Central Collective Agreement - OPSEU

Central Collective Agreement - OPSEU

Central Collective Agreement - OPSEU

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

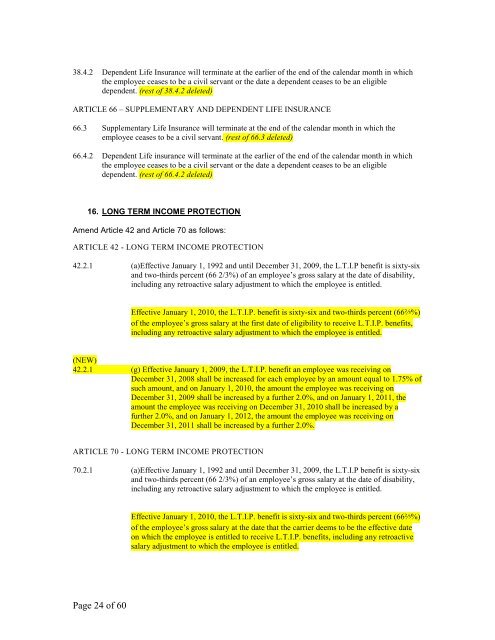

38.4.2 Dependent Life Insurance will terminate at the earlier of the end of the calendar month in which<br />

the employee ceases to be a civil servant or the date a dependent ceases to be an eligible<br />

dependent. (rest of 38.4.2 deleted)<br />

ARTICLE 66 – SUPPLEMENTARY AND DEPENDENT LIFE INSURANCE<br />

66.3 Supplementary Life Insurance will terminate at the end of the calendar month in which the<br />

employee ceases to be a civil servant. (rest of 66.3 deleted)<br />

66.4.2 Dependent Life insurance will terminate at the earlier of the end of the calendar month in which<br />

the employee ceases to be a civil servant or the date a dependent ceases to be an eligible<br />

dependent. (rest of 66.4.2 deleted)<br />

16. LONG TERM INCOME PROTECTION<br />

Amend Article 42 and Article 70 as follows:<br />

ARTICLE 42 - LONG TERM INCOME PROTECTION<br />

42.2.1 (a)Effective January 1, 1992 and until December 31, 2009, the L.T.I.P benefit is sixty-six<br />

and two-thirds percent (66 2/3%) of an employee’s gross salary at the date of disability,<br />

including any retroactive salary adjustment to which the employee is entitled.<br />

Effective January 1, 2010, the L.T.I.P. benefit is sixty-six and two-thirds percent (66²⁄³%)<br />

of the employee’s gross salary at the first date of eligibility to receive L.T.I.P. benefits,<br />

including any retroactive salary adjustment to which the employee is entitled.<br />

(NEW)<br />

42.2.1 (g) Effective January 1, 2009, the L.T.I.P. benefit an employee was receiving on<br />

December 31, 2008 shall be increased for each employee by an amount equal to 1.75% of<br />

such amount, and on January 1, 2010, the amount the employee was receiving on<br />

December 31, 2009 shall be increased by a further 2.0%, and on January 1, 2011, the<br />

amount the employee was receiving on December 31, 2010 shall be increased by a<br />

further 2.0%, and on January 1, 2012, the amount the employee was receiving on<br />

December 31, 2011 shall be increased by a further 2.0%.<br />

ARTICLE 70 - LONG TERM INCOME PROTECTION<br />

70.2.1 (a)Effective January 1, 1992 and until December 31, 2009, the L.T.I.P benefit is sixty-six<br />

and two-thirds percent (66 2/3%) of an employee’s gross salary at the date of disability,<br />

including any retroactive salary adjustment to which the employee is entitled.<br />

Effective January 1, 2010, the L.T.I.P. benefit is sixty-six and two-thirds percent (66²⁄³%)<br />

of the employee’s gross salary at the date that the carrier deems to be the effective date<br />

on which the employee is entitled to receive L.T.I.P. benefits, including any retroactive<br />

salary adjustment to which the employee is entitled.<br />

Page 24 of 60