Property valuation in the Nordic countries - KTI

Property valuation in the Nordic countries - KTI

Property valuation in the Nordic countries - KTI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In F<strong>in</strong>land, many <strong>in</strong>vestors and valuers mentioned that <strong>the</strong>y regularly use external <strong>in</strong>formation<br />

from <strong>KTI</strong> to def<strong>in</strong>e <strong>the</strong> operat<strong>in</strong>g costs. Any external <strong>in</strong>formation that is used regularly <strong>in</strong> <strong>the</strong> o<strong>the</strong>r<br />

<strong>countries</strong> was not mentioned.<br />

3.10 Impact of <strong>valuation</strong> parameters on property returns<br />

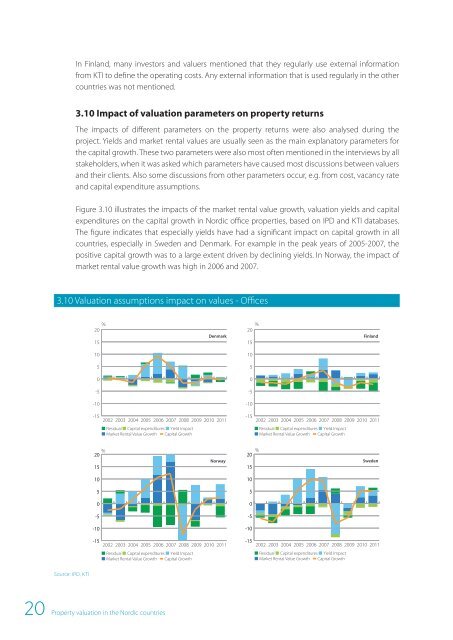

The impacts of different parameters on <strong>the</strong> property returns were also analysed dur<strong>in</strong>g <strong>the</strong><br />

project. Yields and market rental values are usually seen as <strong>the</strong> ma<strong>in</strong> explanatory parameters for<br />

<strong>the</strong> capital growth. These two parameters were also most often mentioned <strong>in</strong> <strong>the</strong> <strong>in</strong>terviews by all<br />

stakeholders, when it was asked which parameters have caused most discussions between valuers<br />

and <strong>the</strong>ir clients. Also some discussions from o<strong>the</strong>r parameters occur, e.g. from cost, vacancy rate<br />

and capital expenditure assumptions.<br />

Figure 3.10 illustrates <strong>the</strong> impacts of <strong>the</strong> market rental value growth, <strong>valuation</strong> yields and capital<br />

expenditures on <strong>the</strong> capital growth <strong>in</strong> <strong>Nordic</strong> office properties, based on IPD and <strong>KTI</strong> databases.<br />

The figure <strong>in</strong>dicates that especially yields have had a significant impact on capital growth <strong>in</strong> all<br />

<strong>countries</strong>, especially <strong>in</strong> Sweden and Denmark. For example <strong>in</strong> <strong>the</strong> peak years of 2005-2007, <strong>the</strong><br />

positive capital growth was to a large extent driven by decl<strong>in</strong><strong>in</strong>g yields. In Norway, <strong>the</strong> impact of<br />

market rental value growth was high <strong>in</strong> 2006 and 2007.<br />

3.10 Valuation assumptions impact on values - Offices<br />

%<br />

20<br />

15<br />

Denmark<br />

%<br />

20<br />

15<br />

F<strong>in</strong>land<br />

10<br />

10<br />

5<br />

5<br />

0<br />

0<br />

-5<br />

-5<br />

-10<br />

-10<br />

-15<br />

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

Residual Capital expenditures Yield Impact<br />

Market Rental Value Growth Capital Growth<br />

-15<br />

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

Residual Capital expenditures Yield Impact<br />

Market Rental Value Growth Capital Growth<br />

% %<br />

20<br />

20<br />

Norway<br />

15<br />

15<br />

Sweden<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

-15<br />

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

Market Rental Value Growth Capital Growth Market Rental Value Growth Capital Growth<br />

Residual Capital expenditures Yield Impact<br />

Residual Capital expenditures Yield Impact<br />

Source: IPD, <strong>KTI</strong><br />

20 <strong>Property</strong> <strong>valuation</strong> <strong>in</strong> <strong>the</strong> <strong>Nordic</strong> <strong>countries</strong>