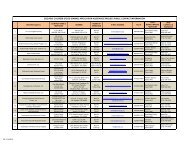

cp 49-055 benefit determinations - Department of Public Social ...

cp 49-055 benefit determinations - Department of Public Social ...

cp 49-055 benefit determinations - Department of Public Social ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

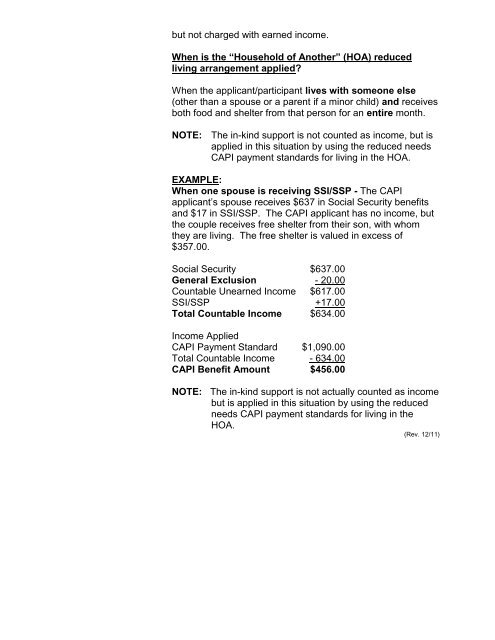

ut not charged with earned income.<br />

When is the “Household <strong>of</strong> Another” (HOA) reduced<br />

living arrangement applied?<br />

When the applicant/participant lives with someone else<br />

(other than a spouse or a parent if a minor child) and receives<br />

both food and shelter from that person for an entire month.<br />

NOTE: The in-kind support is not counted as income, but is<br />

applied in this situation by using the reduced needs<br />

CAPI payment standards for living in the HOA.<br />

EXAMPLE:<br />

When one spouse is receiving SSI/SSP - The CAPI<br />

applicant’s spouse receives $637 in <strong>Social</strong> Security <strong>benefit</strong>s<br />

and $17 in SSI/SSP. The CAPI applicant has no income, but<br />

the couple receives free shelter from their son, with whom<br />

they are living. The free shelter is valued in excess <strong>of</strong><br />

$357.00.<br />

<strong>Social</strong> Security $637.00<br />

General Exclusion - 20.00<br />

Countable Unearned Income $617.00<br />

SSI/SSP +17.00<br />

Total Countable Income $634.00<br />

Income Applied<br />

CAPI Payment Standard $1,090.00<br />

Total Countable Income - 634.00<br />

CAPI Benefit Amount $456.00<br />

NOTE: The in-kind support is not actually counted as income<br />

but is applied in this situation by using the reduced<br />

needs CAPI payment standards for living in the<br />

HOA.<br />

(Rev. 12/11)