Annual Report 2005 (60 pages / 1.3MB) - JAL | JAPAN AIRLINES

Annual Report 2005 (60 pages / 1.3MB) - JAL | JAPAN AIRLINES

Annual Report 2005 (60 pages / 1.3MB) - JAL | JAPAN AIRLINES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

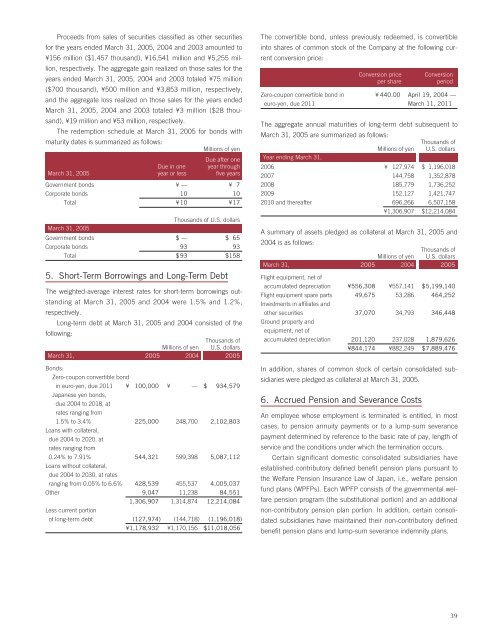

Proceeds from sales of securities classified as other securities<br />

for the years ended March 31, <strong>2005</strong>, 2004 and 2003 amounted to<br />

¥156 million ($1,457 thousand), ¥16,541 million and ¥5,255 million,<br />

respectively. The aggregate gain realized on those sales for the<br />

years ended March 31, <strong>2005</strong>, 2004 and 2003 totaled ¥75 million<br />

($700 thousand), ¥500 million and ¥3,853 million, respectively,<br />

and the aggregate loss realized on those sales for the years ended<br />

March 31, <strong>2005</strong>, 2004 and 2003 totaled ¥3 million ($28 thousand),<br />

¥19 million and ¥53 million, respectively.<br />

The redemption schedule at March 31, <strong>2005</strong> for bonds with<br />

maturity dates is summarized as follows:<br />

Millions of yen<br />

Due after one<br />

Due in one year through<br />

March 31, <strong>2005</strong> year or less five years<br />

Government bonds ¥— ¥ 7<br />

Corporate bonds 10 10<br />

Total ¥10 ¥17<br />

Thousands of U.S. dollars<br />

March 31, <strong>2005</strong><br />

Government bonds $— $ 65<br />

Corporate bonds 93 93<br />

Total $93 $158<br />

5. Short-Term Borrowings and Long-Term Debt<br />

The weighted-average interest rates for short-term borrowings outstanding<br />

at March 31, <strong>2005</strong> and 2004 were 1.5% and 1.2%,<br />

respectively.<br />

Long-term debt at March 31, <strong>2005</strong> and 2004 consisted of the<br />

following:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

March 31, <strong>2005</strong> 2004 <strong>2005</strong><br />

Bonds:<br />

Zero-coupon convertible bond<br />

in euro-yen, due 2011 ¥ 100,000 ¥ — $ 934,579<br />

Japanese yen bonds,<br />

due 2004 to 2018, at<br />

rates ranging from<br />

1.5% to 3.4% 225,000 248,700 2,102,803<br />

Loans with collateral,<br />

due 2004 to 2020, at<br />

rates ranging from<br />

0.24% to 7.91% 544,321 599,398 5,087,112<br />

Loans without collateral,<br />

due 2004 to 2030, at rates<br />

ranging from 0.05% to 6.6% 428,539 455,537 4,005,037<br />

Other 9,047 11,238 84,551<br />

1,306,907 1,314,874 12,214,084<br />

Less current portion<br />

of long-term debt (127,974) (144,718) (1,196,018)<br />

¥1,178,932 ¥1,170,156 $11,018,056<br />

The convertible bond, unless previously redeemed, is convertible<br />

into shares of common stock of the Company at the following current<br />

conversion price:<br />

Conversion price<br />

per share<br />

Zero-coupon convertible bond in ¥ 440.00 April 19, 2004 —<br />

euro-yen, due 2011 March 11, 2011<br />

The aggregate annual maturities of long-term debt subsequent to<br />

March 31, <strong>2005</strong> are summarized as follows:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

Year ending March 31,<br />

2006 ¥ 127,974 $ 1,196,018<br />

2007 144,758 1,352,878<br />

2008 185,779 1,736,252<br />

2009 152,127 1,421,747<br />

2010 and thereafter 696,266 6,507,158<br />

¥1,306,907 $12,214,084<br />

A summary of assets pledged as collateral at March 31, <strong>2005</strong> and<br />

2004 is as follows:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

March 31, <strong>2005</strong> 2004 <strong>2005</strong><br />

Flight equipment, net of<br />

accumulated depreciation ¥556,308 ¥557,141 $5,199,140<br />

Flight equipment spare parts 49,675 53,286 464,252<br />

Investments in affiliates and<br />

other securities 37,070 34,793 346,448<br />

Ground property and<br />

equipment, net of<br />

accumulated depreciation 201,120 237,028 1,879,626<br />

¥844,174 ¥882,249 $7,889,476<br />

In addition, shares of common stock of certain consolidated subsidiaries<br />

were pledged as collateral at March 31, <strong>2005</strong>.<br />

6. Accrued Pension and Severance Costs<br />

Conversion<br />

period<br />

An employee whose employment is terminated is entitled, in most<br />

cases, to pension annuity payments or to a lump-sum severance<br />

payment determined by reference to the basic rate of pay, length of<br />

service and the conditions under which the termination occurs.<br />

Certain significant domestic consolidated subsidiaries have<br />

established contributory defined benefit pension plans pursuant to<br />

the Welfare Pension Insurance Law of Japan, i.e., welfare pension<br />

fund plans (WPFPs). Each WPFP consists of the governmental welfare<br />

pension program (the substitutional portion) and an additional<br />

non-contributory pension plan portion. In addition, certain consolidated<br />

subsidiaries have maintained their non-contributory defined<br />

benefit pension plans and lump-sum severance indemnity plans.<br />

39