Property valuation in the Nordic countries - KTI

Property valuation in the Nordic countries - KTI

Property valuation in the Nordic countries - KTI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

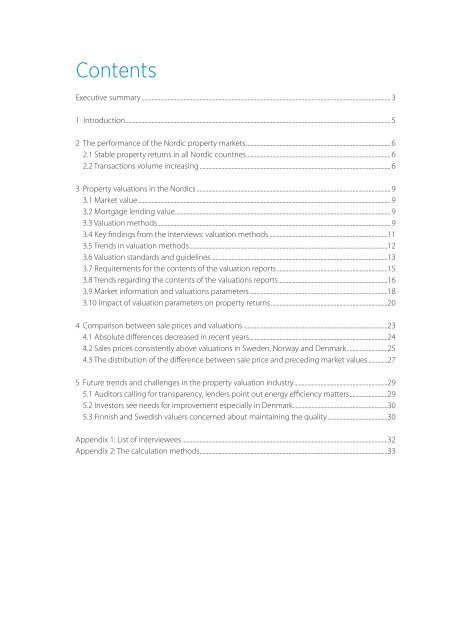

Contents<br />

Executive summary............................................................................................................................................................................ 3<br />

1 Introduction....................................................................................................................................................................................... 5<br />

2 The performance of <strong>the</strong> <strong>Nordic</strong> property markets.................................................................................................... 6<br />

2.1 Stable property returns <strong>in</strong> all <strong>Nordic</strong> <strong>countries</strong>.................................................................................................... 6<br />

2.2 Transactions volume <strong>in</strong>creas<strong>in</strong>g.................................................................................................................................... 6<br />

3 <strong>Property</strong> <strong>valuation</strong>s <strong>in</strong> <strong>the</strong> <strong>Nordic</strong>s...................................................................................................................................... 9<br />

3.1 Market value.............................................................................................................................................................................. 9<br />

3.2 Mortgage lend<strong>in</strong>g value..................................................................................................................................................... 9<br />

3.3 Valuation methods................................................................................................................................................................. 9<br />

3.4 Key f<strong>in</strong>d<strong>in</strong>gs from <strong>the</strong> <strong>in</strong>terviews: <strong>valuation</strong> methods..................................................................................11<br />

3.5 Trends <strong>in</strong> <strong>valuation</strong> methods.........................................................................................................................................12<br />

3.6 Valuation standards and guidel<strong>in</strong>es..........................................................................................................................13<br />

3.7 Requirements for <strong>the</strong> contents of <strong>the</strong> <strong>valuation</strong> reports.............................................................................15<br />

3.8 Trends regard<strong>in</strong>g <strong>the</strong> contents of <strong>the</strong> <strong>valuation</strong>s reports............................................................................16<br />

3.9 Market <strong>in</strong>formation and <strong>valuation</strong>s parameters................................................................................................18<br />

3.10 Impact of <strong>valuation</strong> parameters on property returns.................................................................................20<br />

4 Comparison between sale prices and <strong>valuation</strong>s....................................................................................................23<br />

4.1 Absolute differences decreased <strong>in</strong> recent years................................................................................................24<br />

4.2 Sales prices consistently above <strong>valuation</strong>s <strong>in</strong> Sweden, Norway and Denmark.............................25<br />

4.3 The distribution of <strong>the</strong> difference between sale price and preced<strong>in</strong>g market values..............27<br />

5 Future trends and challenges <strong>in</strong> <strong>the</strong> property <strong>valuation</strong> <strong>in</strong>dustry.................................................................29<br />

5.1 Auditors call<strong>in</strong>g for transparency, lenders po<strong>in</strong>t out energy efficiency matters...........................29<br />

5.2 Investors see needs for improvement especially <strong>in</strong> Denmark..................................................................30<br />

5.3 F<strong>in</strong>nish and Swedish valuers concerned about ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g <strong>the</strong> quality..........................................30<br />

Appendix 1: List of <strong>in</strong>terviewees..............................................................................................................................................32<br />

Appendix 2: The calculation methods..................................................................................................................................33