PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

PDF format - International Tax Dialogue

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

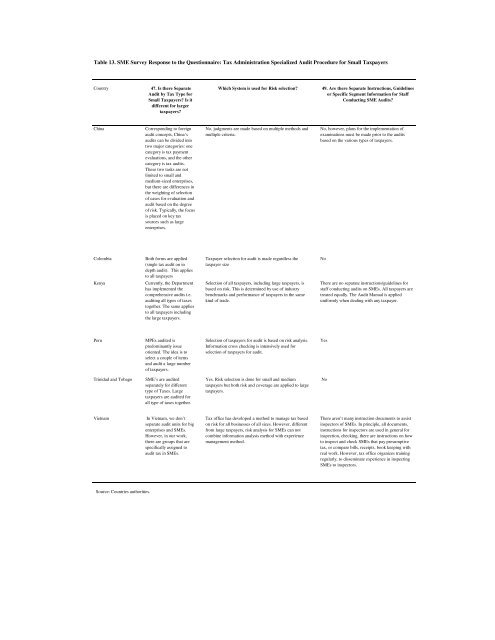

Table 13. SME Survey Response to the Questionnaire: <strong>Tax</strong> Administration Specialized Audit Procedure for Small <strong>Tax</strong>payers<br />

Country 47. Is there Separate<br />

Audit by <strong>Tax</strong> Type for<br />

Small <strong>Tax</strong>payers? Is it<br />

different for larger<br />

taxpayers?<br />

Which System is used for Risk selection?<br />

49. Are there Separate Instructions, Guidelines<br />

or Specific Segment In<strong>format</strong>ion for Staff<br />

Conducting SME Audits?<br />

China<br />

Corresponding to foreign<br />

audit concepts, China’s<br />

audits can be divided into<br />

two major categories: one<br />

category is tax payment<br />

evaluations, and the other<br />

category is tax audits.<br />

These two tasks are not<br />

limited to small and<br />

medium-sized enterprises,<br />

but there are differences in<br />

the weighting of selection<br />

of cases for evaluation and<br />

audit based on the degree<br />

of risk. Typically, the focus<br />

is placed on key tax<br />

sources such as large<br />

enterprises.<br />

No, judgments are made based on multiple methods and<br />

multiple criteria.<br />

No, however, plans for the implementation of<br />

examinations must be made prior to the audits<br />

based on the various types of taxpayers.<br />

Colombia<br />

Kenya<br />

Both forms are applied<br />

(single tax audit on in<br />

depth audit). This applies<br />

to all taxpayers<br />

Currently, the Department<br />

has implemented the<br />

comprehensive audits i.e.<br />

auditing all types of taxes<br />

together. The same applies<br />

to all taxpayers including<br />

the large taxpayers.<br />

<strong>Tax</strong>payer selection for audit is made regardless the<br />

taxpayer size<br />

Selection of all taxpayers, including large taxpayers, is<br />

based on risk. This is determined by use of industry<br />

benchmarks and performance of taxpayers in the same<br />

kind of trade.<br />

No<br />

There are no separate instructions/guidelines for<br />

staff conducting audits on SMEs. All taxpayers are<br />

treated equally. The Audit Manual is applied<br />

uniformly when dealing with any taxpayer.<br />

Peru<br />

MPEs audited is<br />

predominantly issue<br />

oriented. The idea is to<br />

select a couple of items<br />

and audit a large number<br />

of taxpayers.<br />

Selection of taxpayers for audit is based on risk analysis.<br />

In<strong>format</strong>ion cross checking is intensively used for<br />

selection of taxpayers for audit.<br />

Yes<br />

Trinidad and Tobago<br />

SME’s are audited<br />

separately for different<br />

type of <strong>Tax</strong>es. Large<br />

taxpayers are audited for<br />

all type of taxes together.<br />

Yes. Risk selection is done for small and medium<br />

taxpayers but both risk and coverage are applied to large<br />

taxpayers.<br />

No<br />

Vietnam In Vietnam, we don’t<br />

separate audit units for big<br />

enterprises and SMEs.<br />

However, in our work,<br />

there are groups that are<br />

specifically assigned to<br />

audit tax in SMEs.<br />

<strong>Tax</strong> office has developed a method to manage tax based<br />

on risk for all businesses of all sizes. However, different<br />

from large taxpayers, risk analysis for SMEs can not<br />

combine in<strong>format</strong>ion analysis method with experience<br />

management method.<br />

There aren’t many instruction documents to assist<br />

inspectors of SMEs. In principle, all documents,<br />

instructions for inspectors are used in general for<br />

inspection, checking, there are instructions on how<br />

to inspect and check SMEs that pay presumptive<br />

tax, or compare bills, receipts, book keeping with<br />

real work. However, tax office organizes training<br />

regularly, to disseminate experience in inspecting<br />

SMEs to inspectors.<br />

Source: Countries authorities.