PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

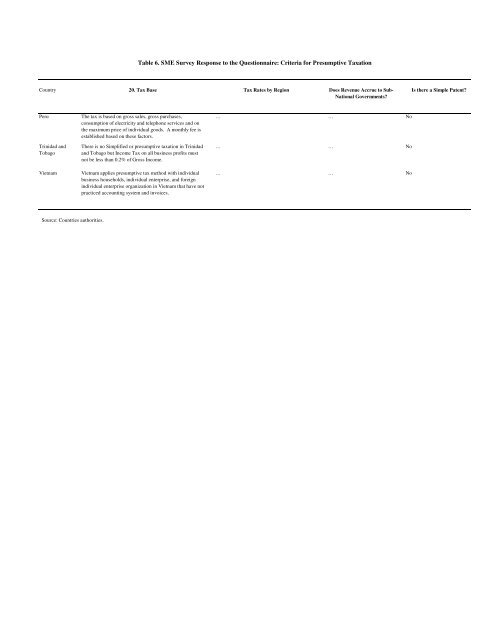

Table 6. SME Survey Response to the Questionnaire: Criteria for Presumptive <strong>Tax</strong>ation<br />

Country 20. <strong>Tax</strong> Base <strong>Tax</strong> Rates by Region Does Revenue Accrue to Sub-<br />

National Governments?<br />

Is there a Simple Patent?<br />

Peru<br />

Trinidad and<br />

Tobago<br />

Vietnam<br />

The tax is based on gross sales, gross purchases,<br />

consumption of electricity and telephone services and on<br />

the maximum price of individual goods. A monthly fee is<br />

established based on these factors.<br />

There is no Simplified or presumptive taxation in Trinidad<br />

and Tobago but Income <strong>Tax</strong> on all business profits must<br />

not be less than 0.2% of Gross Income.<br />

Vietnam applies presumptive tax method with individual<br />

business households, individual enterprise, and foreign<br />

individual enterprise organization in Vietnam that have not<br />

practiced accounting system and invoices.<br />

… … No<br />

… … No<br />

… … No<br />

Source: Countries authorities.