cp 49-055 benefit determinations - Department of Public Social ...

cp 49-055 benefit determinations - Department of Public Social ...

cp 49-055 benefit determinations - Department of Public Social ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Vocational training,<br />

Buying a vehicle, or<br />

Buying computer equipment<br />

NOTE: Administrative staff shall call General Relief & CAPI<br />

Programs staff to determine whether a PASS can be<br />

approved.<br />

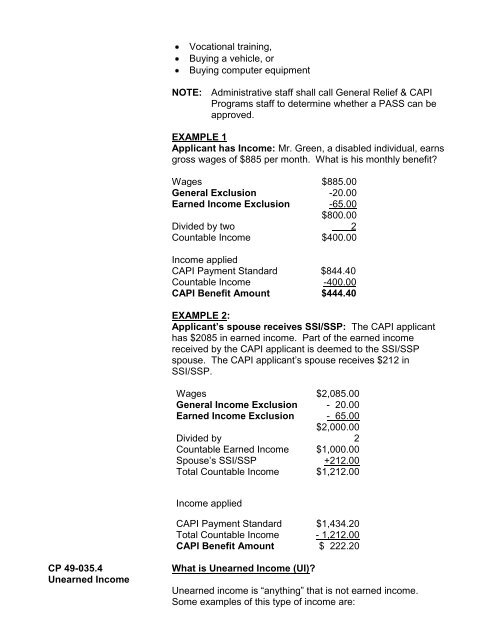

EXAMPLE 1<br />

Applicant has Income: Mr. Green, a disabled individual, earns<br />

gross wages <strong>of</strong> $885 per month. What is his monthly <strong>benefit</strong>?<br />

Wages $885.00<br />

General Exclusion -20.00<br />

Earned Income Exclusion -65.00<br />

$800.00<br />

Divided by two 2<br />

Countable Income $400.00<br />

Income applied<br />

CAPI Payment Standard $844.40<br />

Countable Income -400.00<br />

CAPI Benefit Amount $444.40<br />

EXAMPLE 2:<br />

Applicant’s spouse receives SSI/SSP: The CAPI applicant<br />

has $2085 in earned income. Part <strong>of</strong> the earned income<br />

received by the CAPI applicant is deemed to the SSI/SSP<br />

spouse. The CAPI applicant’s spouse receives $212 in<br />

SSI/SSP.<br />

Wages $2,085.00<br />

General Income Exclusion - 20.00<br />

Earned Income Exclusion - 65.00<br />

$2,000.00<br />

2<br />

Divided by<br />

Countable Earned Income $1,000.00<br />

Spouse’s SSI/SSP +212.00<br />

Total Countable Income $1,212.00<br />

Income applied<br />

CAPI Payment Standard $1,434.20<br />

Total Countable Income - 1,212.00<br />

CAPI Benefit Amount $ 222.20<br />

CP <strong>49</strong>-035.4<br />

Unearned Income<br />

What is Unearned Income (UI)?<br />

Unearned income is “anything” that is not earned income.<br />

Some examples <strong>of</strong> this type <strong>of</strong> income are: