Annual Report 2005 (60 pages / 1.3MB) - JAL | JAPAN AIRLINES

Annual Report 2005 (60 pages / 1.3MB) - JAL | JAPAN AIRLINES

Annual Report 2005 (60 pages / 1.3MB) - JAL | JAPAN AIRLINES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

As lessor<br />

Certain consolidated subsidiaries lease certain equipment under<br />

noncancelable lease agreements referred to as direct financing<br />

leases. Direct financing leases, defined as leases which do not<br />

transfer the ownership of the leased property to the lessee, are principally<br />

accounted for as operating leases.<br />

l. Appropriation of retained earnings and disposition of<br />

accumulated deficit<br />

Under the Commercial Code of Japan, the appropriation of retained<br />

earnings and disposition of accumulated deficit with respect to a<br />

financial period is made by resolution of the stockholders at a general<br />

meeting held subsequent to the close of the financial period<br />

and the accounts for that period do not, therefore, reflect such<br />

appropriations and disposition.<br />

m. Cash equivalents<br />

Cash equivalents are defined as highly liquid, short-term investments<br />

with an original maturity of 3 months or less.<br />

2. U.S. Dollar Amounts<br />

Amounts in U.S. dollars are included solely for the convenience of<br />

the reader. The rate of ¥107 = U.S.$1.00, the approximate<br />

exchange rate prevailing on March 31, <strong>2005</strong>, has been used in<br />

translation. The inclusion of such amounts is not intended to imply<br />

that yen have been or could be readily converted, realized or settled<br />

in U.S. dollars at that or any other rate.<br />

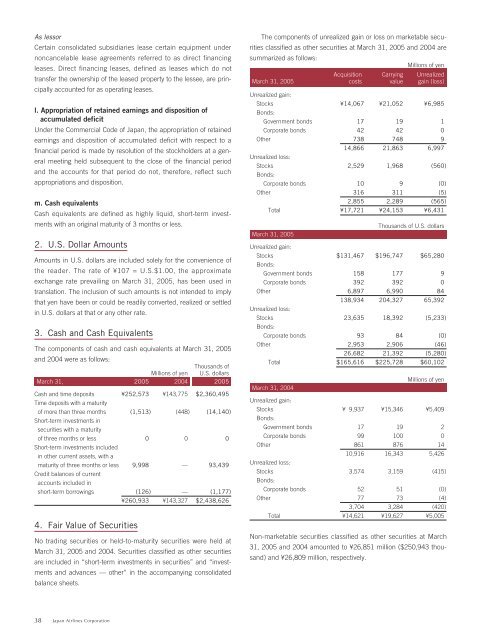

3. Cash and Cash Equivalents<br />

The components of cash and cash equivalents at March 31, <strong>2005</strong><br />

and 2004 were as follows:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

March 31, <strong>2005</strong> 2004 <strong>2005</strong><br />

Cash and time deposits ¥252,573 ¥143,775 $2,3<strong>60</strong>,495<br />

Time deposits with a maturity<br />

of more than three months (1,513) (448) (14,140)<br />

Short-term investments in<br />

securities with a maturity<br />

of three months or less 0 0 0<br />

Short-term investments included<br />

in other current assets, with a<br />

maturity of three months or less 9,998 — 93,439<br />

Credit balances of current<br />

accounts included in<br />

short-term borrowings (126) — (1,177)<br />

¥2<strong>60</strong>,933 ¥143,327 $2,438,626<br />

4. Fair Value of Securities<br />

No trading securities or held-to-maturity securities were held at<br />

March 31, <strong>2005</strong> and 2004. Securities classified as other securities<br />

are included in “short-term investments in securities” and “investments<br />

and advances — other” in the accompanying consolidated<br />

balance sheets.<br />

The components of unrealized gain or loss on marketable securities<br />

classified as other securities at March 31, <strong>2005</strong> and 2004 are<br />

summarized as follows:<br />

Millions of yen<br />

Acquisition Carrying Unrealized<br />

March 31, <strong>2005</strong> costs value gain (loss)<br />

Unrealized gain:<br />

Stocks ¥14,067 ¥21,052 ¥6,985<br />

Bonds:<br />

Government bonds 17 19 1<br />

Corporate bonds 42 42 0<br />

Other 738 748 9<br />

14,866 21,863 6,997<br />

Unrealized loss:<br />

Stocks 2,529 1,968 (5<strong>60</strong>)<br />

Bonds:<br />

Corporate bonds 10 9 (0)<br />

Other 316 311 (5)<br />

2,855 2,289 (565)<br />

Total ¥17,721 ¥24,153 ¥6,431<br />

March 31, <strong>2005</strong><br />

Thousands of U.S. dollars<br />

Unrealized gain:<br />

Stocks $131,467 $196,747 $65,280<br />

Bonds:<br />

Government bonds 158 177 9<br />

Corporate bonds 392 392 0<br />

Other 6,897 6,990 84<br />

138,934 204,327 65,392<br />

Unrealized loss:<br />

Stocks 23,635 18,392 (5,233)<br />

Bonds:<br />

Corporate bonds 93 84 (0)<br />

Other 2,953 2,906 (46)<br />

26,682 21,392 (5,280)<br />

Total $165,616 $225,728 $<strong>60</strong>,102<br />

March 31, 2004<br />

Millions of yen<br />

Unrealized gain:<br />

Stocks ¥ 9,937 ¥15,346 ¥5,409<br />

Bonds:<br />

Government bonds 17 19 2<br />

Corporate bonds 99 100 0<br />

Other 861 876 14<br />

10,916 16,343 5,426<br />

Unrealized loss:<br />

Stocks 3,574 3,159 (415)<br />

Bonds:<br />

Corporate bonds 52 51 (0)<br />

Other 77 73 (4)<br />

3,704 3,284 (420)<br />

Total ¥14,621 ¥19,627 ¥5,005<br />

Non-marketable securities classified as other securities at March<br />

31, <strong>2005</strong> and 2004 amounted to ¥26,851 million ($250,943 thousand)<br />

and ¥26,809 million, respectively.<br />

38 Japan Airlines Corporation