

Payment of contributions for social and health insurances is<br />

compulsory for all the employees and their employers and for all<br />

the persons economically active (self employed). The taxable<br />

base for contributions can’t be below the minimum wage and<br />

above a monthly maximum wage.<br />

No No No<br />

Algeria<br />

Argentina<br />

<strong>Tax</strong> and quasifiscal advantages are granted to approved<br />

businesses in the context of the ANDI, ANSEJ, and CNAC<br />

arrangements; a. Reduced rate applied for employer’s social<br />

security payments, 7% instead of 26% b. No<br />

Employers with up to 80 employees with sales below a given<br />

threshold, which increase their number of employees, are granted<br />

with a reduction in their social security contribution for a period<br />

of 12 months. This is an interim feature of the tax system.<br />

No No Yes<br />

No No Yes<br />

Benin … … … …<br />

Bolivia No No No No<br />

Brazil<br />

The only concession is the one included in the SIMPLES. The<br />

social security contribution paid by the employer is included in<br />

the SIMPLES for that the business pays it as a percentage of the<br />

turnover (raging from 1.2% to 2.7% of total turnover) instead of<br />

the payroll (standard rate is 20% of payroll). The self-employed<br />

should contribute to the social security system.<br />

No No Yes, there are micro credit<br />

programs, in which the interest<br />

rates are usually lower than the<br />

average standard market rate.<br />

Chile No No No No<br />

China … … … …<br />

Colombia … … … …<br />

Kenya<br />

There are no specific concessions to small businesses other than<br />

those that apply to all taxpayers. As mentioned earlier, size does<br />

not matter. All taxpayers are treated equally. In addition, selfemployed<br />

individuals are not required to be members of social<br />

security, public health or any other schemes that are compulsory<br />

for employed workers.<br />

No No No<br />

Peru No No No Yes<br />

Trinidad and<br />

Tobago<br />

No, there are no special concessions regarding payments.<br />

However, self-employed can opt not to pay social security (NIS)<br />

but must pay for public health care (Health Surcharge)<br />

No No Yes<br />

Vietnam … No No …<br />

Source: Countries authorities.