PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

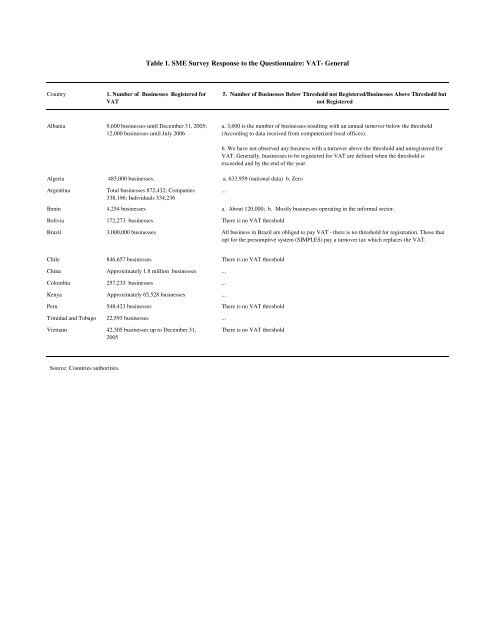

Table 1. SME Survey Response to the Questionnaire: VAT- General<br />

Country<br />

1. Number of Businesses Registered for<br />

VAT<br />

5. Number of Businesses Below Threshold not Registered/Businesses Above Threshold but<br />

not Registered<br />

Albania 9,600 businesses until December 31, 2005;<br />

12,000 businesses until July 2006<br />

a. 3,600 is the number of businesses resulting with an annual turnover below the threshold<br />

(According to data received from computerized local offices).<br />

Algeria 485,000 businesses. a. 633,959 (national data) b. Zero<br />

Argentina<br />

Total businesses 872,432; Companies<br />

338,196; Individuals 534,236<br />

b. We have not observed any business with a turnover above the threshold and unregistered for<br />

VAT. Generally, businesses to be registered for VAT are defined when the threshold is<br />

exceeded and by the end of the year.<br />

Benin 4,254 businesses a. About 120,000; b. Mostly businesses operating in the informal sector.<br />

Bolivia 172,273 businesses There is no VAT threshold<br />

...<br />

Brazil 3,000,000 businesses All business in Brazil are obliged to pay VAT - there is no threshold for registration. Those that<br />

opt for the presumptive system (SIMPLES) pay a turnover tax which replaces the VAT.<br />

Chile 846,657 businesses There is no VAT threshold<br />

China Approximately 1.8 million businesses ...<br />

Colombia 257,233 businesses ...<br />

Kenya Approximately 65,528 businesses ...<br />

Peru 548,423 businesses There is no VAT threshold<br />

Trinidad and Tobago 22,593 businesses ...<br />

Vietnam 42,305 businesses up to December 31,<br />

2005<br />

There is no VAT threshold<br />

Source: Countries authorities.