cp 49-055 benefit determinations - Department of Public Social ...

cp 49-055 benefit determinations - Department of Public Social ...

cp 49-055 benefit determinations - Department of Public Social ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

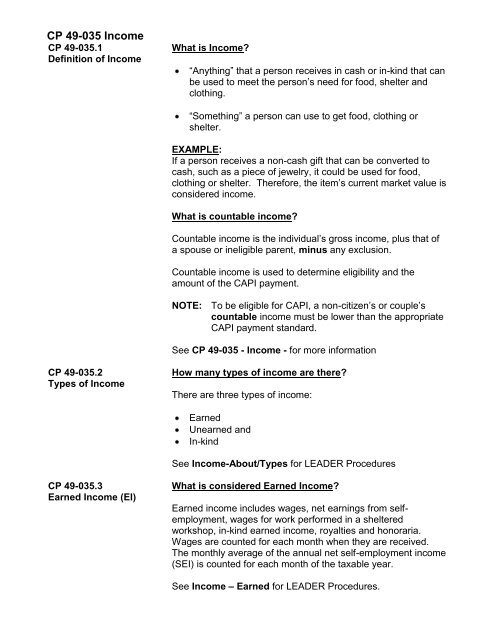

CP <strong>49</strong>-035 Income<br />

CP <strong>49</strong>-035.1<br />

Definition <strong>of</strong> Income<br />

What is Income?<br />

“Anything” that a person receives in cash or in-kind that can<br />

be used to meet the person’s need for food, shelter and<br />

clothing.<br />

“Something” a person can use to get food, clothing or<br />

shelter.<br />

EXAMPLE:<br />

If a person receives a non-cash gift that can be converted to<br />

cash, such as a piece <strong>of</strong> jewelry, it could be used for food,<br />

clothing or shelter. Therefore, the item’s current market value is<br />

considered income.<br />

What is countable income?<br />

Countable income is the individual’s gross income, plus that <strong>of</strong><br />

a spouse or ineligible parent, minus any exclusion.<br />

Countable income is used to determine eligibility and the<br />

amount <strong>of</strong> the CAPI payment.<br />

NOTE: To be eligible for CAPI, a non-citizen’s or couple’s<br />

countable income must be lower than the appropriate<br />

CAPI payment standard.<br />

See CP <strong>49</strong>-035 - Income - for more information<br />

CP <strong>49</strong>-035.2<br />

Types <strong>of</strong> Income<br />

How many types <strong>of</strong> income are there?<br />

There are three types <strong>of</strong> income:<br />

Earned<br />

Unearned and<br />

In-kind<br />

See Income-About/Types for LEADER Procedures<br />

CP <strong>49</strong>-035.3<br />

Earned Income (EI)<br />

What is considered Earned Income?<br />

Earned income includes wages, net earnings from selfemployment,<br />

wages for work performed in a sheltered<br />

workshop, in-kind earned income, royalties and honoraria.<br />

Wages are counted for each month when they are received.<br />

The monthly average <strong>of</strong> the annual net self-employment income<br />

(SEI) is counted for each month <strong>of</strong> the taxable year.<br />

See Income – Earned for LEADER Procedures.